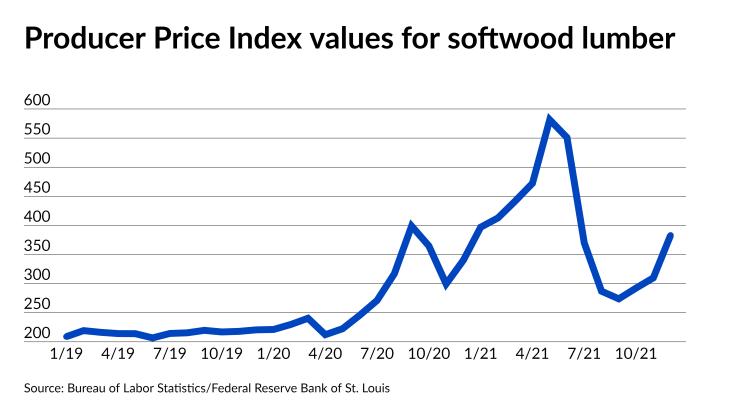

Lumber prices are lower than they were at their peak during the pandemic; but the volatility associated with them is the highest it’s been in at least three-quarters of a century.

Not only did the December 2021 Producer Price Index report reflect record-high

The metric, highlighted in

The housing finance industry is used to some volatility in lumber prices from time to time, but the current level is nearly three times as high as the previous record.

“Record-high volatility of softwood lumber prices continues to be as problematic as high prices,” David Logan, NAHB’s director of tax and trade analysis, wrote in the report.

The Producer Price Index value for softwood lumber in December of last year was 383, up from 309 the previous month and 340 a year earlier, in line with an unusual uptick that

The recent gains and volatility in the price of lumber have contributed home inventory shortages that have strained affordability and

“Demographic-fueled demand is strong and existing-home inventory, making a new home an attractive option. Yet higher construction costs (labor, lumber, materials) are being passed on to buyers,” First American Deputy Chief Economist Odeta Kushi noted in a recent report.