Following almost two months of declines, mortgage volumes increased for a

The MBA’s Market Composite Index, which measures mortgage volumes based on surveys of association members, rose a seasonally adjusted 2% from the previous week for the seven-day period ending May 6, with the uptick in purchases offsetting a sustained slowdown in refinance originations. But overall weekly volume was 50% lower than its level of one year ago.

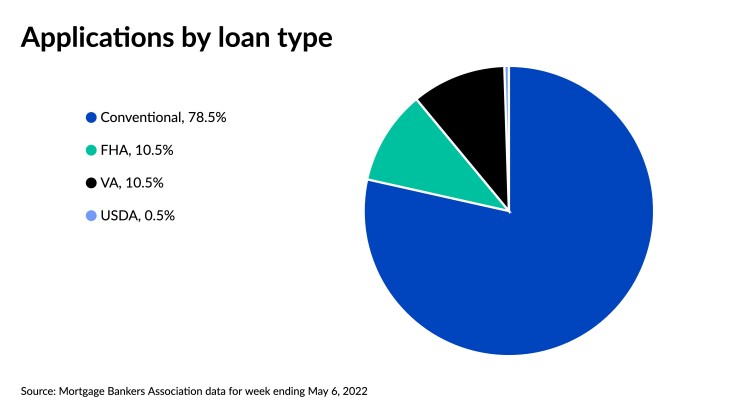

“The increase in mortgage applications last week was driven by a strong gain in application activity for conventional and government purchase loans,” said Joel Kan, MBA’s associate vice president of economic and industry forecasting, in a press release.

The seasonally adjusted Purchase Index came in 5% higher week over week, but the volume was almost 8% lower than what was reported in the same period last year.

“Despite a slow start to this year’s spring homebuying season, prospective buyers are showing some resiliency to higher rates. Purchase activity has now increased for two straight weeks,” he added.

After edging up a week ago, the Refinance Index retreated again, falling 2% on a weekly basis. Refinance activity is currently down by 72% from the same time frame in 2021. “The rapid rise in mortgage rates continues to hit the refinance market,” Kan said.

The share of refinances relative to total loan volume also shrank again, accounting for 32.4% of all applications compared to 33.9% seven days earlier. “Most homeowners refinanced to lower rates in the past two years,” Kan said.

After two weeks of declining average amounts, the mean size of applications climbed upward again, with increases seen in all categories. The average refinance amount surged 6.5% to $302,000 from $283,600 the previous week, while the mean purchase size — which hit record levels earlier this year — inched back up to $449,800 from $448,100, an uptick of 0.3%. The average overall loan size crossed over the $400,000 threshold, coming in at $401,900, an increase of 2.4% week over week from $392,300.

As interest rates have shot up over the past two months, the share of

“More borrowers continue to utilize ARMs to combat higher rates,” Kan said, noting the share of ARMs had also increased to 19% by dollar volume.

The Government Index went up by a fraction on a seasonally adjusted basis, even as federally backed loans accounted for a smaller percentage of overall activity compared to the previous week.

Interest rates among MBA members accelerated across all categories tracked by the association, as the average rate of 30-year conforming loans with balances of $647,200 or less rose to its highest point — 5.53% — since 2009, Kan said. A week earlier, the average rate came in at 5.36%.

The average rate for nonconforming jumbo loans with balances greater than $647,200 also came in above 5%, jumping 16 basis points to 5.08% from 4.92% week over week.

The contract fixed interest rate of FHA-backed 30-year mortgages climbed 10 basis points to 5.37% from 5.27% seven days earlier.

The 15-year fixed-rate mortgage average saw a similar level of increase as 30-year rates, rising to 4.79% from 4.68% the prior week.

The contract interest rate for 5/1 ARMs shot up 22 basis points to an average of 4.47% from 4.25% the prior week.