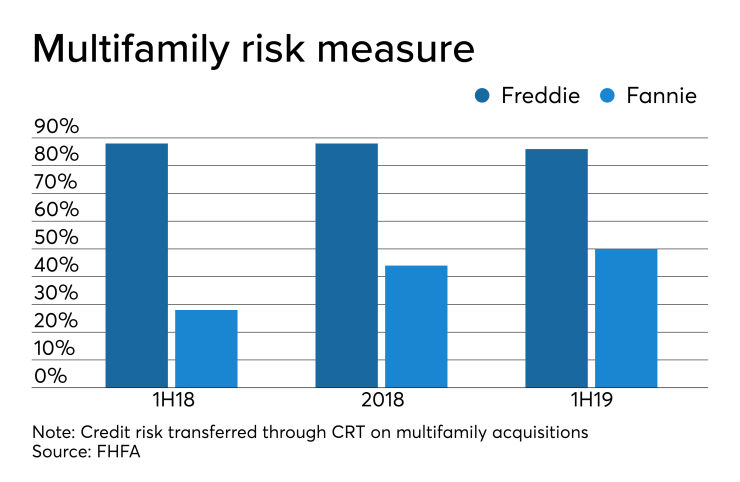

The Federal Housing Financial Agency's latest report on credit risk transfers shows Fannie Mae continues to slowly improve a multifamily mortgage risk-sharing metric that lags Freddie Mac's by a wide margin.

Fannie Mae shared 50% of its credit risk capital on 2018 multifamily acquisitions through the first half of 2019 while Freddie Mac transferred 86%.

Comparable figures in the FHFA's previous CRT progress report were 44% for Fannie Mae and 88% for Freddie Mac. That report reflected full-year 2019 numbers. In the first half of last year, the comparable figures were 28% for Fannie Mae and 88% for Freddie Mac.

CRT strategies in general are expected to become more important at the GSEs as government officials seek to prepare them for a release from conservatorship by helping them rebuild sufficient risk-based capital buffers.

Differences in the way the two GSEs share their risk accounted for the gap in their numbers. Fannie primarily uses a lender risk-sharing arrangement, which has some alignment-of-interests benefits but gets less scorecard credit. Freddie primarily shares risk with investors through financial structures.

Fannie continues to use its traditional delegated underwriting and servicing model for much of its multifamily risk sharing. Fannie has said its goal is not necessarily to match Freddie Mac's number, but to

For example, Fannie recently adapted its Connecticut Avenue Securities single-family CRT vehicle for use in the multifamily market

"We were very, very pleased with that deal," Fannie Mae Chief Financial Officer Celeste Brown said in a recent interview.