-

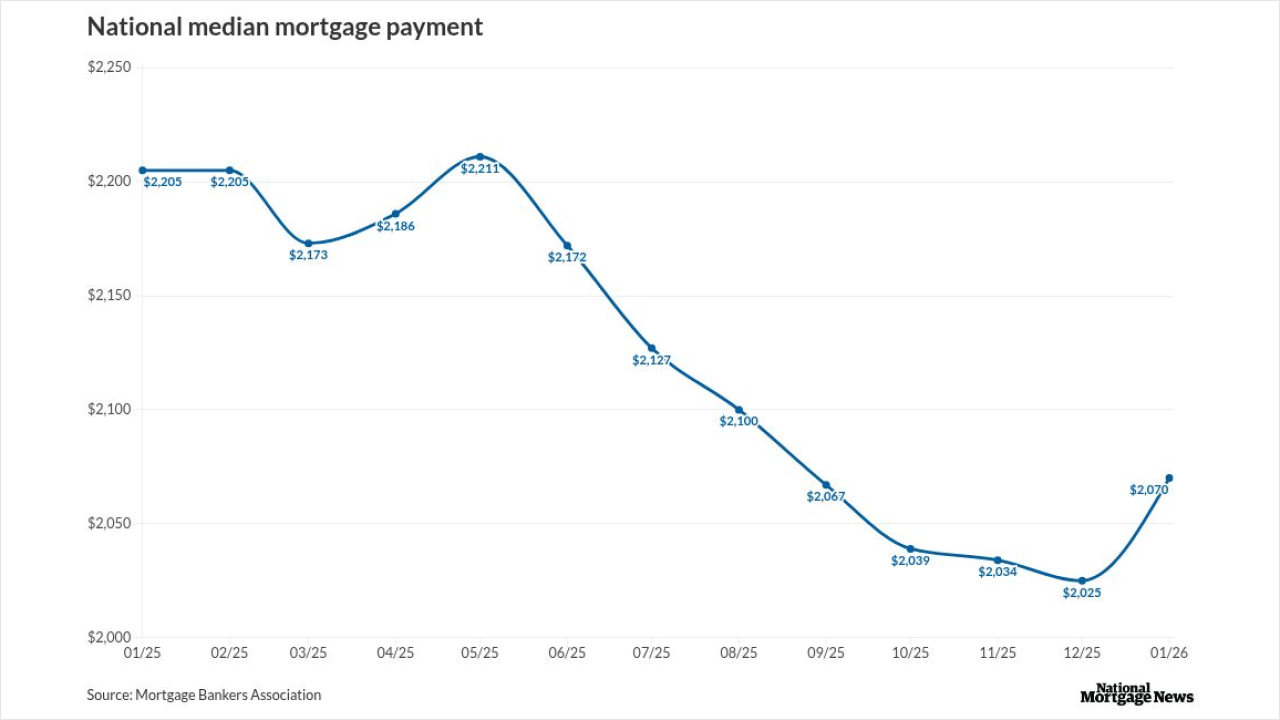

The national median payment applied for by purchase applicants rose from $2,025 in December to $2,070 last month, according to the Mortgage Bankers Association.

February 26 -

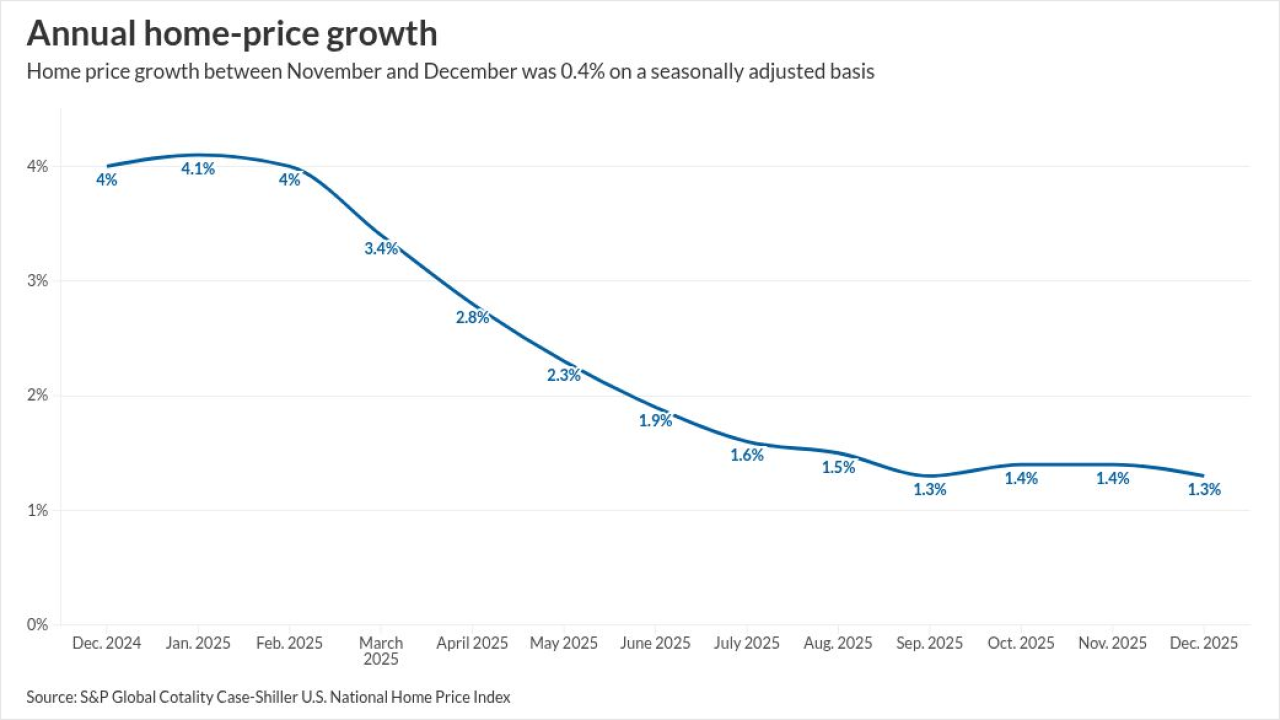

Home prices edged up nationwide, but gains were modest and uneven. Major indexes agree on direction, differ on size, as 2025 posted weak growth.

February 24 -

Residential lending remains steady in select cities as resilient housing markets, strong employment, limited supply, and migration trends shape borrower demand.

February 18 -

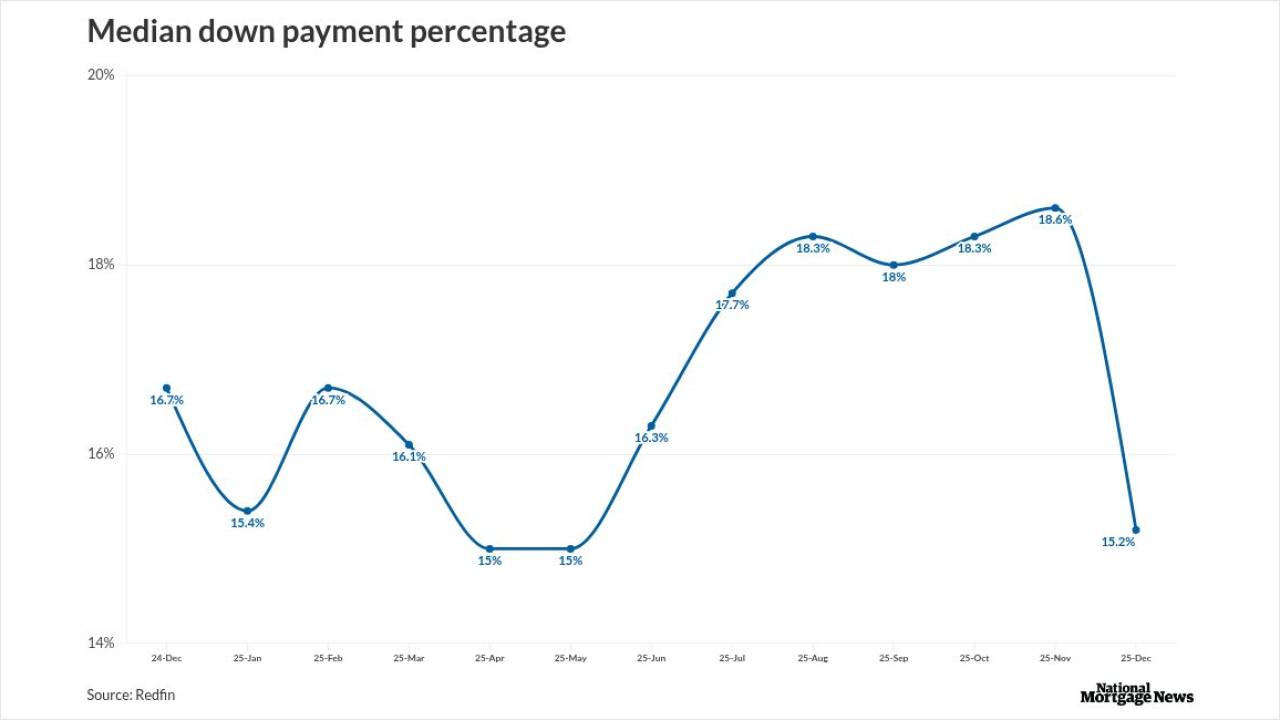

The typical homebuyer's down payment in the United States decreased 1.5% year over year to $64,000 in December, Redfin said.

February 18 -

Contract closings decreased 8.4%, the biggest drop since February 2022, to a 3.91 million annualized pace in January, according to National Association of Realtors data released Thursday.

February 12 -

The income needed to afford a home had been rising on an annual basis nearly every month for five years, but affordability has been improving since the summer.

February 12 -

The brokerage alleges Zillow uses "anticompetitive tactics" to bar listings that haven't been posted to a local multiple-listing service, or MLS, within 24 hours of them being publicly marketed.

February 6 -

Less than 45% of mortgage residential properties in the United States were equity-rich last quarter, a 1.5-percentage-point drop from the third quarter.

February 3 -

The average homebuyer who purchased a home below the asking price last year received a 7.9% discount, the largest since 2012, Redfin found.

February 2 -

While FHFA reported a year-over-year increase in national home values in November, the Case-Shiller HPI saw flat annual growth as well as monthly decreases.

January 27 -

Hartford, Connecticut, topped Zillow's list of the hottest housing markets this year on the back of its nation-leading home-price appreciation forecast.

January 19 -

Home prices are now something Americans can wager on. Polymarket partnered with Parcl to offer prediction markets tied to housing price indices.

January 9 -

Rochester, New York, and Harrisburg, Pennsylvania, stood atop Realtor.com's list for the second consecutive year, due to their affordability.

January 9 -

Annual home-price appreciation ended last year at 0.7%, the smallest calendar-year increase since 2011, when prices dropped 2.9%, according to ICE.

January 6 -

National home prices grew monthly and annually in October, but considerably less than last year, according to S&P Dow Jones Indices.

December 30 -

Home prices rose 0.2% nationally month-over-month in November, but there were an estimated 37.2% more sellers than buyers in the market, Redfin said.

December 26 -

More than 80% of mortgage brokers expect business to grow in 2026, mainly through the strengthening of referral networks and the expansion of non-QM offerings.

December 19 -

After home equity surged in 2023, average gains slowed last year before falling into negative territory over the past 12 months, Cotality said.

December 12 -

Hartford, Connecticut, Rochester, New York, and Worcester, Massachusetts, headed the list of the 100 largest metro areas in the country, according to Realtor.com.

December 10 -

Forty percent of Americans planning to buy or sell a home in 2026 worry about a potential market crash, according to a new report from Clever Offers.

December 9