Senate leaders have reportedly agreed to attach a mortgage insurance deduction bill to must-pass tax legislation dealing with export subsidies.Sen. Gordon Smith, R-Ore., has secured a commitment to include his bill (S. 846) in the foreign sales corporation/extraterritorial income bill, Mortgage Wire has learned. The senator's press secretary could not be reached to confirm the agreement. Sen. Smith's bill is designed to lower the cost of buying a home for families who cannot come up with a large downpayment and have to purchase mortgage insurance. S. 846 would allow homebuyers with incomes below $100,000 to deduct 100% of the mortgage insurance premiums from their taxes. Senate leaders are hoping to pass the FSC-ETI bill in March, but it is a controversial measure that is getting embroiled in issues such as overtime pay rules and the outsourcing of jobs to foreign countries. The House tax-writing panel has been unable to agree on an FSC-ETI bill.

-

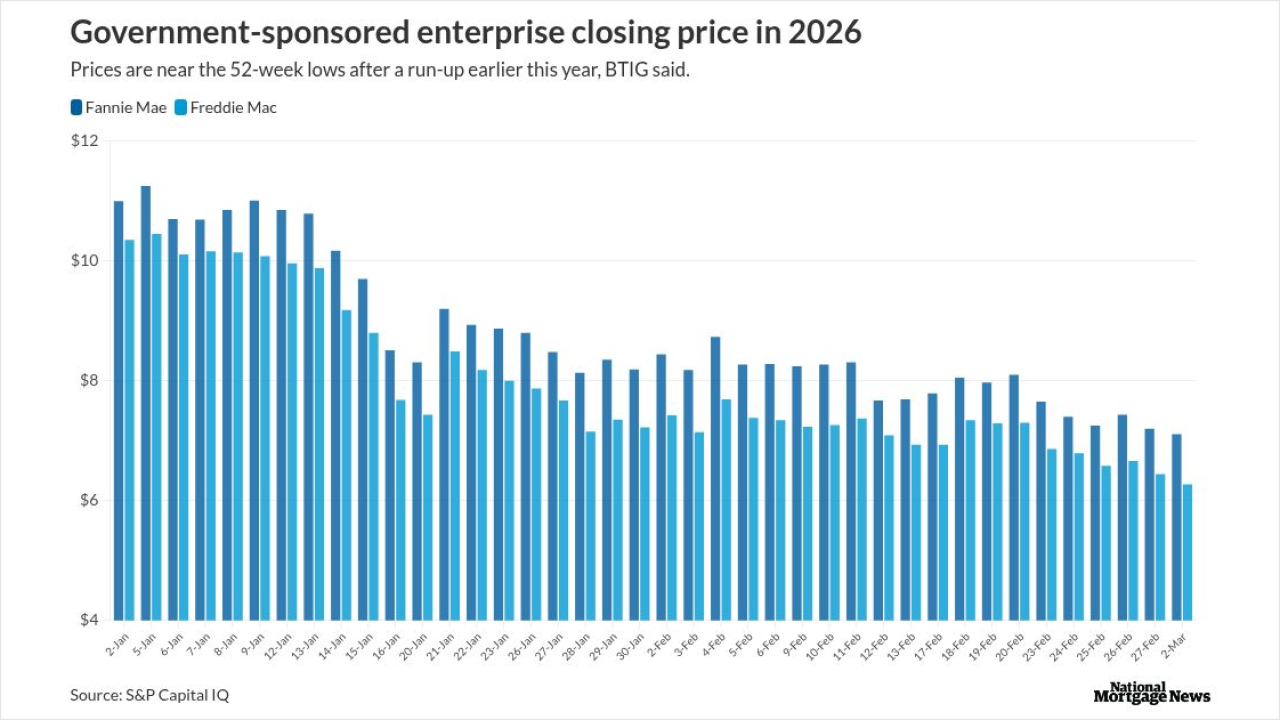

The Supreme Court's decision seems to set limits on Pres. Trump's power, even if he wasn't inclined to hold on to the GSEs to control mortgage rates, BTIG said.

9m ago -

An appellate court denied the bank's argument targeting the state's Foreclosure Abuse Prevention Act and ordered it to pay the defendant's legal fees.

2h ago -

This year 40 companies had what it takes to land on the Best Mortgage Companies to Work For list.

March 2 -

Markets were bracing for the chaos of a regional war; banks may be the target of sophisticated cyberattacks, experts warn.

March 1 -

MBS numbers at both soared in January, when Trump directed the enterprises to accumulate more bonds, but a decline in loans shrunk Freddie's total number.

February 27 -

New York is seeking $21 billion in federal grants for a construction project at Sunnyside Yard, which would allow the city to build 12,000 new affordable homes.

February 27