The average 30-year fixed mortgage rate fell from 6.28% to 6.26% over the seven-day period ended Dec. 1, according to Freddie Mac's Primary Mortgage Market Survey.The average 15-year fixed mortgage rate was unchanged at 5.81%, the average rate for five-year Treasury-indexed hybrid adjustable-rate mortgages rose from 5.75% to 5.76%, and the average rate for one-year Treasury-indexed ARMs climbed from 5.14% to 5.16%. Fees and points averaged 0.5 of a point for fixed-rate mortgages, 0.6 of a point for hybrid ARMs, and 0.8 of a point for one-year ARMs. "Mortgage rates are in a holding pattern at the moment as financial markets try to discern where inflation and growth in the economy are headed," said Frank Nothaft, Freddie Mac's chief economist. "Until the market decides these issues, mortgage rates should stay within a relatively narrow band." A year ago, the average 30-year and 15-year fixed rates were 5.81% and 5.23%, respectively, and the average one-year ARM rate was 4.19%, Freddie Mac said.

-

In the highest-priced housing markets, some buyers see adjustable-rate mortgages as the only loan they may initially qualify for, Cotality found.

9h ago -

The company dropped the broker channel just months after Frank Martell became CEO; now that Anthony Hsieh is running things again, LoanDepot brought it back.

March 9 -

TransUnion cuts VantageScore 4.0 to $0.99, aiming to boost lender choice and affordability as FHFA pushes mortgage score modernization and competition.

March 9 -

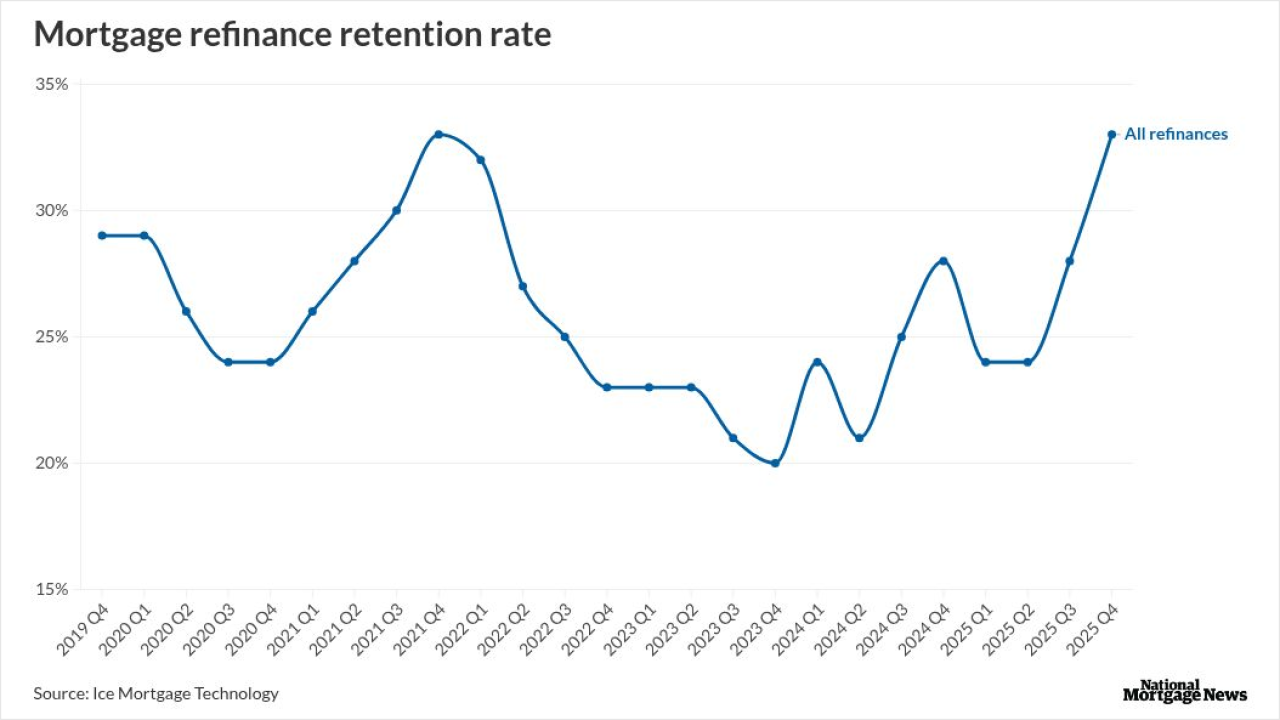

An estimated 565,000 first-lien refinances closed in the fourth quarter, up 50% from a year prior and the most since the second quarter of 2022, ICE found.

March 9 -

Borrowers or lenders could use the prediction markets as a hedging tool, although experts noted the lack of trading volume as cause for caution.

March 9 -

The industry welcomed the Department of Veterans Affairs' plan for implementing legislatively-created borrower relief but some would like more clarification.

March 6