Four classes of notes and one class of preference shares issued by McKinley Funding III Ltd., a collateralized debt obligation backed partly by residential mortgage-backed securities, have been downgraded by Moody's Investors Service.The downgrades were as follows: class A-2, from Aaa to A2 (and left on review for possible further downgrade); class B-l, from Aa2 to Caa3 (and left on review for possible further downgrade); class B-2, from Aa3 to Ca; class C, from Baa2 to Ca; and preference shares, from Ba1 to Ca. Moody's said the negative rating actions reflect "severe deterioration" in the credit quality of the underlying portfolio, as well as a Dec. 10 event of default caused by the failure of the class A overcollateralization ratio to equal or exceed 100%, as required under the indenture.

-

The number of homes with default notices, scheduled auctions or bank repossessions last month was down from January but up 20% from a year ago.

58m ago -

While federal examination and investigative activity has all but stopped, the regulator is still providing regulatory guidance to the industry.

6h ago -

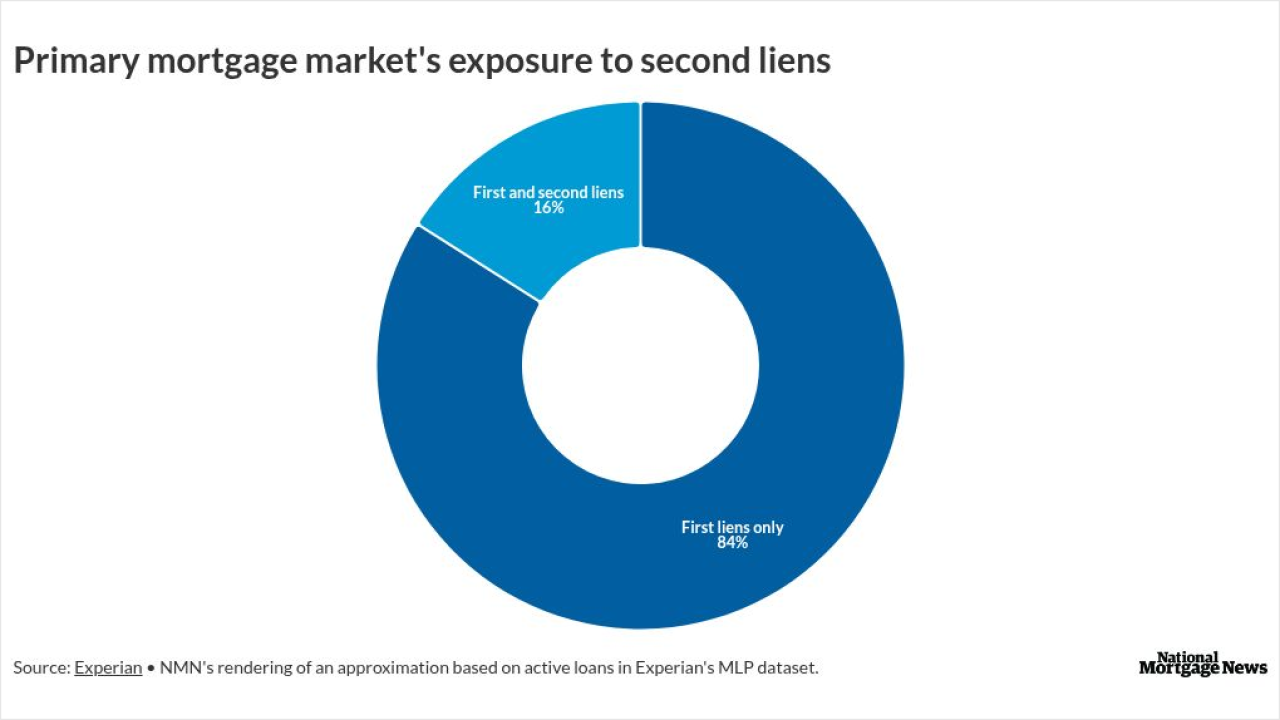

Agency MBS investors have had limited information about primary loans coexisting with home equity products, and may want to get more now, according to Experian.

March 11 -

A near-record share of homeowners unable to sell their properties are renting them out instead, with "accidental landlords" accounting for 2.3% of listed rental stock in October, per Zillow data.

March 11 -

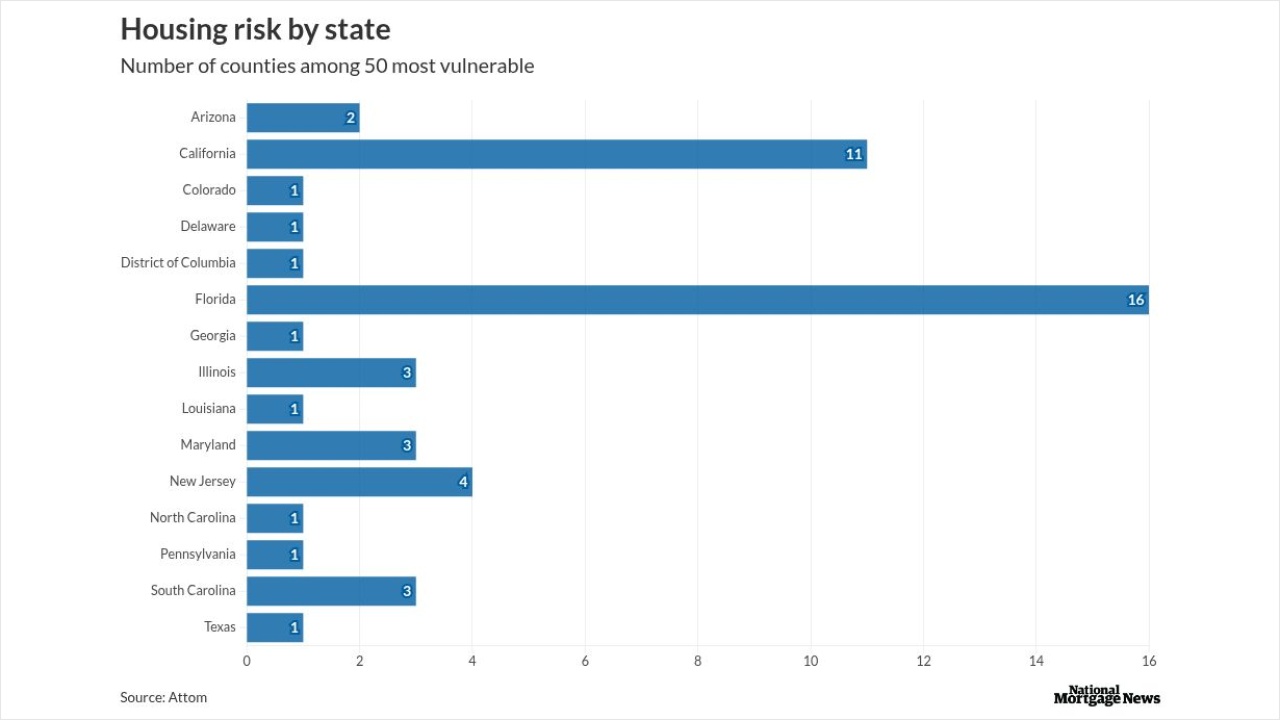

Residents in more than half of U.S. counties need greater than one-third of income to successfully manage major housing costs, according to new Attom research.

March 11 -

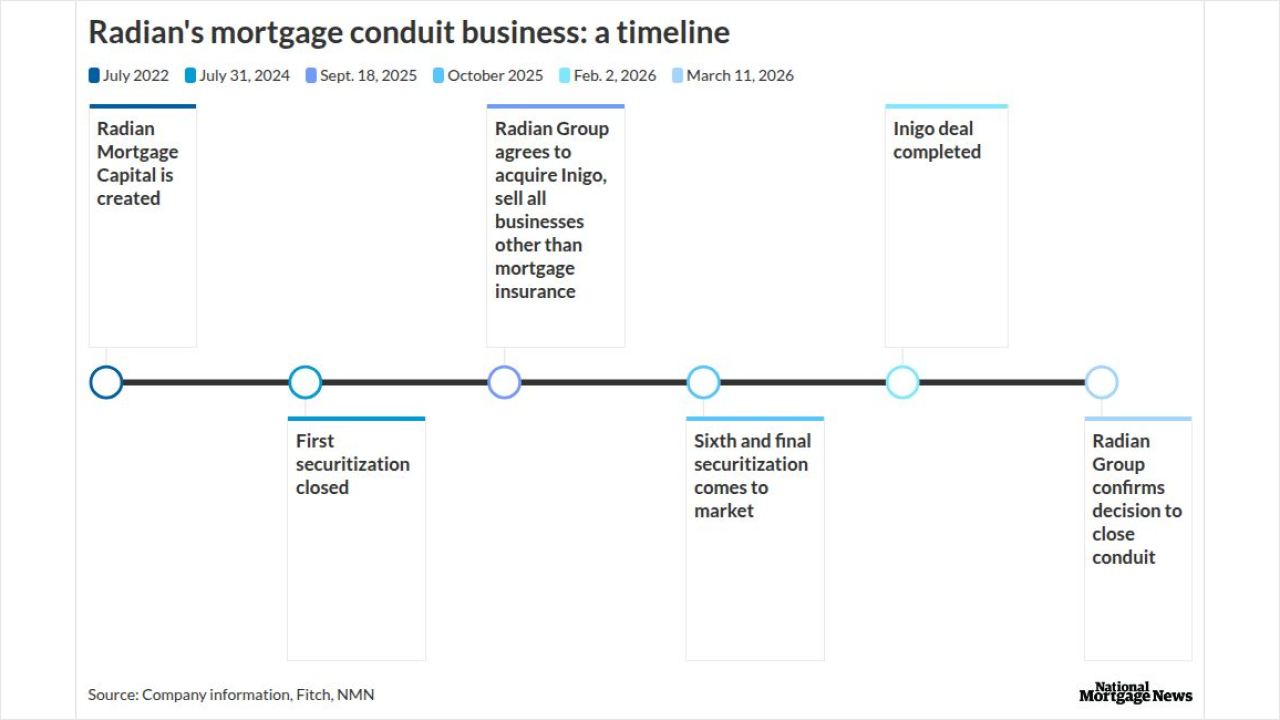

Radian Group was looking to sell the aggregator, along with its title and real estate units, following a business model pivot related to the Inigo buy.

March 11