While not far off

The MBA's Market Composite Index, a measure of loan application volume based on surveys of the trade group's members, came decreased for the fourth week in row, dropping a seasonally adjusted 0.8% for the period ending Aug. 11. The slowdown followed a larger 3.1% decline seven days earlier. On an annual basis, overall volumes last week also finished 29.4% lower.

Mortgage activity came in muted, as the average rate for 30-year conforming fixed loans headed up for a third straight week to finish at its highest mark since 2001. The average jumped up 7 basis points to 7.16%, matching a number also seen in October 2022. Borrower points decreased, though, to 0.68 from 0.70 for 80% loan-to-value ratio loans.

"Overall applications decreased because of these higher rates, as both purchase and refinance applications ended the week at their lowest levels since February 2023," said Joel Kan, MBA vice president and deputy chief economist, in a press release.

The

Meanwhile the 30-year jumbo average for loans exceeding the conforming amount among MBA lenders similarly climbed up 7 basis points to land at 7.11%, up from 7.04% in the prior survey. Points also deceased to 0.55 from 0.66.

With the

Meanwhile, the seasonally adjusted Purchase Index came in nearly flat, decreasing by 0.3% from the previous survey period. Last week's volume was 26.6% lower compared to a year ago. But while the market proved sluggish, more encouraging signs for the market appeared in the federal loan market, Kan noted.

"Government purchase applications provided a bright spot, increasing 2.4% over the week, driven by increases in both FHA and VA purchase categories," he said.

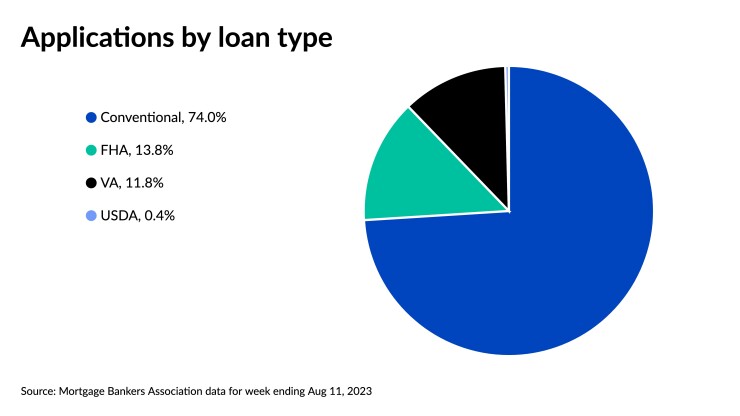

Government-backed application volumes still registered a decline overall, though, but smaller than the composite index thanks in part to the uptick in FHA purchases. The share of federally sponsored activity increased as a result, accounting for 13.8% of last week's total, up from 13.6% in the previous survey. Applications sponsored by the Department of Veterans Affairs garnered the same week-over-week share of 11.8%. U.S. Department of Agriculture-backed mortgages, likewise, took the same 0.4% portion as one week prior.

Despite the recent upward trajectory of FHA mortgages, which are often used by first-time buyers for affordable properties, the average purchase-loan size increased last week to $417,200 from $416,900. Mean refinance amounts, though, declined 1.9% to $251,900 from $256,800. The retreat in refinance sizes brought the overall average down 0.2% to $369,900 from $370,600.

Among the fixed interest rates tracked by the MBA, the FHA-backed 30-year mortgage saw the only decrease, dipping 9 basis points to 6.93% from the prior week's 7.02%, which was its most elevated since 2002. Points for 80% LTV loans headed up to 1.17 from 1.14.

The contract average of the 15-year fixed home loan jumped 6 basis points week over week, to 6.57% compared to 6.51% in the previous survey. Borrower points inched up to 0.94 from 0.92.

With most fixed averages higher compared to earlier in the month, the share of adjustable-rate mortgages rose for a third week in row, clocking in at 7% of total volume, making up its biggest slice of activity since April as borrowers looked for some affordability relief, according to Kan. Seven days earlier, ARMs accounted for a 6.9% share.

To borrowers' benefit, the contract average rate of the 5/1 ARM, fell 16 basis points to 6.2% from 6.36% in the prior survey. Borrowers used 1.45 points on average compared to 1.2 a week earlier. The loans have a fixed rate for five years before adjusting to market levels.