Private mortgage insurers are counting on Federal Housing Finance Agency to reduce some of the fees charged by Fannie Mae and Freddie Mac to spur lending to first-time homebuyers.

Such a move could help the insurers regain market share from the Federal Housing Administration. Fannie and Freddie require borrowers who put down less 20% to have private mortgage insurance. So reducing the government-sponsored enterprises' fees could result in more private policies being written, as more low-downpayment borrowers opted for conforming mortgages over FHA loans.

Executives at mortgage insurers MGIC (MTG) and Radian Group (RDN) said at an investor conference this week that they expect the FHFA will reduce some fees in the next year. Banks, lenders and mortgage insurers have pressured FHFA Director Mel Watt to reduce fees charged by Fannie and Freddie in an effort to jumpstart the housing recovery.

The fees, which include so-called loan-level price adjustments and guarantee fees, are typically embedded in mortgage rates. They have become a sore spot because they increase the cost of getting a mortgage. Industry groups allege that some fees, which increase for borrowers with lower credit scores, are pricing potential homebuyers out of the market.

"There's a lot of discussion about why more loans aren't being made," Patrick Sinks, the president and chief operating officer of MGIC, in Milwaukee, said Tuesday at a Keefe, Bruyette & Woods mortgage finance conference in New York.

Watt "has put forth the idea that he's going to be looking at guarantee fees and loan level price adjustments and are they charging the right rates for loans," Sinks said. "There's a possibility of a reduction there [in fees] that could stimulate lending."

If the fees were reduced, borrowers who are considered the worst credits, with low FICO scores and high loan-to-value ratios, may be likelier to get a loan backed by Fannie Mae or Freddie Mac. Such borrowers typically opt for loans backed by the Federal Housing Administration,

To be sure, the FHFA has made no determination on whether it will reduce fees. The agency declined to comment for this story.

Last month,

Another caveat is that the FHFA could reduce the loan-level fees charged to borrowers with lower credit scores and higher loan-to-value ratios but at the same time raise overall guarantee fees. That would not necessarily cause borrowers to shift to Fannie or Freddie from FHA, and therefore would not help insurers much.

C. Robert Quint, Radian's chief financial officer, said that if the GSEs lowered the loan-level price adjustments it could lead to an increase in market share for insurers. But he also said it was too early to know how strong the effect of such a change would be.

"To the extent the execution is changed and is more favorable for GSE loans, that is a positive," Quint said. "And that would enable the MI industry to regain more share from FHA."

In January, Watt delayed a fee hike that had been proposed by his predecessor Ed DeMarco, saying he needed to study its impact on mortgage credit availability.

"There are a number of people in the lending community who have said [fees] are too high," said Sinks. "If we can get transparency on loan-level price adjustments, and they could bring [those] down, then perhaps there's a way for us to play a bigger role."

Some analysts say Watt is more likely to maintain the status quo this year and may reduce some fees in 2015.

"There's a thought out there that Watt would lower or flatten the loan level price adjustment grid," says Jason Stewart, a managing director and co-head of research at Compass Point Research & Trading. "Watt has been studying first time homebuyer credit availability, and is noting how restrictive credit is to that borrower."

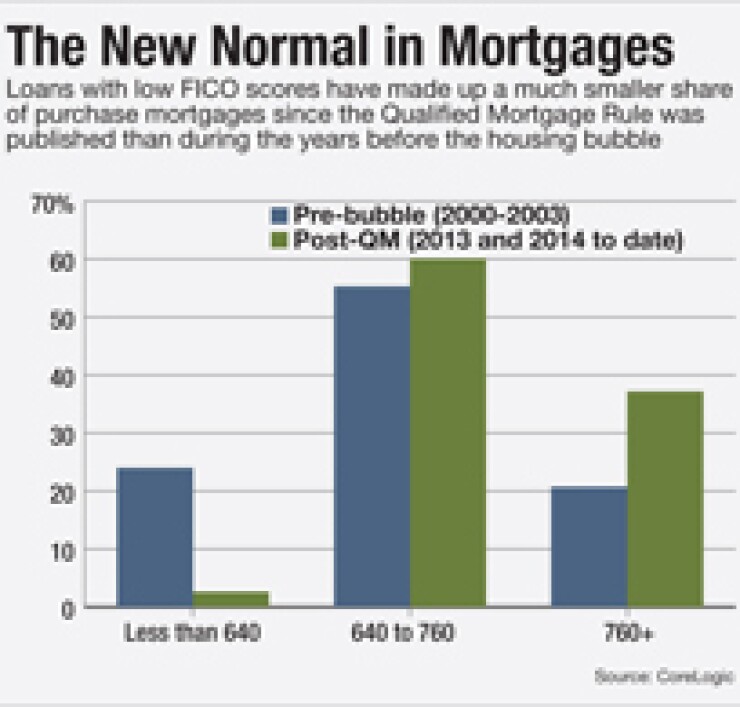

In the last year, lending to borrowers with credit scores below 640 has stagnated, while lending to borrowers with scores above 760 has skyrocketed, according to data from CoreLogic.

Lowering some fees "will mean a certain sub-segment of borrowers will choose GSE loans because they're more competitive," Stewart says.

Brian Collins and Bonnie Sinnock contributed to this story.