Their respective diversification strategies contributed to the period's results.

The smallest of the four major title insurance underwriters, Stewart Information Services, is looking to increase its revenues from non-title sources through acquisitions. The company completed two transactions after the quarter ended.

Meanwhile, First American finally completed its purchase of ServiceMac. Fidelity previously expanded in life insurance, while Old Republic has operated in multiple lines for years. Even Doma wants to participate in adjacent businesses like

Below each insurer reveals how they performed over the quarter.

Stewart's 3Q net income up year-over-year

"In many ways, Stewart's performance this quarter exemplifies the momentum we have experienced over the past year and a half as the company continues to execute on its long-term growth and profitability improvement strategy," CEO Fred Eppinger said in the earnings release. "In the third quarter, we took advantage of healthy domestic and Canadian residential markets and improving commercial trends, along with increased scale and continued operating discipline."

Pretax income in the title segment was $119.1 million, compared with $125.7 million

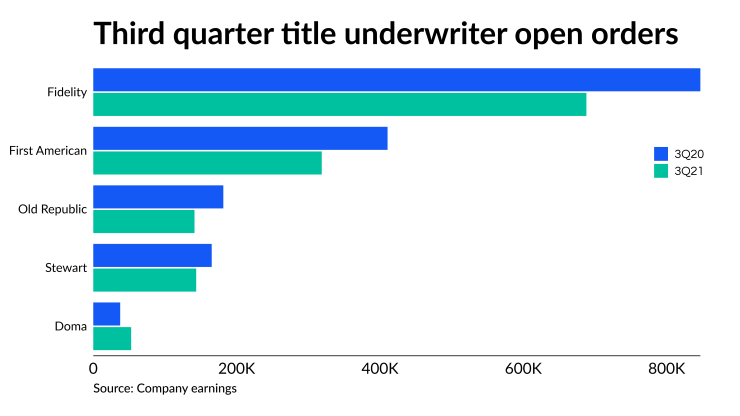

Still, open orders fell to 143,624 in the quarter, slightly up from 143,301 in the second quarter but down from 165,261 units in the third quarter last year. Closed orders ended the quarter at 109,113, compared with 117,189 in the second quarter and 112,788 one year prior.

Operating revenues in the ancillary services and corporate segment grew 122% year-over-year in the third quarter to $61.9 million from $27.9 million, because of Stewart's prior acquisitions plus higher appraisal management services revenues. In the second quarter, this segment had $58.2 million in operating revenues.

The ancillary services operations generated pretax income of $2.8 million, which included a $2.5 million gain related to an acquisition contingent liability adjustment and $4.2 million in purchased intangibles amortization expense. That is compared with pretax income of $0.3 million (which included $1.1 million of purchased intangibles amortization expense) in the third quarter of 2020.

Stewart adds PropStream to its non-title string of purchases

The latest transaction, the second major deal Stewart has done in the second half of this year, will be funded by available company resources, a press release said.

However, "while cash on the consolidated balance sheet totaled $608 million at Sept. 30, cash held at the holding company was just $204 million, and the majority of that was used to fund the $192 million IR acquisition," Keefe Bruyette & Woods analyst Bose George said in a research note.

Stewart has completed a string of non-title purchases of late, including

George said Stewart would likely have to draw on its credit line to fund the transaction. "In late October, the company entered into a new credit agreement providing the company access to up to $725 million in total capital ($200 million revolver, $400 million term loan, and option to increase revolver by $125 million)" he wrote. "Of this, the company has already drawn $370 million on the term loan, paying off $274 million of the previous credit facility, and leaving about $96 million of cash at holding company (plus $12 million remaining from Sept. 30 from [the] Informative Research deal, so $108 million in total we estimate)."

Stewart did file a preliminary prospectus for a debt offering, amount to be determined, in which one of the uses of the proceeds would be acquisitions, including PropStream.

First American's net income more than doubles year-over-year

In Q3, First American saw its net income grow to $445.3 million from $302.3 million in the prior quarter and $182.3 million in the previous year.

"Our title segment achieved a pretax margin of 16.4% resulting from record commercial and agency revenues which, along with continued growth in purchase, far outweighed the decline in refinance activity," CEO Dennis Gilmore said in a press release.

However, that margin is down from 19.1% in the second quarter and 19% one year prior. Still, commercial revenue was $262.4 million in the third quarter, up from $142.6 million for the third quarter of 2020.

"We continue to realize strategic and financial benefits from the venture investments we’ve made over the past few years," Gilmore added. "This quarter, we recognized net realized investment gains totaling $278 million, the most significant of these gains coming from our investment in

Open orders fell to 318,800 from 410,600, while closed orders over the same period fell to 252,700 from 291,500.

For October, open order counts were down 7% from September, and 26% from one year prior, according to a note from KBW's George. Refis made up 42% of the count, compared with 45% one month prior and 58% one year prior.

"For the fourth quarter, we forecast closed purchase orders down 12% year-over-year and closed refinance orders down 50% year-over-year," George wrote. "So overall, we think the first-month results are tracking well alongside our forecast."

Title responsible for half of Fidelity's 3Q net earnings

In

F&G, (previously known as Fidelity and Guaranty Life Insurance Company), which was acquired by Fidelity after its own deal to buy Stewart was squashed by regulators, had net earnings of $373 million in the most recent quarter.

"Our third quarter margins and earnings were the strongest third quarter results in our company's history which speaks to our market leading position combined with the outstanding execution of our entire team," said William Foley, chairman, in a press release. "Total commercial revenues also continued at record levels as we achieved $366 million of revenues in the third quarter of 2021, an increase of 69% as compared to the year ago third quarter."

Open orders fell to 688,000 from 847,000 one year prior, while closed orders slipped to 527,000 from 571,000.

Old Republic's operating income rises with fewer orders

"Title insurance net premiums and fees earned increased by 33.3% in the third quarter and by nearly 43% for the year-to-date period, with strong results generated from both agency and direct production channels," Old Republic's earnings release said. "This performance was driven by a continued low interest rate environment and a robust real estate market, with increases in purchase transactions partially offset by a decline in refinance levels."

Open orders fell to 141,250 in the third quarter from 181,465 one year earlier, while closed orders were down to 123,124 from 143,523 over the same time frame.

Net premiums earned in its mortgage insurance business fell nearly 29% year-over-year to $7.7 million as that business continues to run-off and is not replaced by new policies.

Meanwhile, claims costs were down 116.5% because of fewer new delinquencies along with improving trends in cure rates and claim severity influenced by the ongoing economic recovery and continued strength in the real estate market.

That drove an 83.9% increase in pretax operating income to $8.4 million from $4.5 million.

Non-family underwriters grew business in 3Q

However, its third quarter net loss also grew to $34.3 million from $3.6 million a year ago.

"Our recent performance and momentum allow us the confidence to invest more aggressively in our product roll-out, particularly as it relates to the accelerated migration of our Local Purchase business to the Doma Intelligence platform, which we remain on track to start by year-end," Chief Financial Officer Noaman Ahmad said in a press release. "We believe that the acceleration of these investments is worth any short-term trade off in margins that will likely be required to get to larger scale faster."

As for the other publicly-traded non-family underwriter, Investors Title, even as it had its best quarter ever for premiums written, net earnings fell to $14.5 million in the third quarter from $15.3 million one year prior.

"Our results for the quarter and the year have been influenced predominately by continued strength in residential real estate demand as well as high levels of refinance activity," said J. Allen Fine, Investors' chairman, in a press release. "In addition, we have benefitted from recent investments to expand our market presence in key markets."

The company had $74.3 million in net premiums written in the third quarter, versus $65.7 million in the second quarter and $52.7 million one year prior.