Two Wall Street firms and a single-family rental investor have purchased portions of Fannie Mae’s latest nonperforming loan package.

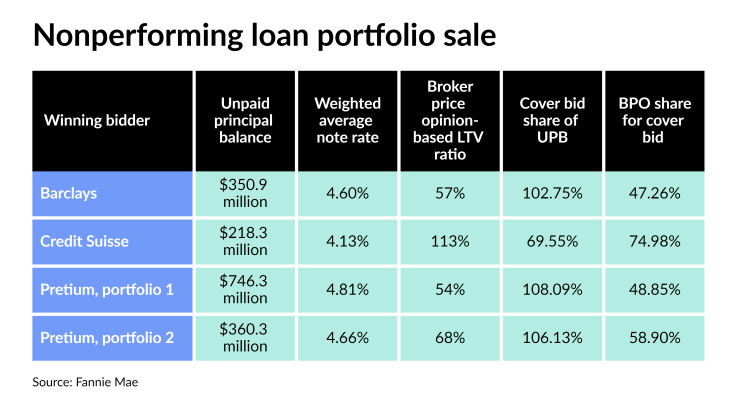

The four pools totaling $1.68 billion were sold to these companies or their affiliates with the following weighted averages for note rates and broker price opinion-based loan-to-value ratios, respectively: nearly $350.9 million (4.6%, 57%) to Barclays; more than $218.3 million (4.13%, 113%) to Credit Suisse; and two separate packages of loans to Pretium: one over $746.3 million (4.81%, 54%) and the other almost $360.3 million (4.66%, 68%). The shares of the unpaid principal balance and BPO for the cover (second-highest) bids, were, respectively: 102.75%, 47.26%; 69.55%, 74.98%; 108.09%, 48.85%; and 106.13%, 58.9%.

The deadline for bids on other NPLs reserved for the community buyers is Oct. 19.

Sales outcomes for NPLs are coming into focus as the administration’s

In the past, NPL sales at both the government-sponsored enterprises’ and the Department of Housing and Urban Development have

While community buyers have been active in the NPL market to a degree, the pool of participants and the amount of loans purchased has been relatively small due in part to the purchasers’ limited financial resources. As a result, Fannie Mae and Freddie Mac have worked to balance that interest in getting some nonperforming loans in these buyers’ hands with the need to engage in investor sales that may do more to help shore up their capital buffers, reducing taxpayer exposure.

Investor buyers of Fannie’s NPLs agree to honor any loss mitigation like forbearance or modification in place at the time of sale before starting foreclosures. Also foreclosures are currently subject to

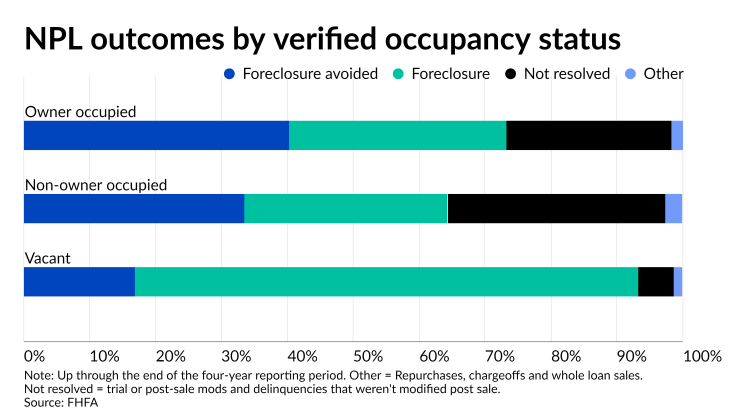

As of Dec. 30, 2020, Fannie and Freddie had seen outcomes where foreclosures were avoided for more than 40% of owner occupants involved in NPL sales, nearly one-third of properties with other occupants such as renters, and almost 17% of vacant homes, according to the Federal Housing Finance Agency.