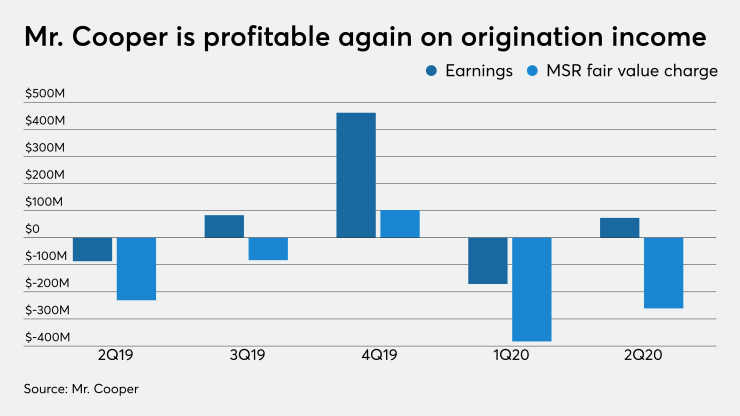

Mr. Cooper was profitable for the third time in the past four quarters on the strength of its mortgage origination business.

The company had second-quarter net income of $73 million; that included a $261 million mark-to-market loss from its mortgage servicing rights portfolio.

In the first quarter, Mr. Cooper lost $171 million because of a

The company's pretax operating income in the second quarter was $350 million, making it "the strongest operating results in our history," Jay Bray, chairman and CEO, said in a press release. "Strong origination profits not only offset pressure on the servicing margin, but also earned back the MSR mark within the same quarter, demonstrating the significant progress we've made in building a balanced and profitable business model."

The mark-to-market caused Mr. Cooper's servicing segment to record a pretax loss of $251 million in the second quarter. This segment had a pretax loss of $325 million in the first quarter and a pretax loss $135 million of the second quarter of 2019.

Meanwhile its origination business did $10.7 billion in volume, down from $12.4 billion in the first quarter. For last year's second quarter, Mr. Cooper originated $10 billion.

But pretax operating income rose to $434 million in the second quarter from $158 million in the first quarter and $118 million a year ago.

That was because net gain-on-sale from originations grew to $573 million from $297 million in the first quarter and $244 million in the second quarter of 2019.

Its