Late payments on securitized commercial mortgages, which saw a big jump in June, retreated just as quickly in July.

The delinquency rate for U.S. commercial real estate loans in CMBS is now 5.49%, a decrease of 26 basis points from the June level, according to Trepp.

The rate is now only two basis points higher than where it stood at the end of May.

After hitting a post-crisis low in February 2016, the reading has moved up in 13 of the last 17 months as more loans from 2006 and 2007 have reached their maturity dates and have not been paid off via refinancing.

Delinquency readings for four of the five major property types retreated in June. Only the lodging sector saw its rate go up.

The July 2017 rate is now 73 basis points higher than the year-ago level and 26 basis points higher year-to-date. The reading hit a multiyear low of 4.15% in February 2016. The all-time high was 10.34% in July 2012.

About $1.4 billion in loans became newly delinquent in July. Almost $1.2 billion in loans were cured last month. Another $1.7 billion in CMBS loans that were previously delinquent were resolved with a loss or at par in July.

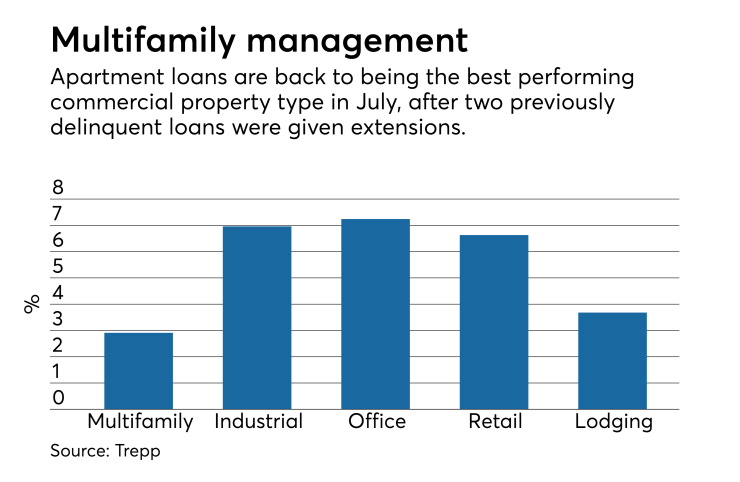

The multifamily delinquency rate dropped 101 basis points to 2.91%, though this was largely attributable to two portfolios that were reported delinquent in June and were subsequently given an extension, resulting in them being reported as current in July.

The industrial delinquency rate moved down 61 basis points to 6.96%, the office delinquency rate fell 43 basis points to 7.24% and the retail delinquency rate decreased two basis points to 6.63%.

Lodging was the only sector to report an increase in the delinquency rate, by 15 basis points to 3.68%.