Commerce Home Mortgage said the Federal Home Loan Bank of San Francisco's denial of its reinstatement as a member smacks of the redlining practices that have held back investment in minority neighborhoods.

The nonbank mortgage lender is permitted to join an FHLB because it is certified as a

After it was certified as a CDFI in 2018, Commerce Home was accepted as a member of the FHLBank-San Francisco and purchased stock in the institution in December 2018. It made a second purchase the following April.

But on May 29, 2019, the FHLBank-San Francisco sent Commerce Home a letter stating the mortgage lender's membership was now denied because the Bank determined it did not meet the liquidity test. The FHFA, the FHLB-San Francisco said, did not consider pair-off and investor receivables, mortgage loans held for sale at fair value, and mortgage servicing rights to be liquid assets for the purpose of the requirement.

Carlos Salas, Commerce Home's chairman, said the company met the liquidity requirements.

"The FHFA and the FHLBank-San Francisco have very clear, unambiguous regulatory guidelines for how to qualify, which we met," he said.

Commerce Home reapplied for membership and that too was denied. It is appealing this decision and "the very extraordinary procedural move of nullifying our original acceptance," said Salas.

The appeal is with the Federal Housing Finance Agency, which regulates the FHLBanks.

CDFIs are subject to concentration limits and there is a difference

"We think it's unfortunate that CDFIs are treated differently because the only thing that makes them different is the make-up of their borrowers, which tend to be minority and low-and-moderate income borrowers," he added.

In a statement from a spokesperson, the FHLBank-San Francisco said it "evaluates all applications for membership according to FHFA rules and requirements, and we will cooperate with the FHFA regarding Commerce's appeal according to the framework they have established."

As part of its regulatory functions, the FHFA has established

Commerce Home, headquartered in Irvine, Calif., joined for many of the same reasons that the FHLB's more traditional members sought membership, Salas said. The FHLB's advance program would help the company with liquidity, in order to reach more borrowers

"So in that respect, we're just like any like applicant or member of an FHLB, and are entitled to membership," he added.

The distinguishing characteristic of a CDFI is that it lends to minority and low-to-moderate income borrowers. The only difference between Commerce Home's loans from those from other lenders is that many of Commerce's are made to minority borrowers, Salas said.

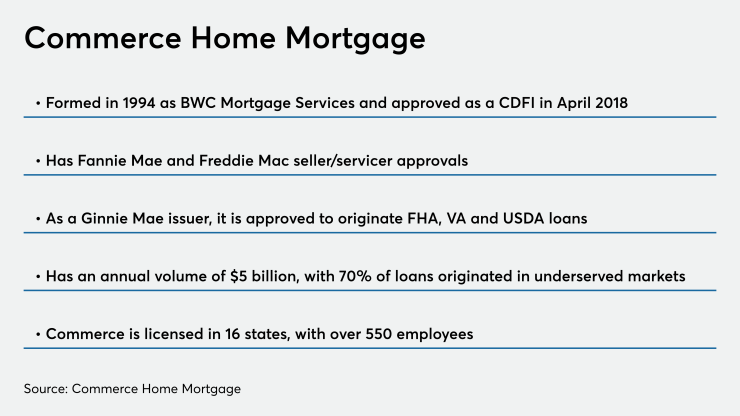

Commerce currently originates over $5 billion in mortgages annually, more than 70% of which are to underserved markets. It is licensed in 16 states and employs over 550 employees, 41% of which are racial/ethnic minorities and 55% of which are women. Its board and senior leadership are both majority minority (67% and 75%, respectively), Salas pointed out.

"A policy that disfavors a lender by category, where the only distinguishing characteristic is that they concentrate on making minority loans … is de facto discriminatory in its impact," he said.

Rev. Everett Bell, the chairman of Commerce Home's advisory board, met with both the FHFA and the FHLBank-San Francisco to discuss the case.

"A lot of times there's conversations about help that never does come because the commitment towards change is not there," Bell said. "My concern is this; if CDFIs are created to engage these communities, why is there so much unwillingness to create the necessary and intentional relationships to bring about the change in those communities?"

Commerce Home wants the FHFA to grant its appeal and instruct the FHLBank-San Francisco to admit it as a member on equal terms to its bank members.

Alternatively, it is looking to be allowed to join another district "until such time that the FHLBank-San Francisco remediates its discriminatory practices that are resulting in an inability to serve minority borrowers and their CDFI lenders on the same terms and conditions as white borrowers and the banks who serve them," the appeal said.

Commerce Home wants the FHFA to take a hard look at the appeal and afterwards, they'll understand that allowing it to be an FHLBank member is a very commendable outcome, not only for commerce but for the minority and low income communities it serves.

"I think that part of the concern is a question of how we treat all community development financial institutions," Bell said.

"But to change the rules after a member is granted membership and then make their rulemaking decision retroactive to before they became a member is questionable."

In response, the FHLBank-San Francisco spokesperson said, "Based on the totality of information available to the Bank, the Bank believed that Commerce never met all of the membership eligibility criteria of the Federal Home Loan Bank Act as implemented by Part 1263 of the FHFA regulations and enforced by the FHFA. In particular, Commerce did not meet the liquidity test set forth in Section 1263.16(b)(2)(iv) of the FHFA regulations. The last time the FHFA amended Part 1263 was in June 2017. Because the FHFA has indicated to us that the appeal is confidential, we can’t comment on the appeal itself."

Still, "That is the kind of action that feels like redlining," Bell said. "Because what they do is in effect limit the impact that these institutions can have in the communities that they were created to serve."