Late payments on securitized commercial mortgages fell in September for the third consecutive month.

The Trepp CMBS Delinquency Rate is now 5.4%, a decrease of four basis points from the August level.

Delinquencies on office buildings, retail, hotels, apartment buildings and industrial property loans hit a post-crisis low of 4.15% in February 2016, then climbed consistently for more than a year as loans issued in 2006 and 2007 reached their maturity dates and did not pay off.

Commercial mortgages generally have terms of 10 years and repay the bulk of principal in a final, balloon payment. So while the worst pre-crisis loans went bad early, a number of borrowers who obtained loans with very loose terms right before the financial crisis were able to keep making interest payments. It was only when they had to refinance that they ran into problems.

In the 16 months between March 2016 and June 2017, the delinquency rate moved up 13 times.

Now, according to Trepp, it appears that the wave of maturities has been reduced to more of a ripple. “When combined with the continued resolution of distressed loans, the largest monthly rate increases should be behind us,” the firm stated in its monthly delinquency report. “In fact, further declines in the overall reading are quite possible in the coming months.”

The September 2017 rate is 62 basis points higher than the year-ago level and 17 basis points higher year-to-date.

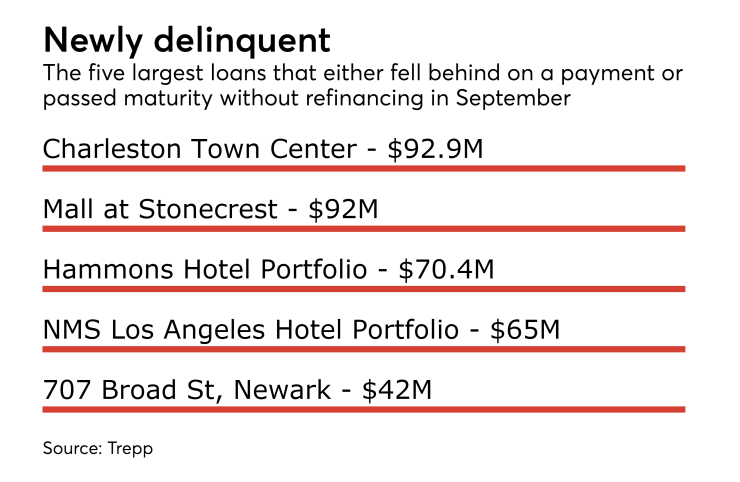

Almost $1.3 billion in loans became newly delinquent in September, which put 32 basis points of upward pressure on the delinquency rate. Over $800 million in notes were cured last month, while almost $700 million in previously delinquent CMBS loans were resolved with a loss or at par in September. These changes helped shave 20 and 17 basis points off of the September reading, respectively.

Some property types fared better than others in September. The office delinquency rate dropped 21 basis points, but is still the highest, at 7.1%.

The retail delinquency rate fell six basis points to 6.55%.

The industrial delinquency rate was unchanged at 6.55%.

The multifamily delinquency rate inched up nine basis points to 3%, but this is still the best performing property type.

The delinquency reading for hotel loans moved up 35 basis points to 3.84%.