-

The shareholders of Nationstar Mortgage Holdings and WMIH Corp. each voted to approve a $1.9 billion acquisition plan that will see the parent company of nonbank lender and servicer Mr. Cooper combine with the successor to S&L and subprime mortgage lender Washington Mutual.

June 29 -

The son of a Lake Worth, Fla., man arrested this month in an alleged rent-fraud scam is wanted for acting as an accomplice in the crime, the Palm Beach County Sheriff's Office said.

June 29 -

Mortgage industry hiring and new job appointments for the week ending June 29.

June 29 -

The U.S. Supreme Court agreed to decide whether thousands of borrowers can invoke a federal debt-collection law when they are facing foreclosure.

June 28 -

Bank of America allows foreclosed houses in black and Hispanic neighborhoods to fall into disrepair even as it studiously maintains bank-owned homes in white areas, housing activists allege.

June 28 -

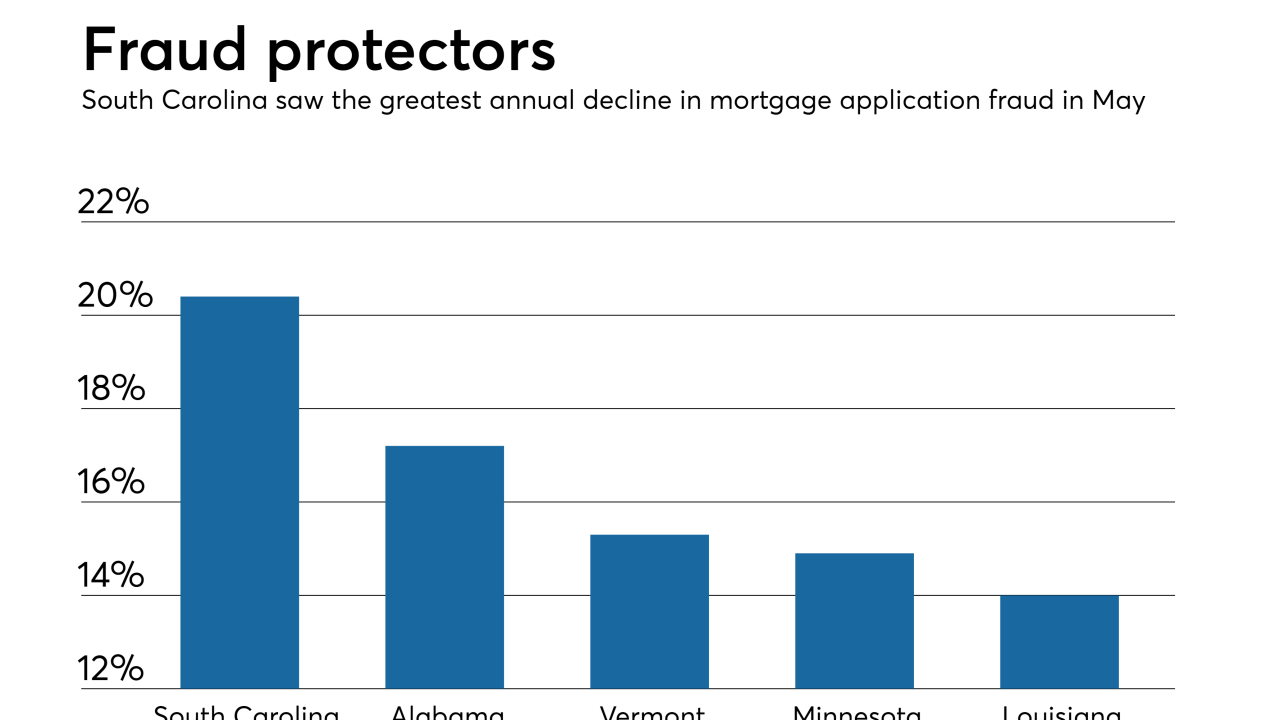

While purchase mortgages account for a growing share of overall volume, industrywide investments in more automated and efficient underwriting processes have helped lower instances of fraud.

June 28 -

Most mortgage lenders and banks do not maintain a comprehensive vendor management strategy, exposing institutions to increased compliance risk, according to a recent survey.

June 26 -

Ocwen Financial is able to keep the answers to questions from the Consumer Financial Protection Bureau involving the improper handling of escrow accounts confidential, a federal magistrate ruled.

June 26 -

While the digital mortgage movement has primarily focused on the originations side of lending, Black Knight's latest release seeks to apply those principles to servicing to help improve borrower retention and engagement.

June 25 -

Mortgage debt outstanding remains below pre-crisis levels and home equity is growing, even as overall consumer debt is on pace to surpass its previous 2008 peak by $1 trillion, according to LendingTree.

June 25