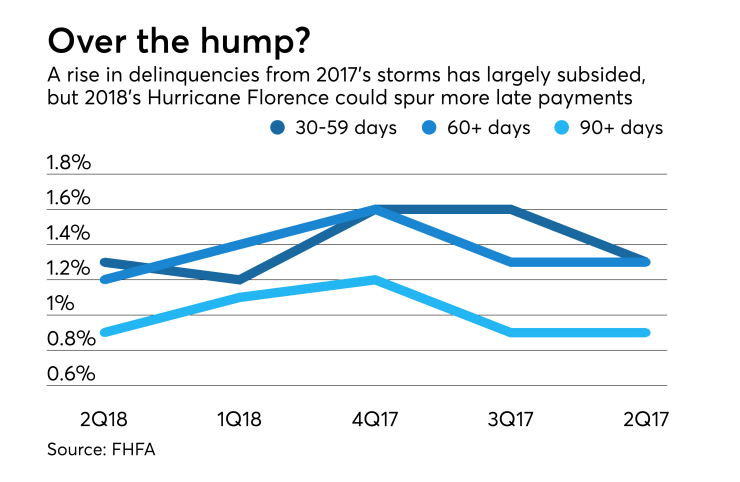

After a run-up in the latter half of last year, delinquencies on mortgages sold to Fannie Mae and Freddie Mac look fairly stable for the time being.

Delinquency rates had risen following last year's hurricane season, but in the second quarter they remained more or less in line with year-ago numbers.

The percentage of loans delinquent at both agencies combined was 1.3% for mortgages 30-59 days late, 1.2% for home loans 60 or more days late, and 0.9% for mortgages 90 or more days late.

Following the 2017 storms, the short-term delinquencies less than 90 days had risen as high as 1.6%, and the serious delinquency rate had gotten as high as 1.2%, according to the Federal Housing Finance Agency's quarterly update on the two government-sponsored enterprises' loan performance.

But the respite from higher delinquencies will likely be temporary, as Hurricane Florence is

The GSEs also completed 70,945 foreclosure prevention actions in the second quarter. In total, the GSEs have taken more than 4.1 million actions aimed at preventing foreclosures since the start of conservatorships in September 2008.

Of these actions, almost 3.5 million have helped homeowners stay in their homes, including more than 2.2 million permanent loan modifications.

Twenty-five percent of modifications in the second quarter were modifications with principal forbearance. Extended-term-only modifications accounted for 49% of all loan mods during the quarter.

There were 2,612 completed short sales and deeds-in-lieu during the quarter, bringing the total to 687,911 since the conservatorships began in September 2008.