Mortgage activity fell to its lowest point since July in the week preceding Labor Day, as low inventory offset favorable interest rates, according to the Mortgage Bankers Association.

The Market Composite Index, which measures mortgage volume based on surveys of MBA members, dropped a seasonally adjusted 1.9% for the weekly period ending Sept. 3. The unadjusted index decreased by 3% from

“Refinance volume has been moderating, while purchase volume continues to be lower than expected given the lack of homes on the market,” said Mike Fratantoni, MBA's senior vice president and chief economist, in a press statement.

The Purchase Index edged down 0.2% on a seasonally adjusted basis from the previous week’s level, while unadjusted volume decreased 3%. The unadjusted index showed purchases were 18% lower from one year ago. The Refinance Index dropped 3% week over week, with volume 4% below activity seen in the same week of 2020. Refinance applications accounted for the same share of mortgage activity as they did one week earlier — 66.8%.

Interest rates have sustained their low levels for much of 2021, barely moving in the past several weeks and thereby creating little

“We expect that further improvements will lead to a tapering of Fed MBS purchases by the end of the year, which should put some upward pressure on mortgage rates,” he said.

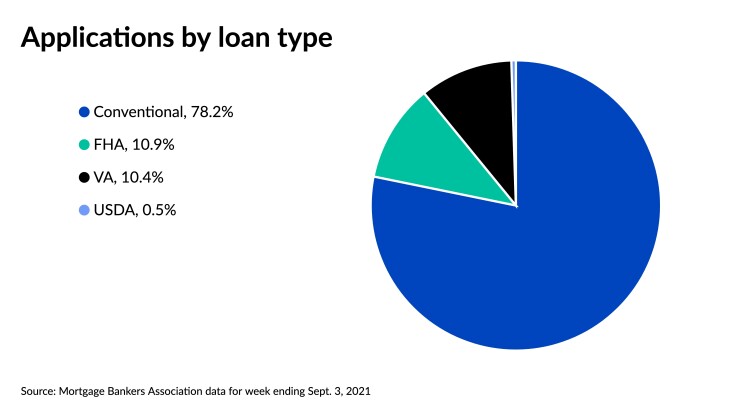

Mortgages taken through government programs started to trend upward in the latter half of the summer, making up larger shares of overall volume compared to earlier this year. The percentage of loans backed by the Federal Housing Administration accounted for 10.9% of all applications for the week, down from 11.2% seven days earlier. Veterans Affairs-sponsored mortgages increased in share of activity to 10.4% compared to 9.7% the prior week, while the U.S. Department of Agriculture applications remained unchanged on a weekly basis at 0.5%.

The percentage of adjustable-rate mortgages decreased to 2.5% from 3.1% the week prior.

Average loan sizes fall again

Mortgage size amounts continued to drop, shrinking for the fifth week in a row. The average loan size of all applications came in at $329,200, dropping 2% from $335,900 the prior week. The mean refinance loan size fell below $300,000 for the first time since early July, coming in at $299,200, a 2.2% decrease from $305,800 a week earlier. The average size of purchase mortgages also dipped to $389,800, compared to $396,500 a week earlier, down 1.7%, reflecting some recent data that showed

Conforming 30-year rate unchanged

Fixed-rate mortgages remained near their levels from one week earlier, while the average adjustable rate headed downward.

- The average contract interest rate of 30-year fixed-rate mortgages with conforming loan balances of $548,250 or less stayed at 3.03%, the same rate as a week earlier.

- The contract interest rate of 30-year fixed-rate jumbo loans with balances greater than $548,250 averaged 3.14%, up one basis point from 3.13% the prior week.

- The average contract interest rate of FHA-backed 30-year mortgages edged down to 3.07% compared to 3.09% a week earlier.

- The average contract interest rate of 15-year fixed-rate mortgages decreased to 2.37%, falling from 2.39% the previous week.

- The average contract interest rate for 5/1 adjustable-rate mortgages fell during the weekly period to 2.56%, down 24 basis points from the prior week’s average of 2.8%.