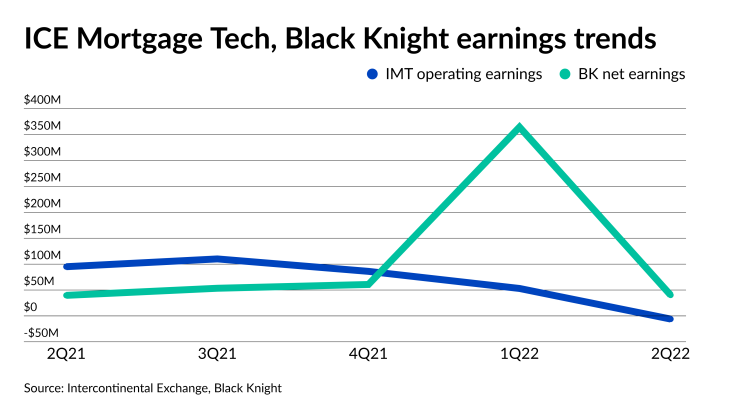

Intercontinental Exchange executives were bullish on its mortgage business even though that segment produced a GAAP operating loss of $6 million in the second quarter.

This is compared with operating income of $53 million in the first quarter and $95 million in the

Part of the optimism can be attributed to ICE Mortgage Technology's second quarter revenue performance, down just $10 million

"Recurring revenues, which accounted for over half of segment revenues and totaled $160 million in the quarter, increased 18% year-over-year," said Warren Gardiner, chief financial officer, on Intercontinental Exchange's second quarter earnings call. "These strong recurring revenues continued to drive outperformance versus an industry that experienced

If anything, the challenging mortgage environment has presented the company with an opportunity to have "more constructive conversations" with its customers regarding the origination process workflow, Gardiner continued.

While the quarter had similar origination volume with the second quarter of 2019, revenue in the most recent period was up on a pro forma basis by nearly $100 million.

Regarding updates on the

But speaking in broader terms about the deal, Ben Jackson, president of Intercontinental Exchange and chair of ICE Mortgage Technology, said "we remain very excited about the efficiencies that combined entities will bring to the end consumer and other stakeholders across the mortgage ecosystem."

The data and analytics segment had a 21% increase in revenue in the first half of the year versus the same time in 2021 and has added clients including Chase, as well as "a number of leading independent mortgage bankers and a top-three homebuilder," said Jackson.

ICE Mortgage Technology had $160 million of recurring revenue in the second quarter, up 18% from the previous year. At the same time, transactional revenue fell 33% to $137 million.

When asked about client cancellations, Gardiner reported "a small, small number of lenders that have had some challenges and potentially go out of business, but it's a very small number that we've seen so far."

Meanwhile, Black Knight reported second quarter net earnings of $40.3 million, while down 89% from the first quarter's $364.4 million, it's up from $39.7 million in

"Our core performance in the second quarter was consistent with our expectations and highlights the ongoing strength and resilience of our business as we continued to expand and extend our relationships with existing clients through cross-sell and contract renewals, win new clients and deliver innovative new solutions," Anthony Jabbour, who stepped down as CEO in May to become executive chairman, said in a press release. "Our performance further demonstrates our ability to deliver results despite an uncertain economic environment."

Operating income for its software solutions business — the MSP servicing platform and Empower loan origination system — was $154.8 million in the second quarter, compared with $153.1 million in the first quarter and $141.6 million one year ago.

At the same time, the data and analytics segment reported operating income of $13.7 million, a drop on a quarter-to-quarter basis from $15.2 million and from $17.1 million year-over-year.