Resales of properties bought by iBuyers surged to a record high in the first quarter, according to Zillow Research, but their acquisition of homes declined, similar to the rest of the purchase market

The leading iBuyers Opendoor, Offerpad and Zillow Offers resold 26,537 homes in the first three months of the year. Those sales set a record for a third consecutive quarter, with volumes increasing by 24% from 21,332 in Q4 and 10,738 three months earlier.

Other data in the first-quarter iBuyer report from Zillow, though, gave mixed indications, reflecting the uncertainty currently surrounding the housing market. The

The median price of homes acquired by iBuyers fell to $347,000, down from the fourth quarter of last year’s $364,900 and Q3’s $371,466. But the amount was still above the national median sales price, which increased 2% from the fourth quarter to $340,000. The cost of homes sold to iBuyers typically runs higher than the national price because they tend to operate in larger, more expensive housing markets.

While a continued downturn in sales will have an impact, the conditions could lead iBuyers to better returns per-sale than they would have in a hot market, according to Chuck Vander Stelt, a Realtor and real estate blogger at Quadwalls, in Valparaiso, Indiana.

“There will always be impatient home sellers and that is who iBuyers need to target in order to purchase homes at profitable prices,“ he said in an emailed statement. “As the market cools and slows, impatient sellers will look for convenient options, which is the product the iBuyer is really selling.”

On the resale side, the first-quarter median markup of homes sold by iBuyers accelerated 14% from the final three months of 2021, another record since Zillow first began tracking the data in 2018. In the fourth quarter, resale markups increased by only 4.6%.

IBuyers, short for instant buyers, are buying and selling operations that typically purchase off-market homes directly before quickly listing them for resale on the open market after making repairs and updates. While accounting for only a small percentage of the overall sales market, they have earned their share of critics, due to their

Any contraction of prices, though, could put them into trouble, according to Bill Samuel of Blue Ladder Development, a real estate developer and broker who purchases and rehabilitates homes in the Chicago area for resale.

“I do think that the iBuyers would be put in a very difficult spot if the housing market was heading for negative price growth, given they're operating on such thin margins,” he said in an emailed statement.

The market was shaken last year by the

“Zillow's departure from the space was a reality check that buying and reselling real estate on a large scale is incredibly difficult to execute,” Samuel said.

The Atlanta area saw the highest first-quarter volumes of homes sold to iBuyers, at 1,628, followed by Phoenix with 1,232. Rounding out the top five were Dallas, Houston and Charlotte, North Carolina, at 1,116, 844 and 612 respectively.

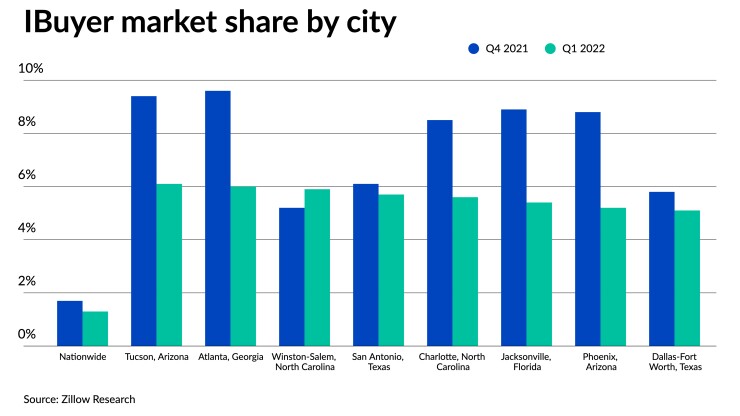

But when measured by market share, the list differed. Tucson, Arizona, where 6.1% of homes sold in the first quarter went to iBuyers, landed in the top spot, but the share decreased from 9.4% in Q4. Behind Tucson was Atlanta with a 6% share, down from 9.6%, and Winston-Salem, North Carolina, where iBuyers purchased 5.9% of available homes, up from 5.2% the previous quarter. San Antonio followed with a 5.7% share, down from 6.1%, with Charlotte sales dropping to 5.6% from 8.5%. Of the 37 metropolitan areas posting more than 50 iBuyer sales in the first quarter, only eight reported an increase in share, according to Zillow.

iBuyers also held homes for resale approximately three weeks longer than they had in the final three months of last year, increasing to 120 days from 98. That includes time needed to prepare to make repairs or updates, list the home and close purchases.