For-sale housing supply saw its biggest drop in over a year,

The total number of home listings tumbled 6.3% year-over-year for the four-week period ending June 11, the largest decrease in 13 months, the online real estate brokerage said. Active listings came in essentially flat from a month earlier in a season when inventory historically rises.

The latest data points to a continuation of muted activity from earlier this spring. While inventory was up approximately one month ago compared to the year before, it slowed to growth of 3.6% from the year before, and fell on a monthly basis by 1%.

Meanwhile, the number of

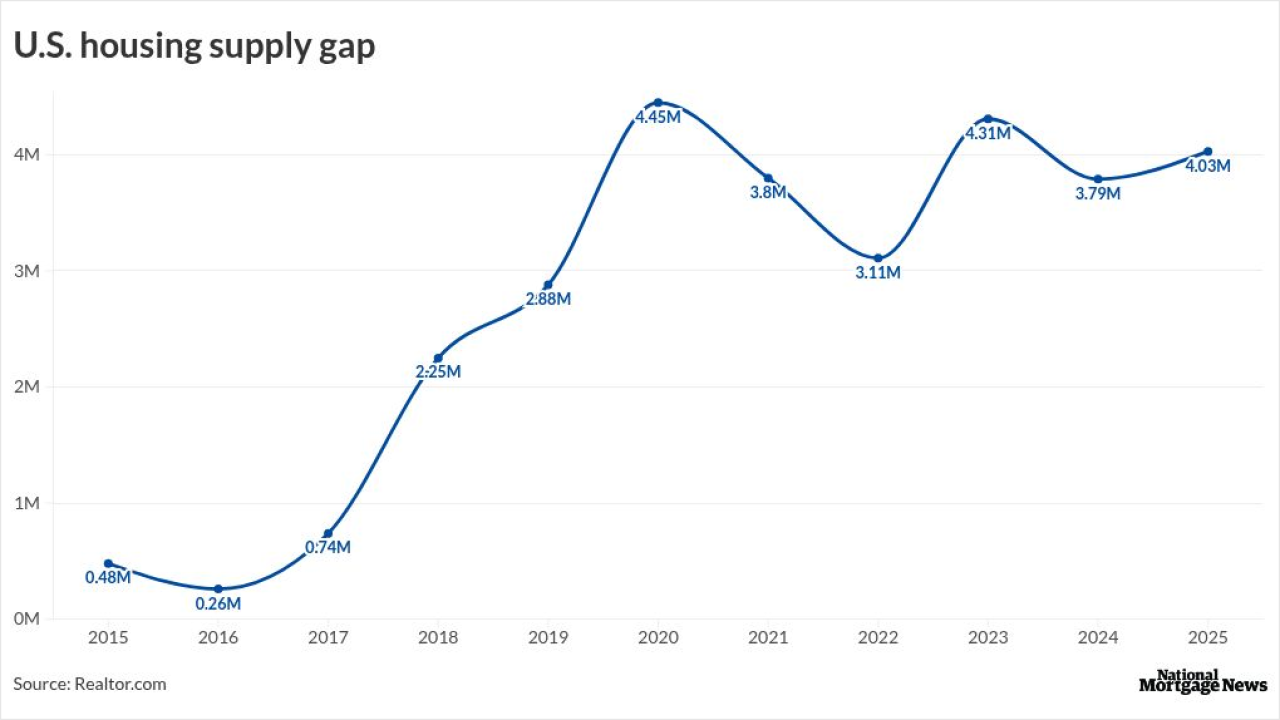

The lack of new listings over the past year is pushing overall supply downward, with total inventory now 39% lower compared to June 2018, Redfin said.

The slowdown in homebuilding immediately following the Great Financial Crisis combined with more recent interest-rate volatility is behind the current collapse in available inventory.

Record-low mortgage rates in 2020 and 2021

The sluggish pace shows no signs of letting up either, with

"The Fed's indication that there are more rate hikes to come is not what homebuyers want to hear," said Redfin economics research lead Chen Zhao, in a press release. "People who are sitting on the sidelines, waiting for mortgage rates to decline, should know that's unlikely to happen in the foreseeable future."

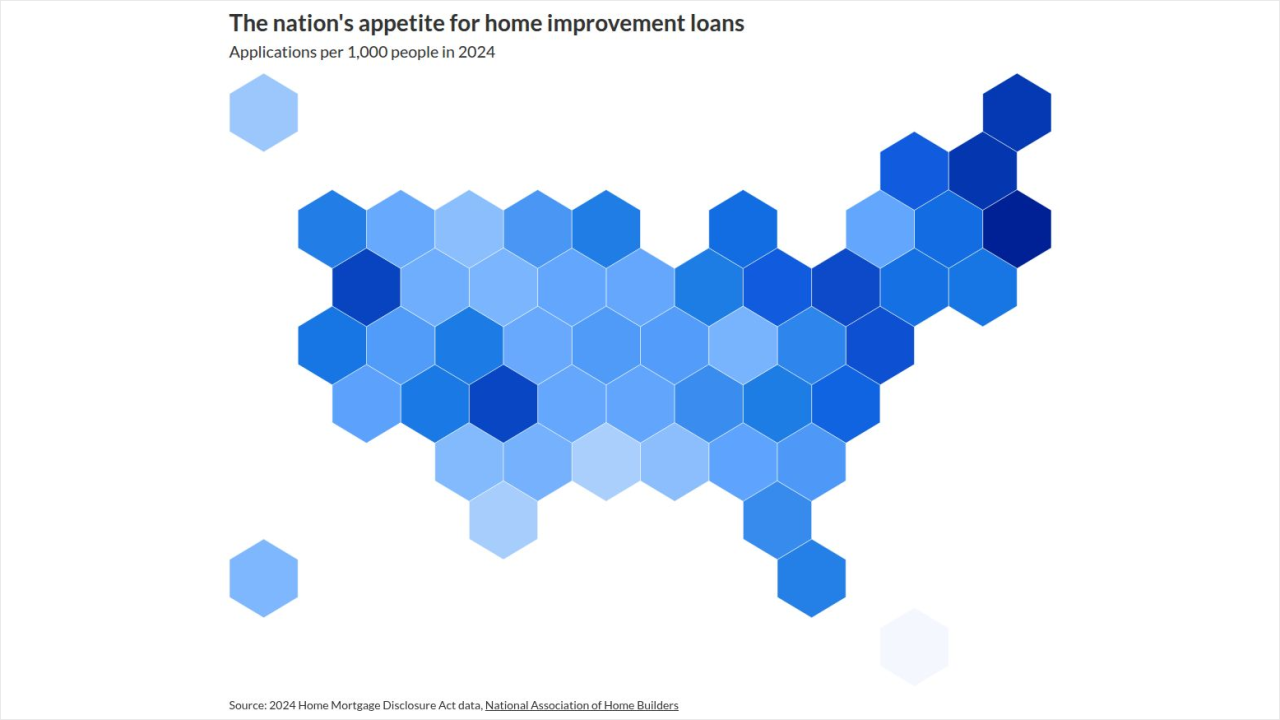

But the effect of inventory shortages on affordability is not hitting all markets equally, based on new findings from real estate data and analytics provider Attom.

"It looks so far — and it's important to stress, so far — to be having more impact in places with the highest housing costs and less impact elsewhere," said Attom CEO Rob Barber in a press release. "This doesn't mean those markets are in danger of a big fall while others are immune, but the data does provide a useful geographical snapshot of the initial market dip."

In a first-quarter housing report, Attom determined upscale communities and Western regions that benefited greatly from a hot market of a few years ago are now among the most impacted when looking at data, such as falling home values, negative equity growth and foreclosure activity. Between second quarter 2022 and the first three months this year, the U.S. housing market overall experienced flat or negative performance for the first time in more than a decade.

Almost half of the top 50 counties Attom deemed to have the greatest negative impact from recent headwinds were located in Oregon and Washington State. The current downturn is also more likely to hit areas where median home values exceed $350,000. Most of the other counties on the list outside the West were located in markets where single-family homes typically sold above that level.

In the three-quarter period, median home prices dropped nationwide by 7.2%, but fell further in 31 of the 50 counties on Attom's list. At the same time, the number of homeowners with underwater mortgages where the amount owed exceeds the home's value increased overall to 6.2% from 5.9%, but exceeded that pace in all 50 counties.

Attom's data largely mirrors numbers reported throughout the first half of the year by other research groups,