Genworth Financial has postponed the initial public offering for its U.S. private mortgage insurance business, citing volatility in the stock prices for the other companies in the sector.

The Enact Holdings IPO was Plan B for the company

"In light of the recent significant trading volatility in the mortgage insurance sector, Genworth's Board of Directors determined that current market pricing for the planned offering does not accurately reflect Enact's value," said Tom McInerney, Genworth president and CEO, in a press release issued before the market opened on Thursday. "Therefore, we have decided to postpone the IPO and will continue to evaluate our options as market conditions develop."

On May 4, Genworth released

Since the start of the month, the stock prices of the four companies whose primary line of business is mortgage insurance saw significant declines.

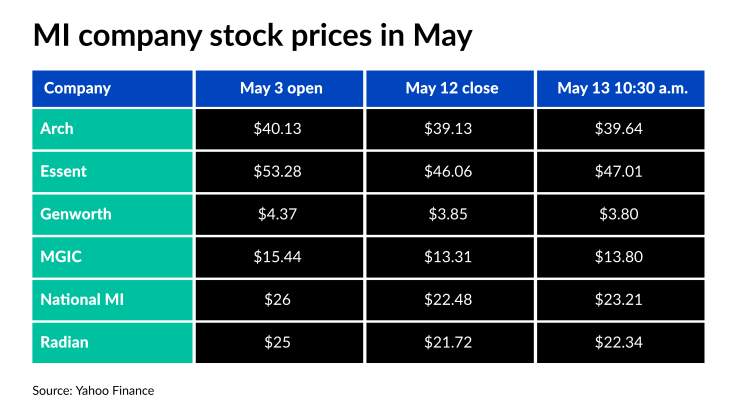

Essent Group opened on May 3 at $53.28 per share and closed on May 12 at $46.06. During that same time frame, MGIC Investment went from $15.44 per share to $13.31; NMI Holdings from $26 to $22.48 and Radian Group $25 to $21.72.

Arch Capital Group, where PMI is one of several lines of business it offers, had a much smaller drop, from $40.13 to $39.13.

Genworth, whose long-term insurance business has been a problem for the company for an extended period of time, went from $4.37 per share to $3.85 per share in that same time frame.

All five of its competitors opened higher on Thursday morning and had significant gains in price by 10:30 a.m. Essent was up 95 cents per share; NMI, 73 cents per share; Radian, 62 cents per share; Arch, 51 cents per share and MGIC, 49 cents per share.

But Genworth opened the day at $3.70 per share, 15 cents lower, although it had regained ground by 10 a.m., and was only 10 cents down from the previous day.

"Our primary objective has been and will continue to be protecting the value of Enact," McInerney said. "We maintain our positive long-term outlook for the MI sector, given strong trends in the U.S. housing market and expected tailwinds as the economy recovers from COVID-19."

Genworth's liquidity position to meet its