-

Servicers have long skimped on technology investment, leaving legacy systems that can't keep pace with compliance demands. But rising costs and a new round of regulations are compelling both servicers and vendors to finally address these deficiencies.

October 12 -

Fannie Mae said that it will sell 7,300 loans with a total of $1.39 billion in unpaid principal balance.

October 12 -

United Guaranty Corp. has initiated a disaster policy after Hurricane Matthew tore across the Southeast this past week.

October 12 -

The number of completed foreclosures nationwide in August dropped 42% from a year earlier, according to CoreLogic.

October 11 -

Fannie Mae plans to sell a pool of 3,600 loans with $806 million in unpaid principal balance.

October 11 -

Companies in the path of the storm have battened down the hatches, as others have prepared for the impact the hurricane could have on home sales and loan servicing in the weeks to come.

October 7 -

It's been a tough year for farmers, and lenders are looking for ways to help those borrowers offset sagging income.

October 7 -

Cybersecurity precautions often focus on preventing a data breach. But what if those precautions aren't enough? Here's a look at steps lenders and servicers can take now to prepare their response in the event of a catastrophic data breach.

October 7 -

Mortgage industry hiring and new job appointments for the week ending Oct. 7.

October 7 -

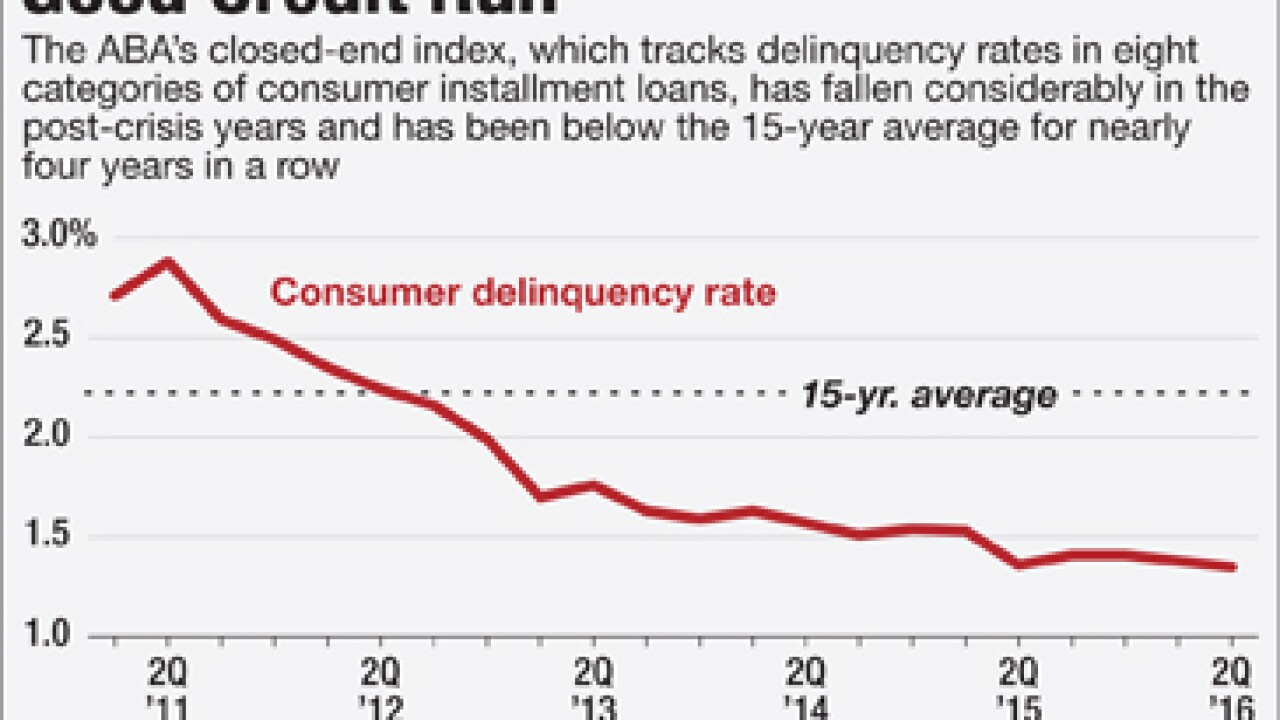

The 1.35% delinquency rate was the lowest since at least 2001, and it marked nearly four years of delinquencies below the 15-year average of 2.21%.

October 6