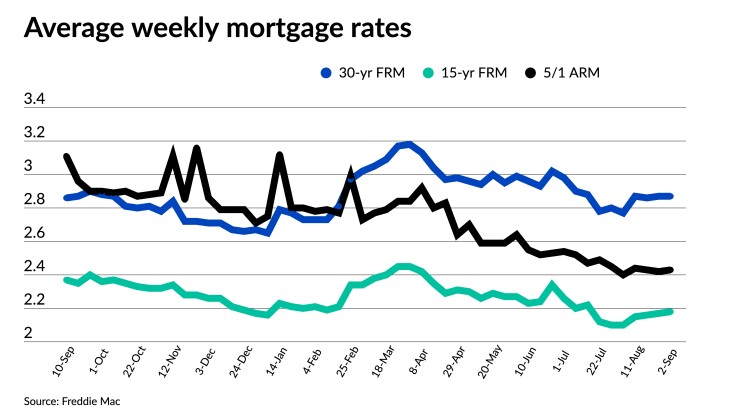

The summer’s low mortgage rates held steady over the past week, even as the central bank signaled it was ready to take its first steps toward tightening monetary policy as the country’s economy improves.

The 30-year fixed-rate mortgage was unchanged for the weekly period ending September 2, averaging 2.87% for the

The stabilization of mortgage rates and other favorable

“Heading into the fall, home purchase demand is stable, home sales remain firm and above pre-pandemic levels, and inventory of unsold homes is tight but improving modestly,” Khater noted in a press release. “These factors will allow for home price pressures to ease over the remainder of the year.”

Investors have been anxiously awaiting a timeline regarding interest rate hikes and tapering of the central bank’s asset purchase program, which was enacted last year to prop up the economy in the wake of pandemic slowdowns.

While Federal Reserve Chair Jerome Powell has indicated that tapering might begin this year, he also made clear that asset purchases and interest rate adjustments did not go hand in hand. Benchmark interest rates have been kept near zero since March 2020. His announcement led to few ripples, but no big waves in the mortgage market.

“Fed Chair Jerome Powell said that while a modest tightening of policy would likely be necessary by the end of the year, the central bank remains far from taking more drastic efforts, such as increasing interest rates,” said Zillow economist Matthew Speakman in an online post. “Bond yields retreated slightly following the statement, and mortgage rates followed suit, even as fresh inflation data showed firm price pressures persist.”

The next major economic announcement that could impact mortgage rates is due on Friday with the release of the Bureau of Labor Statistics August employment report, said Speakman.

Other major mortgage rates also remained near their prior week’s levels, registering modest rises. The 15-year fixed-rate mortgage posted a one-basis-point increase, climbing to 2.18% from 2.17%. In the same week of 2020, the 15-year average came in at 2.42%.

The five-year Treasury-indexed adjustable-rate mortgage averaged 2.43%, also up a single basis point from 2.42% the previous week. The five-year ARM during the same period last year was 2.93%.