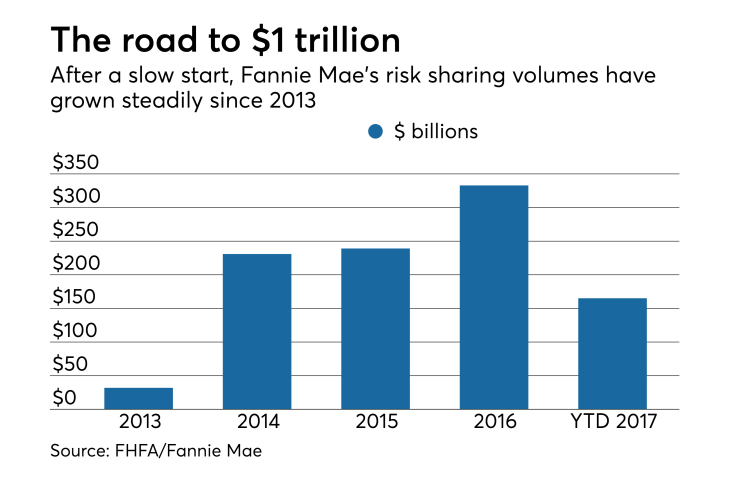

The original unpaid principal balance of single-family mortgage credit risk Fannie Mae has transferred since 2013 has risen to $1 trillion, the agency reported Wednesday.

"I think we've made a ton of progress in a very short period," Andrew Bon Salle, an executive vice president with oversight of Fannie's single-family mortgage business, said while commenting on the programs at a recent conference.

However, Fannie Mae has "mostly done this in a very good economic environment," he noted.

There are questions about whether investors in risk-sharing done through the securities market "will be there if the market turns down," Bon Salle said.

Fannie and fellow government-sponsored enterprise Freddie Mac most commonly share risk with the private market in the form of securities or insurance deals, but they also have shared risk with larger lenders.

The GSEs' conservator and regulator, the Federal Housing Finance Agency, had originally directed them to share more risk with the private sector as part of GSE reform.