-

Mortgage industry hiring and new job appointments for the week ending July 17.

July 17 -

The rise in late and suspended payments following the coronavirus outbreak in the United States may have helped the FHA realize it's high time to improve the process.

July 14 -

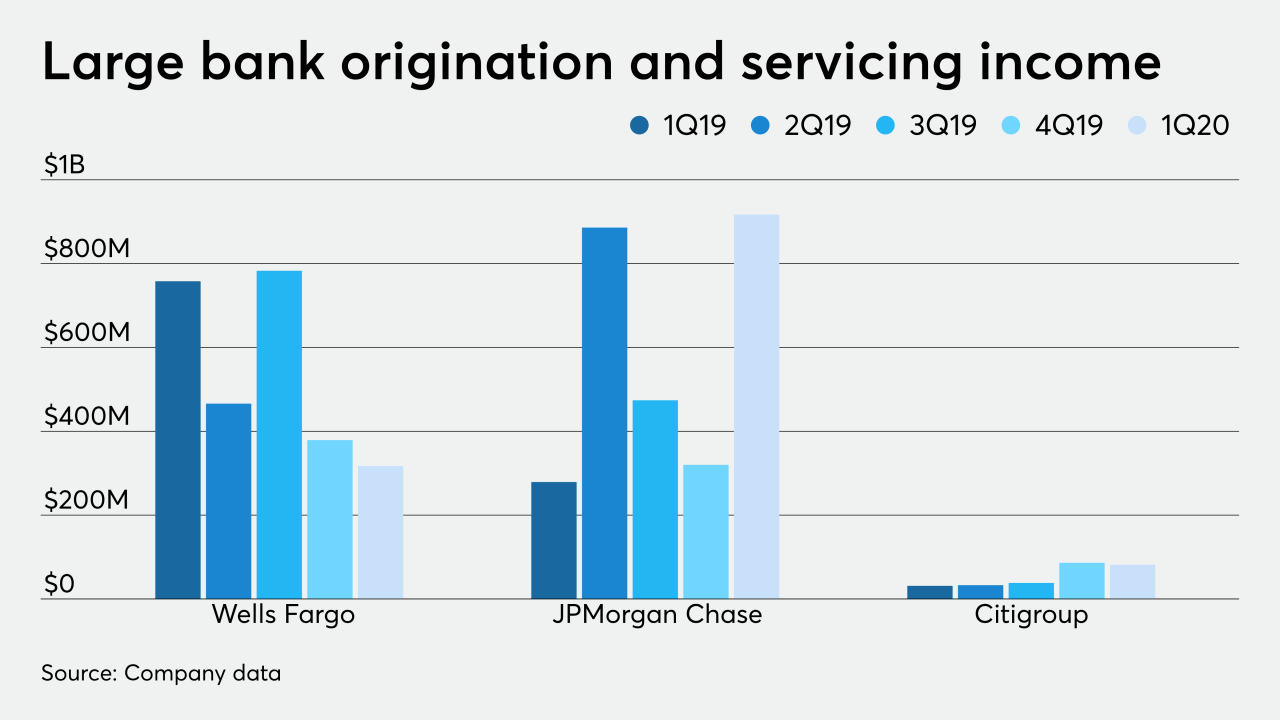

The banks logged strong year-over-year growth in gain-on-sale margins for mortgage loans.

July 14 -

The number of loans going into coronavirus-related forbearance fell for the fourth consecutive week, as the growth rate plummeted 21 basis points between June 29 and July 5, according to the Mortgage Bankers Association.

July 13 -

The amount far surpassed that of any other servicer required to purchase Ginnie Mae-backed loans that were 90 days past due.

July 13 -

A more than $5 billion offering going up for bid is one of the first large transactions seen since the coronavirus complicated trading.

July 10 - asr daily lead

Tricon American Homes launches the fifth securitization since mid-May secured by loans that finance institutional ownership and management of single-family residential rental homes.

July 7 -

The number of loans going into coronavirus-related forbearance dropped for the third consecutive week, as the growth rate fell 8 basis points between June 22 and June 28, according to the Mortgage Bankers Association.

July 7 -

The court struck down a 2015 update to the Telephone Consumer Protection Act, which permitted robocalls to cellphones for government-related debt collection.

July 6 -

By providing flexibility for property tax payments localities can help keep local businesses going and maintain their tax base for the future.

July 6 Greenberg Traurig LLP

Greenberg Traurig LLP