ICE Mortgage Technology saw its pro forma revenue grow 7% in the third quarter compared with the year prior, even as the industry's

Total segment revenues for the quarter were $366 million, an increase from $340 million in the second quarter and up from $343 million on a pro forma basis in the third quarter of 2020.

The pro forma calculation is a measurement that treats Ellie Mae, Simplifile and MERS, three originations-reliant companies, as if they had been owned by Intercontinental Exchange since 2018. The

"While third quarter transaction revenues declined slightly, they were more than offset by a 33% growth in our recurring revenues, which at $143 million once again exceeded the high end of our guidance range and accounted for nearly 40% of total segment revenues," said Warren Gardiner, Intercontinental Exchange's chief financial officer during its earnings call. He attributed this line's growth from a year-ago pro forma of $108 million to increased customer adoption of its digital tools.

Transactional revenues declined 5% to $223 million from $235 million.

"While these secular growth trends have been a clear tailwind for our recurring revenues, there is also opportunity to drive accelerating adoption across our transaction-based businesses, such as our closing solutions, where revenue increased by 30% in the third quarter," Gardiner said. "Looking to the fourth quarter guidance, we expect that recurring revenues will once again grow sequentially and be in a range of $147 million to $152 million."

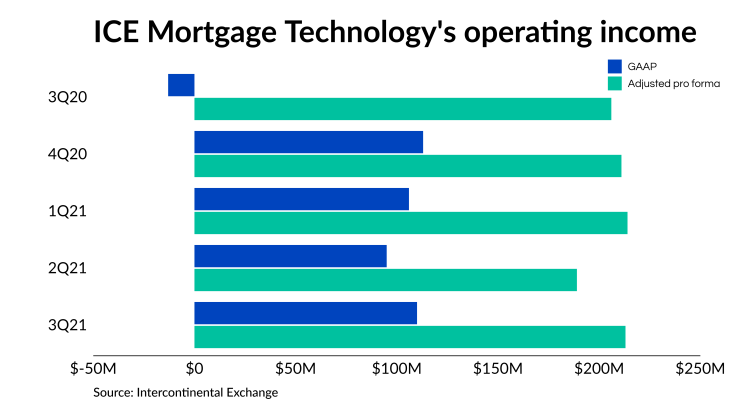

On a GAAP basis, ICE Mortgage Technology ended the quarter with operating income of $110 million, compared with $95 million

Approximately $245 million of ICE Mortgage Technology's revenue is attributed to origination technology, up from $67 million a year ago, reflecting the brief period it owned Ellie Mae.

Closing solutions revenue increased to $88 million year-over-year from $67 million and data analytics grew to $19 million from $5 million; the data analytics line also was not reported prior to the Ellie Mae acquisition. Meanwhile $14 million of third quarter revenue is attributed to other, up from $4 million in the prior year.