Keefe, Bruyette & Woods downgraded its stock ratings for the four stand-alone private mortgage insurers, noting that they could face a capital shortfall in the first quarter of 2021 in a rising delinquency scenario.

While KBW analyst Bose George said he has not changed his view that the private mortgage insurers

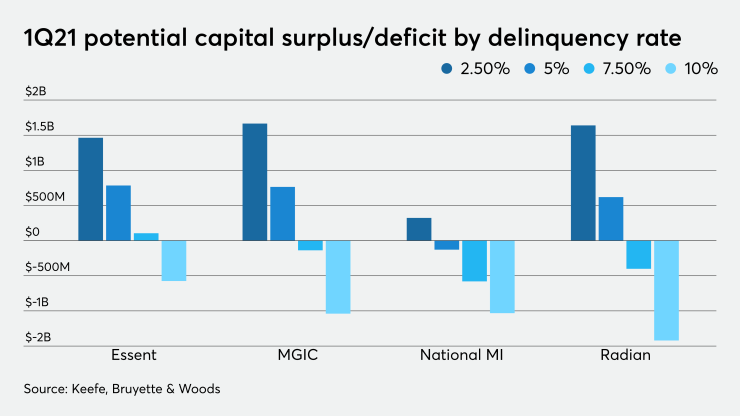

George projects that the four companies he follows — Essent, MGIC, National MI and Radian — should have enough capital surplus under the

"While it remains unclear when the FEMA disaster area designation will be lifted, there is a chance that it could be lifted later this year after most of the country is reopened," George said.

In determining possible PMIERs surpluses or deficits, KBW used an assumption that the natural disaster designation for the coronavirus will be lifted at the same time the

As of March 31, MGIC had $1 billion of excess capital while Radian had $1.13 billion. Since

(Essent did a stock offering on May 27, while National MI did both stock and debt offerings during the first week of June; National MI also did a quota share reinsurance deal that will help with its PMIERs surplus.)

Taking that through to the first quarter of 2021 in a scenario in which the 70% haircut for the PMIERs no longer applied, at a 5% delinquency rate, only National MI would have a PMIERs deficit. But if delinquencies ramp up to 7.5% in the same scenario, Essent would be the only company at a surplus. All four would be at a deficit if the rate went as high as 10%.

Black Knight, which includes forborne mortgages in its calculations, said