Training of employees is one of the keys to preventing mortgage fraud, and companies need to hold internal presentations to arm them with information, according to an expert on the topic who addressed the SourceMedia Mortgage Fraud Conference.Matt Holland, assistant vice president and residential mortgage fraud manager for Sovereign Bank, added that people need to attend such seminars and take information back to their companies to "share the knowledge." This, he said, helps to "contain a problem that is out of control." Lenders need to talk with their brokers and correspondents and tell them that policies to deter fraud are being implemented. This at least puts them on notice, or might even deter them from committing fraud, Mr. Holland said. It is also important, he said, to talk with other industry professionals and share the names of those committing fraud.

-

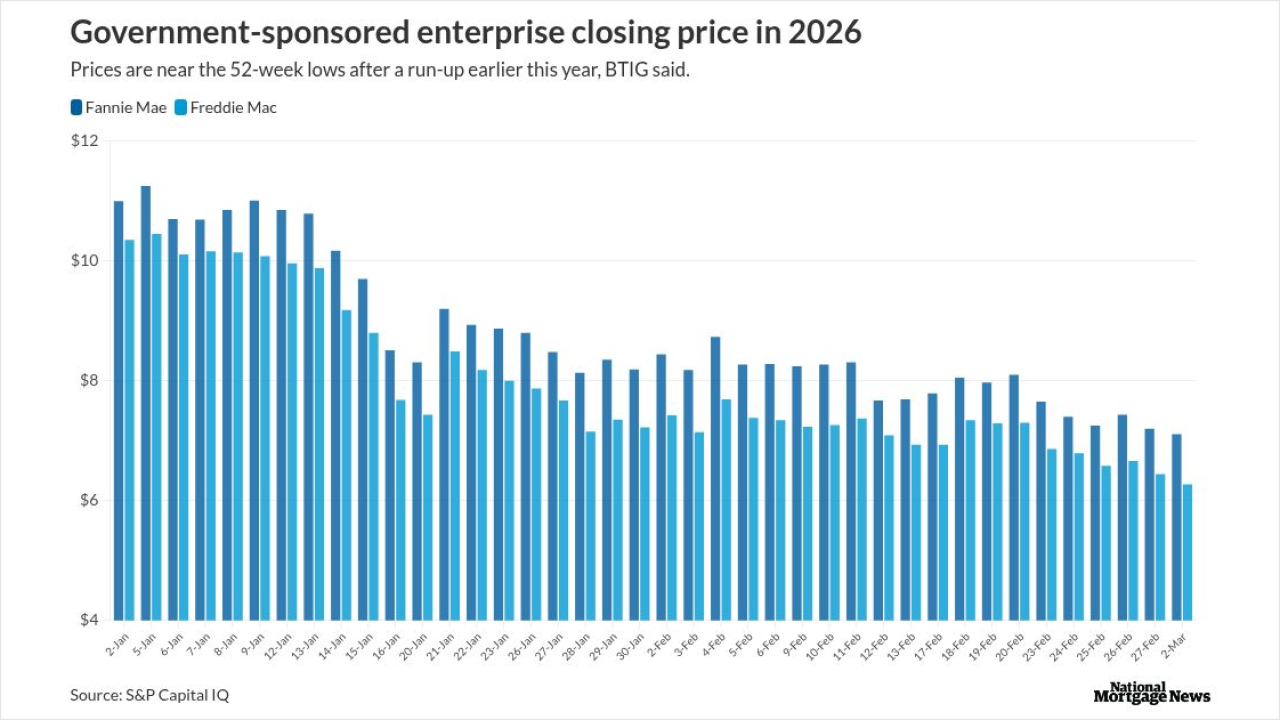

The Supreme Court's decision seems to set limits on Pres. Trump's power, even if he wasn't inclined to hold on to the GSEs to control mortgage rates, BTIG said.

5h ago -

An appellate court denied the bank's argument targeting the state's Foreclosure Abuse Prevention Act and ordered it to pay the defendant's legal fees.

8h ago -

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

March 2 -

Markets were bracing for the chaos of a regional war; banks may be the target of sophisticated cyberattacks, experts warn.

March 1 -

MBS numbers at both soared in January, when Trump directed the enterprises to accumulate more bonds, but a decline in loans shrunk Freddie's total number.

February 27 -

New York is seeking $21 billion in federal grants for a construction project at Sunnyside Yard, which would allow the city to build 12,000 new affordable homes.

February 27