As a hectic year of mortgage industry merger and acquisition activity comes to a close — and engagement season in full swing — we thought it would be fitting to give this year's top M&A deals the same treatment.

Here's a recap of the mortgage industry's biggest M&A deals of 2018. Because what's an M&A deal if not the marriage of two companies?

#totheWaMunandStars — Washington Mutual and Nationstar

Target: Nationstar Mortgage Holdings

Price: $1.9 Billion

Close Date: July 31

The shareholders of Nationstar Mortgage Holdings and WMIH Corp. each voted to

#ShellsaidYes — New Residential and Shellpoint Partners

Target: Shellpoint Partners

Price: $190 million

Close Date: July 2018

New Residential Investment Corp.

#LoveineveryCornerstone — Guild Mortgage and Cornerstone

Target: Cornerstone Mortgage

Price: Undisclosed

Close Date: March 1

Guild Mortgage added to its Midwestern mortgage origination operations through the

#WentwosayIdo — Ocwen and PHH

Target: PHH Corp.

Price: $360 million

Close Date: Oct. 4

Ocwen Financial Corp.’s

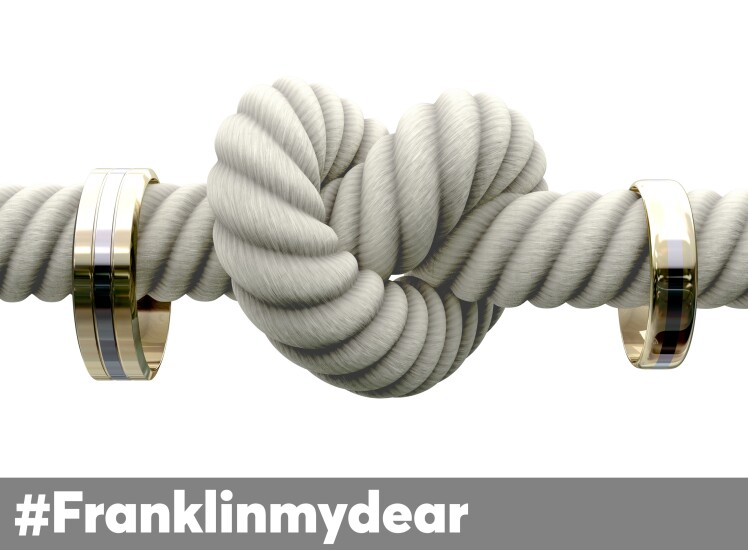

#Franklinmydear — Citizens Bank and Franklin American

Target: Franklin American Mortgage

Price: $511 million

Close Date: Aug. 1

Citizens Financial Group in Providence, R.I., will pay

#oohALa — CoreLogic and a la mode

Target: a la mode

Price: Undisclosed

Close Date: April 2018

CoreLogic, which has already acquired several appraisal technology and services vendors,

#Omahappilyeverafter — Mutual of Omaha and Synergy One Lending

Target: Synergy One Lending

Price: Undisclosed

Close Date: July 16

With its

#AIVAfoundherKnight — Black Knight and AIVA

Target: Heavy Water (AIVA)

Price: Undisclosed

Close Date: June 2018

With its acquisition of artificial intelligence and machine learning developer

#LoveGenworththeOcean — China Oceanwide and Genworth

Target: Genworth

Price: $2.7 billion

Target Close Date: Jan. 31, 2019

Genworth Financial's mortgage insurance business, which had slipped in market share, has

While the companies aimed to seal the deal by the end of the year, their new completion goal has been extended to Jan. 31, 2019.