Although refinances registered a small uptick, a decline in purchase activity left mortgage volumes sliding downward last week, according to the Mortgage Bankers Association. New purchase loans also outnumbered refinances.

The MBA’s Market Composite Index, a measure of loan activity based on a survey of the association’s members, slipped 0.7% on a seasonally adjusted basis for the weekly period ending Feb. 25. Compared to volumes over the same seven-day period one year ago, the seasonally adjusted index was 41.8% lower.

The Refinance Index inched up 1%

“Although there was an increase in government refinance applications, higher rates continue to push potential refinance borrowers out of the market,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting.

While refinances edged upward, the seasonally adjusted Purchase Index dropped 2% from a week earlier and was also 8.7% below its level one year ago. But the average loan size of new purchases started surging again, a sign that home-buying activity is centered on

After falling back from record levels the previous week, the average purchase-loan amount headed upward 0.9% to $454,400 from $450,200. The mean size of refinance mortgages also increased by a fractional amount to $294,900 from $294,700, while new loan activity overall averaged $374,800, up 0.7% from $372,300 in the prior weekly period.

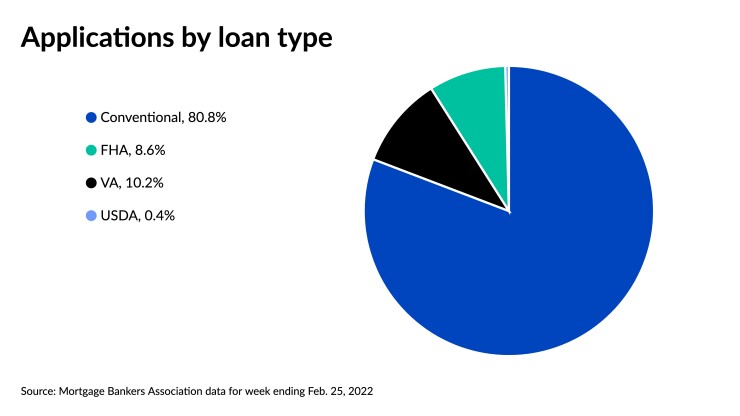

The seasonally adjusted Government Index recorded lower volumes week over week as well, down by 0.4%. Among government-backed activity, Federal Housing Administration-sponsored loans made up 8.6% of all new mortgages, down from 8.7% seven days earlier, but Department of Veterans Affairs-backed applications increased its share to 10.2% from 9.9%. Meanwhile, loans taken through U.S. Department of Agriculture programs amounted to 0.4% of activity, the same as the prior week.

The share of adjustable-rate mortgages relative to overall volume came in at 5.3%, rising from 5.1% seven days prior.

Mortgage rates again increased across all categories tracked by the MBA, reaching multiyear highs, according to Kan. But the war in Ukraine only began showing its effect toward the end of the reporting period, with escalation beginning on Feb. 24. Just as the world has been focused on Eastern Europe, the MBA said

“We will continue to assess the potential impact on mortgage demand from the sharp drop in

interest rates this week due to the invasion of Ukraine,” Kan said.

The contract 30-year fixed-rate average for mortgages with conforming balances below $647,200 climbed to 4.15% last week among MBA members surveyed, up from 4.06% seven days prior.

The 30-year fixed rate for jumbo mortgages with balances greater than the conforming balance increased to 3.88% from 3.84% the previous week.

The contract rate for FHA-backed 30-year fixed-rate loans also averaged 4.15%, up six basis points from 4.09% a week earlier.

The contract average for 15-year fixed-rate mortgages climbed to 3.47%, compared to 3.42% the prior week.

After falling a week earlier, the 5/1 adjustable-mortgage rate average also jumped, rising to 3.44% from 3.26%.