Borrowers are exiting pandemic-related forbearance plans at the fastest pace since February, according to the latest numbers from Black Knight.

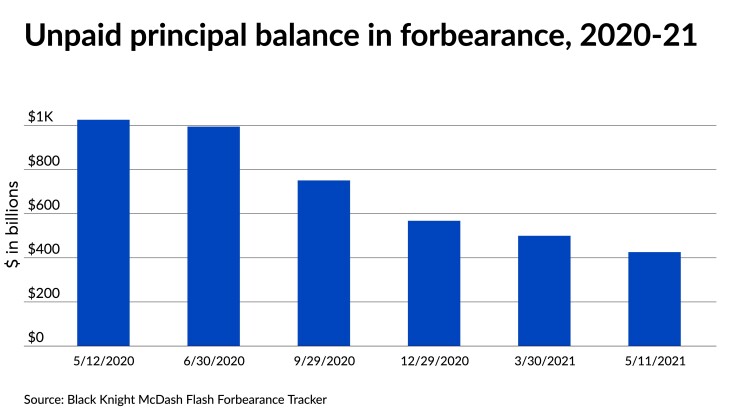

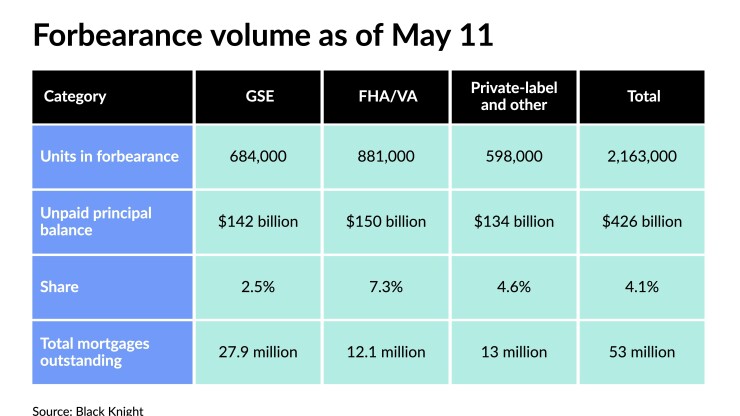

Forbearance volume overall fell for the second week in a row, down 61,000 or 2.7% from one week earlier. Last week, the volume declined by 105,000. Just over 2.16 million borrowers remain in Covid-related forbearance plans, accounting for 4.1% of total volume. The amount of unpaid principal balances in forborne mortgages fell to $426 billion, compared to $438 billion the previous week.

Forbearance numbers were down across all loan types. Fannie Mae and Freddie Mac forbearances fell by 13,000, a week-over-week drop of 1.9%. The number in government-guaranteed FHA and VA plans went down by 19,000 or 2.1%. Private-label and portfolio loans in forbearance declined by 29,000 or 4.6%.

In the last month, 38% of mortgages under review for potential extension of forbearance have been able to leave their plans, the highest percentage since mid-February. Plan starts are also down on 13% on a monthly basis and continue to drop.

The current rate of forbearance exits is due, in part, to the sheer number who entered plans a year ago. In the same week in 2020, forbearance volumes were close to their highest point for the entire year at 4.7 million. Those borrowers accounted for 8.8% of the total number of mortgages, and they owed more than $1 trillion in unpaid principal.

In late May and June, more than one million additional plans are slated for review.