That was no more evident in the fourth quarter, as Enact, as the saying goes, went from "worst to first" when compared with the prior three month period.

It was the only company to report an increase in new insurance written, albeit a modest gain.

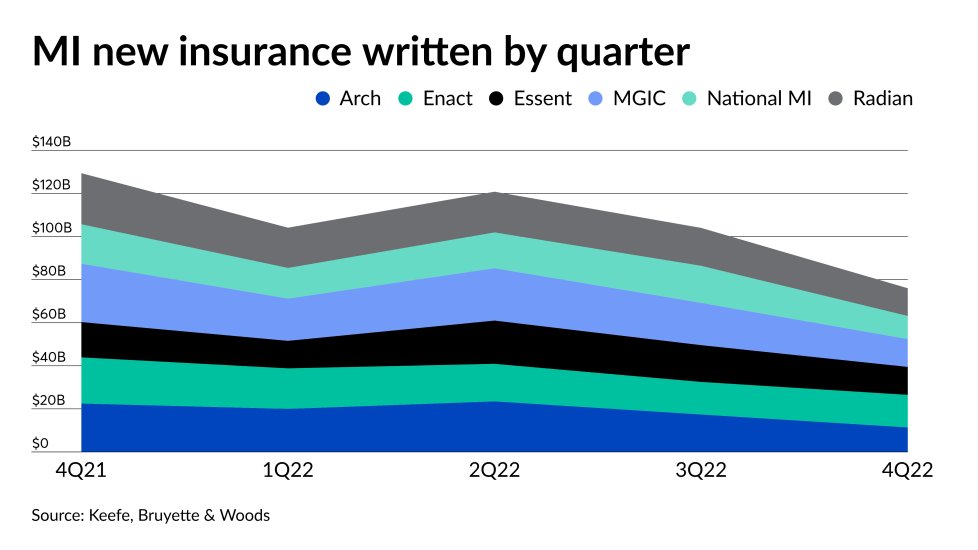

On a year-over-year basis, all six companies reported significant declines in new business. The leading company, MGIC, wrote less business this year than 2021's No. 6, Essent.

But Bose George, an analyst with Keefe, Bruyette & Woods, cautioned against assuming the relative market share shifts will represent long-term trends.

"NIW market share bounces around meaningfully," he said.

With that in mind, here are some key takeaways from the results for each company:

Enact does more business, with an asterisk

For the full year, it made $704 million, an increase over the $547 million profits reported for 2021.

In the fourth quarter, its NIW of $15 billion was 1% higher than the prior quarter but down by 29% from the $21 billion produced for the same period in 2022.

But the most recent period included a one-time deal where it provided insurance on seasoned loans. Without that transaction, NIW would have declined 4% from the third quarter and 32% from the fourth quarter of 2021, Enact said.

For the full year, though, Enact slipped to the No. 4 spot among the six companies at $66.5 billion. In 2021, it ranked third with $97 billion written.

Former parent Genworth Financial still owns 81.4% of Enact's stock. Both companies believe that financial strength conditions established by Fannie Mae and Freddie Mac

"We don't think it would necessarily change the approach to capital/risk management, although we see it being generally supportive of valuation, particularly if macro conditions were to weaken," wrote Eric Hagen, an analyst with BTIG.

Meanwhile, Genworth right now is unlikely to conduct a secondary public offering of Enact stock, said George. Enact paid $206 million in dividends last year to Genworth and George expects a similar amount for 2023 and next year.

"This level of dividends more than covers Genworth's $60 million of annual interest expense and is allowing the company to opportunistically buy back stock and further reduce debt," George said. "Longer term, we believe Genworth wants to do a tax-free spin out of Enact to its shareholders, and we note that in order for a spin of Enact to be tax-free, Genworth cannot reduce its ownership stake in Enact below 80%."

Essent wading into a new pond

"We love the mortgage insurance business, and we've grown it, and we think we can continue to grow it as housing grows, but the pond is only so deep," said Essent Chairman and CEO Mark Casale, during the earnings call. "So when you look at title with annualized revenues in the $20 billion to $25 billion kind of range, it's a big market…we thought this was a good pond to go into."

Fourth quarter net income was $147.4 million, compared with $178.1 million for the prior quarter and $181 million one year prior. But net income for the full year was higher, $831.4 million for 2022 versus $681.6 million in 2021.

NIW ended the period at $13 billion, down from $17.1 billion (24% lower) in the third quarter and $16.4 billion (21% lower) for the fourth quarter of 2021.

Radian completes financial restructuring

It also involved the movement of $276 million of risk in force from Fannie Mae and Freddie Mac credit risk transfers to an unnamed third-party insurer.

As a result of these moves, Radian Guaranty sent $282 million in capital up to the parent company and repaid a $100 million surplus note five years early. In addition, the MI business is expected to start paying $300 million to $400 million worth of dividends to Radian Group, in 2023.

"We think the dividend flexibility enhances risk management, and offers a more seamless avenue to explore share repurchases," Hagen said.

Radian Group earned $162.3 million in the fourth quarter, compared with $198.3 million in the third quarter, and $193.4 million for the same period in 2021.

Full year earnings of $742.9 million were an improvement over the $600.7 million net income from 2021.

Radian's fourth quarter NIW of $12.9 billion was 27% lower than $17.6 billion produced in the prior three month period. It was also 46% lower than the $23.7 billion written during the fourth quarter of 2022.

However, its Homegenius real-estate services and title insurance business recorded an adjusted pretax operating loss of $31.5 million. It took losses of $25.5 million for the third quarter ended Sept. 30, 2022, and $2.1 million for the period ended Dec. 31, 2021. The segment's loss increased for the full year to $88.2 million from $27.3 million for 2021.

"We are pleased to start the new year in a strong position, following the transformative year-end transactions that further enhance our capital strength and financial flexibility," said CEO Rick Thornberry in a press release.

MGIC has largest market share, NIW percentage losses

But it also had the largest percentage drop off in market share on an annual basis, down 4%, as its NIW slipped 52% from the fourth quarter of 2021.

It wrote $12.9 billion in the fourth quarter. This compares with $19.6 billion on a quarter-to-quarter basis and $27.1 billion during the fourth quarter in 2021.

On a full year basis, MGIC remained No. 1 by NIW written among the six companies, with $74.6 billion, but well down from $120.2 billion in 2021.

"As we enter 2023, the credit performance of our insurance-in-force portfolio continues to be strong and our financial strength and capital flexibility position us to navigate the changing economic environment," CEO Tim Mattke said in a press release.

Underwriting income rises for Arch

It had underwriting income of $373.5 million, compared with $244.9 million in the third quarter and $268.6 million a year ago.

Gross premiums written were 2.3% lower than the previous year because of less single premium NIW and lower origination volume in the Australian market, partially offset by an increase in credit risk transfer contracts.

"One thing worthy of mention is that the MI industry is acting in a disciplined and responsible manner," Marc Grandisson, CEO of parent company Arch Capital Group, said on the earnings call. "In the face of these economic uncertainties, premium rates are increasing while underwriting quality remains strong."

Arch's U.S. business reported NIW of $11.4 billion in the fourth quarter, compared with $17.4 billion in the third quarter and $22.5 billion one year ago.

NMI reports record annual profits

For the full year, it earned $292.9 million, versus $231.1 million in 2021.

"In 2022, we delivered strong operating performance, generated significant NIW volume and growth in our high-quality insured portfolio, and achieved record profitability and an 18.4% return on equity," said Adam Pollitzer, National MI president and CEO, in a press release. "We continued to manage with discipline and a focus on through-the-cycle performance."

National MI generated $10.7 billion of NIW, compared with $17.2 billion in the previous quarter and $18.3 billion for the prior year.