In separate pleadings, Black Knight and Intercontinental Exchange asked a federal court judge to declare the Federal Trade Commission's structure unconstitutional.

The filings, both made on April 25, were

Now, both Black Knight and Intercontinental Exchange, are seeking their own injunctive relief against the FTC.

These latest pleadings make similar separation of power arguments that were included

"This court should declare the FTC's structure and procedures unconstitutional," Black Knight's latest response said. "And it should enjoin the FTC from subjecting Black Knight to its unfair and unconstitutional internal forum, adjudicating the legality of Intercontinental Exchange's acquisition of Black Knight in this Article III court instead."

Article III is the portion of the U.S. Constitution that establishes the powers of the judiciary. The Intercontinental Exchange filing contains a similar statement.

The jockeying began on March 9, when the FTC filed an administrative complaint against the transaction, arguing the parties would dominate loan origination systems along with product and pricing engine technology. ICE Mortgage Technology owns the No. 1 LOS, Encompass, while Black Knight currently owns No. 2 Empower.

But the latter entered into

"Rather than engage with and consider the divestiture, the FTC rushed to file an administrative complaint in the FTC's administrative court in March 2023 that failed to account for the divestiture's effect," Black Knight's latest response said. "And, despite delaying the filing of this latest complaint by a month, the FTC yet again fails to account for the divestiture's effect."

The fact that the FTC waited a month to go to court rather than filing for injunction at the same time as the administrative complaint was also cited by both companies as a strike against the agency.

The Black Knight filing adds that Constellation's market capitalization of $41 billion is over three times of its own. Citing a precedent established in the UnitedHealth case, it argued that "the FTC and the court must consider this procompetitive LOS divestiture when assessing the likely competitive effects of the transaction."

Regarding UnitedHealth,

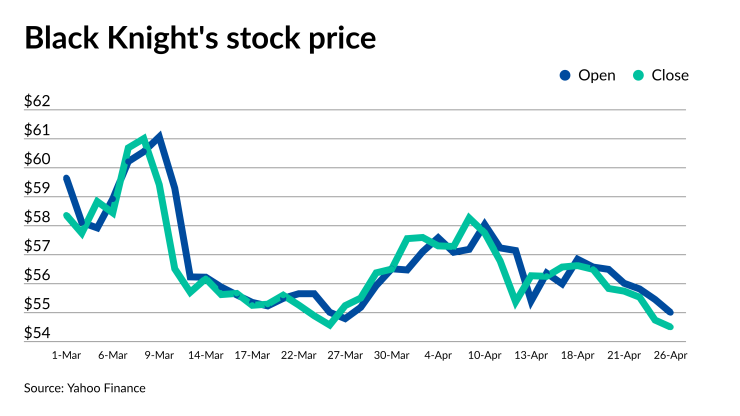

ICE lowered the compensation for Black Knight after the Empower sale was announced to $75 per share in cash and stock. The last time Black Knight's stock price was above that level was on May 2, 2022 after the transaction was announced, and it last closed higher on Jan. 13 of that year.

On April 25, Black Knight closed at $54.75 per share. It opened the following morning at $55.01, but ended the day at $54.51.

Messages left for the FTC, Intercontinental Exchange and Black Knight have not yet been returned.