-

The share of new refinance mortgage applications reached its highest point since December 2016, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 20 -

Top officials at the Internal Revenue Service met with mortgage industry groups this week to discuss possible fixes to the agency’s verification system, which lenders rely on to process mortgage loans.

December 19 -

Mortgage lenders are bracing for big delays in the processing of mortgage applications, citing a problem with the income verification system at the Internal Revenue Service.

December 17 -

The share of new refinance mortgage applications reached its highest point since January, but overall activity fell compared with the previous week, according to the Mortgage Bankers Association.

December 13 -

Mortgage applications for new home purchases increased by 12.2% in November from the same period a year ago, according to the Mortgage Bankers Association.

December 12 -

The company has agreed to buy the operations of Veterans Mortgage in Salt Lake City.

December 12 -

Mortgage application volume increased from one week earlier, driven by a boost in refinance activity, according to the Mortgage Bankers Association.

December 6 -

Mortgage application volume decreased 3.1% from one week earlier as the start of the holiday shopping season likely slowed activity, according to the Mortgage Bankers Association.

November 29 -

Mortgage applications rose slightly this week, increasing 0.1% from a week earlier, according to the Mortgage Bankers Association.

November 22 -

Mortgage application activity rose 3.1% from one week earlier as refinance demand increased, according to the Mortgage Bankers Association.

November 15 -

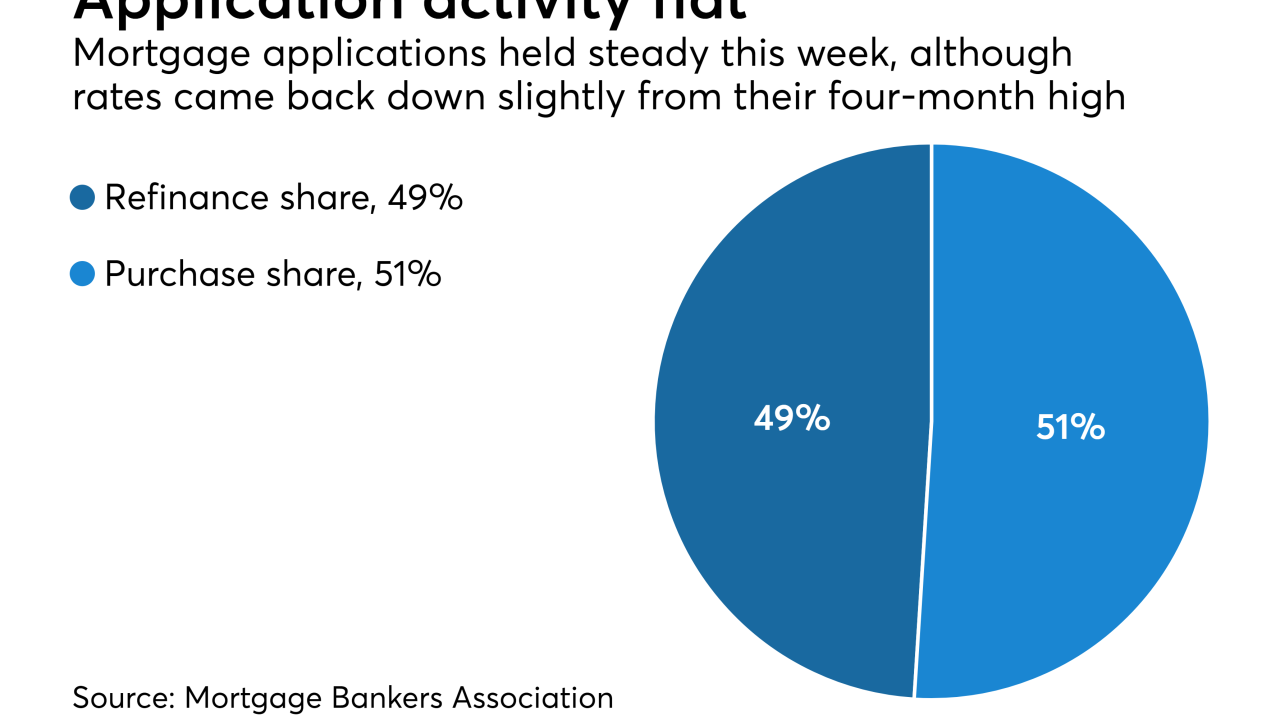

Mortgage application activity was unchanged from one week earlier although rates came back down slightly from their four-month high, according to the Mortgage Bankers Association.

November 8 -

Connecticut was the lone state in the nation in September to see a decline in borrowers misrepresenting facts on mortgage loan applications.

November 2 -

Mortgage rates rose to their highest level since July, leading to a 2.6% decrease in loan applications from one week earlier, according to the Mortgage Bankers Association.

November 1 -

Mortgage applications decreased 4.6% from one week earlier because of higher rates for conforming and government loans, according to the Mortgage Bankers Association.

October 25 -

Federal Housing Finance Agency Director Mel Watt said the agency is poised to examine alternatives to how a Fannie Mae and Freddie Mac assess creditworthiness of home buyers, including seeking public comment on the issue later this fall.

October 23 -

Hawaii's booming economy contributed to the Honolulu bank's 10% increase in loans and 9% increase in deposits in the third quarter.

October 23 -

Mortgage applications increased 3.6% from one week earlier even though rates remained mostly flat during the period, according to the Mortgage Bankers Association.

October 18 -

The share of mortgage refinance applications dropped below 50% for the first time since the start of September, as interest rates rose to a six-week high.

October 11 -

A change in the formula that banks use to calculate borrowers’ debt-to-income ratios, announced by Fannie Mae in April, appears to be spurring more lending.

October 6 -

A decline in refinancing applications offset the gain in purchase activity, leading to an overall drop in application activity of 0.4% from one week earlier.

October 4