Guaranteed Rate is purchasing Stearns Holdings in a move that helps the Chicago-based company expand its joint venture business.

"Stearns Holdings has an extensive partnership model that includes real estate agent, builder and relocation joint ventures, private label relationships and

The transaction also will move Guaranteed Rate into the broker/wholesale business.

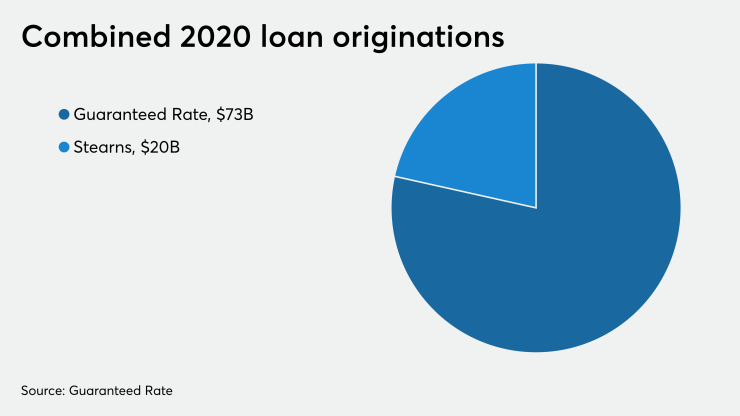

Guaranteed Rate originated $73 billion in 2020, while Stearns Lending did $20 billion. The combined $93 billion of volume is still well behind the $213 billion that Rocket Cos. logged just through

Guaranteed Rate is purchasing the company from funds associated with Blackstone Group. Blackstone will receive an interest in Guaranteed Rate. No other terms related to the deal were disclosed. According to Crunchbase, the only outside investor in Guaranteed Rate is Thomas H. Lee Partners, which

Blackstone acquired 100% of Stearns following

After the deal is completed, Stearns Holdings' retail operation will be rebranded and integrated into Guaranteed Rate. Stearns' wholesale and partnership businesses will remain as stand-alone operations, with its current

Stearns Lending was founded by Glenn Stearns, its CEO through 2012. He left the company prior to becoming the star of Undercover Billionaire.

Sidley Austin acted as the legal advisor to Guaranteed Rate. Houlihan Lokey was the financial adviser to Blackstone and Stearns Holdings and Skadden, Arps, Slate, Meagher & Flom served as their legal adviser.

In a separate transaction, Ncontracts, which provides risk management technology for the financial services industry, bought

The combined companies will have over 260 employees, with more than 3,700 financial institutions and mortgage companies as clients.

"With the addition of the QuestSoft products and expertise to our existing lending compliance solutions, we now have the ability to deliver the most comprehensive set of integrated risk management offerings available in the marketplace," Ncontracts CEO Michael Berman said in a press release.