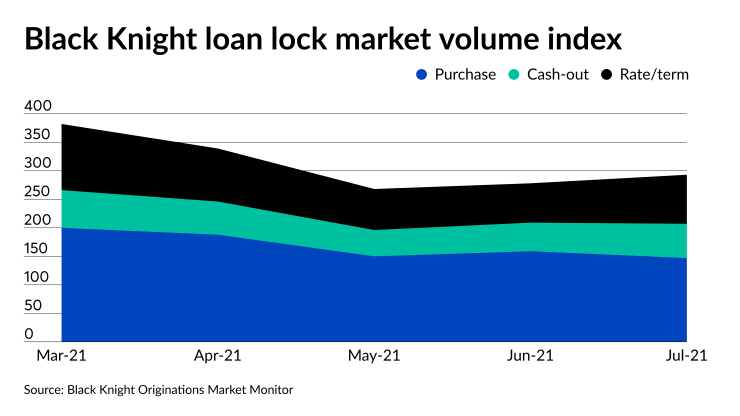

The momentum of the shift towards a purchase-dominated mortgage market was at least temporarily blunted in July, when refinance loans made up half of the rate locks for the first time in five months, Black Knight said.

The 50/50 split was a change from the June Origination Market Monitor report's heavy weighting to purchase, with a 57% share versus 43% in refinances. And a separate report from ICE Mortgage Technology found that in June, for the first time in 18 months, more purchase loans were closed than refinances.

But the increase in COVID-19 infections over the last few weeks has contributed towards a reverse in the trend.

"The market's uncertainty around rising Delta variant caseloads across the U.S. has helped push yields on the 10-year Treasury down to their lowest level since February," said Black Knight Secondary Marketing Technologies President Scott Happ in a press release. "This has, in turn,

The cancellation of the

Total rate locks grew 5.5% in July over June, but rate and term refis were up 24% and cash-outs increased month-over-month by 20%. Purchase rate lock activity fell by 7%.

"While we didn't see homeowners looking to refinance react as quickly or as strongly to such slight rate movements in the past few months, they certainly did so in July," Happ said. "The mid-month surge was pronounced, but short-lived, suggesting that crossing the 3% threshold was what borrowers were waiting for before acting, and when rates ticked back above that psychological line, they held back on the sidelines once again."

However, rates have since started falling below 3% again, as the 10-year yield dropped to 113 basis points on Aug. 4 from a high of 170 bps on May 13. With that happening, the very early look at August lock data suggests potential refi borrowers reentered the market, Happ said.

Meanwhile, during June, purchases rose to 51% of closed mortgage loans, up from 47% in the month prior, according to ICE Mortgage Technology. Conversely, refis represented 48% of closed loans, down from 52% in May. The remaining 1% were for other purposes.

"While we are still seeing a strong refinance market, including the continued growth of

Closing rates, the percentage of applications made in the previous 90 days that actually turn into a mortgage, decreased to 75.3% in June, from 76.9% in May. June's refi closing rate of 74.6% was down from 77% in May, while purchase closing rates fell to 76.3% from 77% during the same time frame..

It took an average of 49 days to go from application to closing that month, down from 53 days in May and a high of 58 days in December and January, according to the ICE Origination Insight report.

The normal time frame between when the consumer decides to lock in their rate and when the mortgage goes to closing