Hometown Lenders' CEO announced a headcount reduction Friday and said that it will transition from a retail shop to a broker model.

Billy Taylor, the founder of the company, described the current state of the market as "maddingly unpredictable" and stated in his email that employees will

"It is in your best interest for us to terminate your employment effective immediately," wrote Taylor in an email that was shared with National Mortgage News.

Over 100 employees were allegedly let go across all departments further slimming ranks at the company, according to an employee with knowledge of the inner workings of the company. As of Oct. 10, the lender sponsors 69 loan officers, per the National Mortgage Licensing System, compared to the 400 LO's employed just four months prior.

Hometown's CEO did not immediately respond to a request for comment.

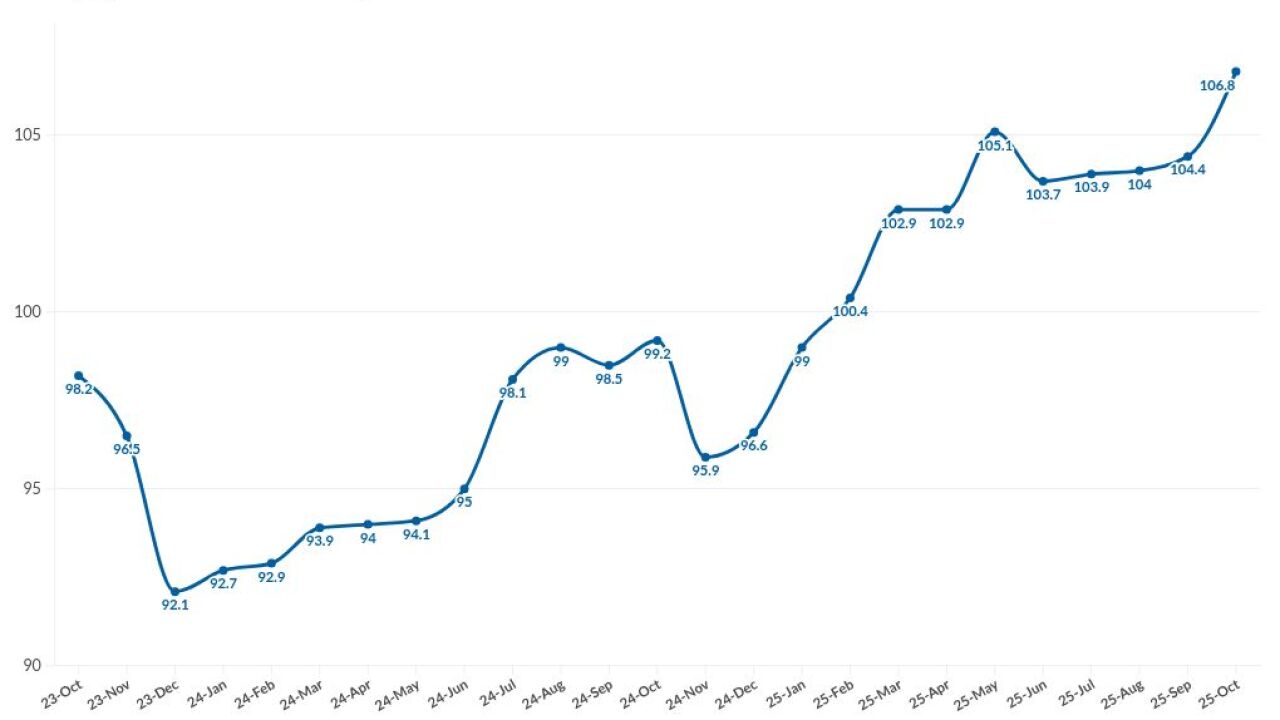

Former and current employees say the company's transition to a broker model is a last ditch effort to stay afloat in a challenging market, made much more difficult as interest rates have edged towards 8%. Rates this high were last seen

Taylor stated that he was hopeful that brokering "for a few weeks, or months" will allow the company to pay off all of its obligations to employees and will help Hometown "survive and thrive again."

"We have been here before and emerged each time stronger and wiser as a result," Taylor wrote in the communication to employees.

Earlier this year both current and former employees alleged the lender stopped paying for rent, utilities and health insurance.

Unpaid bills, ranging from leases to invoices from appraisal management companies and vendor service providers have piled up since mid-2022, causing branch managers to step up and pay for some bills out of pocket without getting reimbursed, they said.

Some of these claims have developed into lawsuits. There are at least

One of the lawsuits, filed by a

Anthony Perri Sr. and Anthony Perri Jr. , a father and son duo who ran the Moketa, Illinois branch, accuse Hometown of failing to pay their final compensation, stopping payments on paychecks and failing to reimburse "hundreds of thousands of dollars of approved expenses."