Situs subsidiary

The more than $4.7 billion agency portfolio has a 3.97% weighted-average interest rate, and the nearly $1.4 billion government portfolio has a 3.84% weighted-average interest rate.

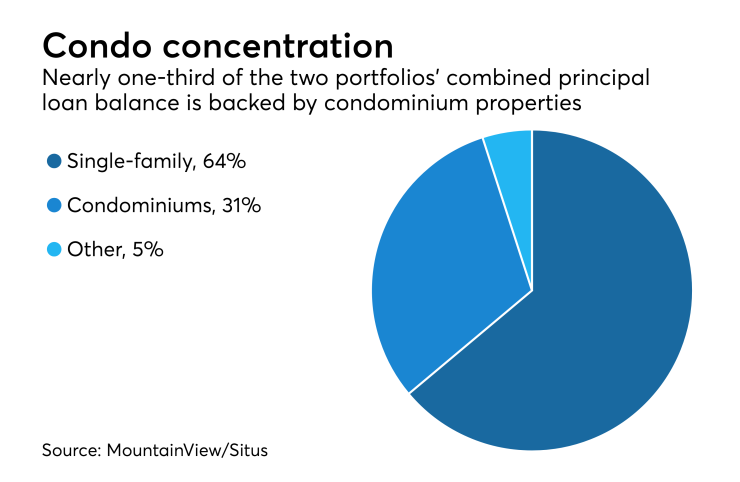

While the bulk of the principal loan amount consists of traditional single-family properties, 31% of it consists of loans backed by condominiums, according to data provided by the unnamed seller. Condos represent 25% of the Ginnie portfolio and 33% of the agency loans.

The offering also contains servicing rights on loans that have a variety of remittance cycles.

The agency portfolio has a 0.58% delinquency rate, and the nearly $1.4 billion government portion of the portfolio has a 5.35% delinquency rate. All of the conventional delinquencies are in the 30-day bucket and the government portfolio's 30-day delinquency rate is 2.17%. The other delinquency rates for the government portfolios are as follows: 60 days, 0.67%, and 90-plus days, 1.35%.

The foreclosure rate for the government loans is 0.73% and 0.42% of the loans are delinquent bankruptcies.

Nearly 21% of the government portfolio is concentrated in Illinois and more than 17% of the agency portfolio is concentrated in that state.

Other major geographic concentrations in the agency portfolio are as follows: Massachusetts, 15.5%; California, 11.5%; and New Jersey, more than 9%. The government portfolio's other top concentrations are: Massachusetts, more than 10%; Florida, more than 9%; and California, 9%.

Most of the loans in both portfolios were originated between 2012 and 2018 and Dovenmuehle is subservicing them on the Black Knight servicing system.

The deadline for written bids is 5 p.m. Eastern on April 17. Bids can be submitted for both or either portfolios. The owner seeks to sell in mid-to-late May with a flexible transfer date.