Mr. Cooper Group priced a $600 million senior-note offering due 2027 through its Nationstar Mortgage Holdings subsidiary to help pay off older, higher-rate debt due in the next couple years.

The offering is expected to close on or around Jan. 16 and will pay 6% interest per annum. Note payments will be made semi-annually on Jan. 15 and July 15 each year, beginning on July 15, 2020.

The company plans to use proceeds from the new note offering in combination with cash on-hand to redeem in full outstanding 6.5% senior notes due 2021 and 6.5% senior notes due 2022. The older notes being redeemed were issued by the company’s Nationstar Mortgage and Nationstar Capital subsidiaries.

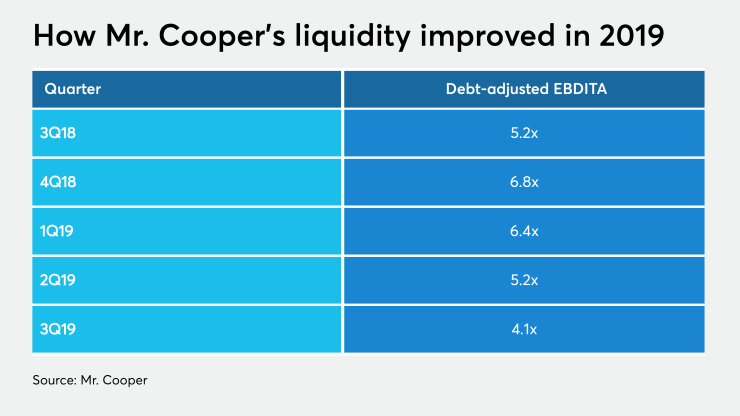

Mr. Cooper has been working to keep its debt-adjusted earnings before depreciation, interest taxes and amortization back down in line with a target of 5x it established in 2019.

The company also recently named Mike Rawls, executive vice president of servicing, to head its Xome real estate services unit.

Rawls replaces Ray Mathoda, who will remain a strategic adviser with the company and plans to transition to a career in life sciences. Rawls will changeover his operational leadership of the servicing segment to Tony Ebers, executive vice president and chief operating officer at Mr. Cooper.

“Given Mike’s track record with our servicing business, he is in a unique position to help Xome achieve its full potential as a leading integrated services provider for the mortgage industry,” Jay Bray, chairman and CEO of Mr. Cooper, said in a press release. “Mike has led our servicing and originations businesses in his tenure with Mr. Cooper. He understands the process and complexities in these businesses and will work with clients to reduce pain points and deliver a better client experience.”