Loan defaults associated with the three late summer hurricanes had a more immediate effect on MGIC Investment Corp.'s secondary market capital cushion than proposed changes by Fannie Mae and Freddie Mac.

The government-sponsored enterprises are proposing changes to the Primary Mortgage Insurer Eligibility Standards that would "materially lower" MGIC Investment Corp.'s cushion of available assets over the minimum required assets, it said in a Securities and Exchange Commission filing made in December.

But borrower defaults in Texas, Florida and Puerto Rico have increased because of hurricanes Harvey, Irma and Maria.

"The PMIERs excess was approximately $100 million lower than it otherwise would have been as a result of the increased delinquencies from the hurricanes," said MGIC's Chief Financial Officer Timothy Mattke during the company's conference call. "We expect that impact to subside over the course of the next few quarters."

MGIC's delinquent inventory consisted of 12,446 loans from the areas affected by the storms at the end of the fourth quarter, compared with 7,162 as of Dec. 31, 2016. The increase in default notices may result in an increase in minimum required assets and a decrease in the level of excess available assets, a note in the company's fourth-quarter earnings press release said.

But it is not expecting an increase in claims — which only happen when a loan goes to foreclosure — based on the experience from similar storms.

Still, "hurricane-affected areas may experience deteriorating economic conditions resulting in more borrowers defaulting on their loans in the future (or failing to cure existing defaults) than we currently expect," the note said.

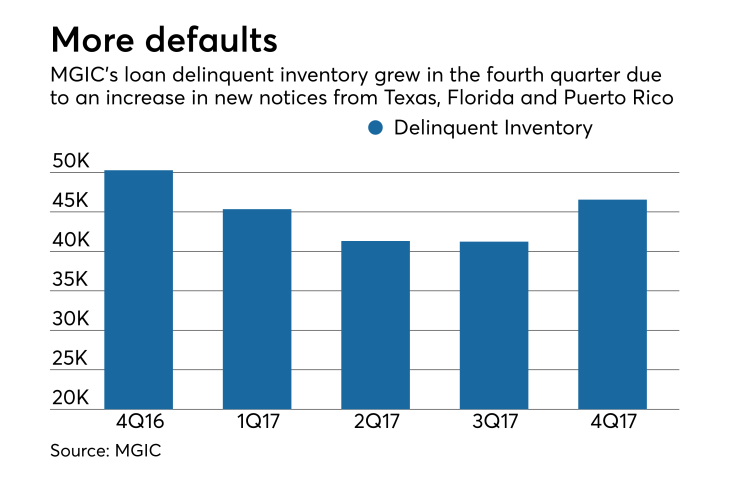

MGIC's total delinquent inventory held 46,556 loans at Dec. 31, 2017, up from 41,235 at Sept. 30, 2017, but down from 50,282 at Dec. 31, 2016.

At the end of the fourth quarter, MGIC had a PMIERs cushion of $800 million, similar to what it had at the end of the third quarter.

MGIC's fourth-quarter and full-year net income were reduced by $133 million as the net deferred tax asset had to be recalculated as a result of the new tax law.

The net income for the quarter was $27.3 million, down from $107.5 million for the fourth quarter of 2016. For the full year, net income was $355.8 million, an increase compared with net income of $342.5 million for 2016.

MGIC's new insurance written of $12.8 billion was unchanged from the fourth quarter of 2016.

"Reflecting the current trends in the origination market we expect to write slightly more new insurance in 2018 compared to 2017 and expect that our insurance-in-force will continue to grow," said MGIC's CEO Patrick Sinks in the press release. "Further we anticipate that the number of new mortgage delinquency notices, claims paid and delinquency inventory will continue to decline."