The National Association of Home Builders now expects the Federal Reserve Board to start tightening short-term interest rates by the end of summer.Chief economist David Seiders originally forecast the Fed would wait until after the November elections to raise the Federal Funds Rate, however improvements in job growth and higher core inflation are now likely to provoke some tightening in August, nearly 90 days before the Presidential election, Mr. Seiders said at the NAHB's Spring Forecast Conference in Washington. Mortgage Bankers Association chief economist is watching the inflation numbers carefully, but he told Mortgage Wire he is not yet ready to change his interest rate forecast. Fannie Mae's chief economist, David Berson, said his forecast, which calls for two and possibly three "tightenings" by the Fed this year, already accounts for a modest rise in inflation. "We're hoping that if inflation comes back with any sort of vengeance, the Fed will cut it off at the knees," Mr. Berson told MW. Mr. Seiders now thinks the central bank will take the federal funds rate to 1.5% by year's end. "The economic recovery process has now evolved from a jobless affair to a full-fledged expansion," he said. The NAHB economist's forecast for long-term fixed-rate mortgages is now 6.2% by the end of this year and 7% by the end of 2005. While the initial impact of higher rates could be positive in the short-term if buyers who were taking a wait-and-see stance decide to take the plunge before rates go any higher, he added, higher rates are "bound to exert some drag on (housing) demand over time."

-

The Supreme Court Friday issued a 6-3 ruling that held that a law granting the White House economic emergency powers does not include the power to tax imports.

3h ago -

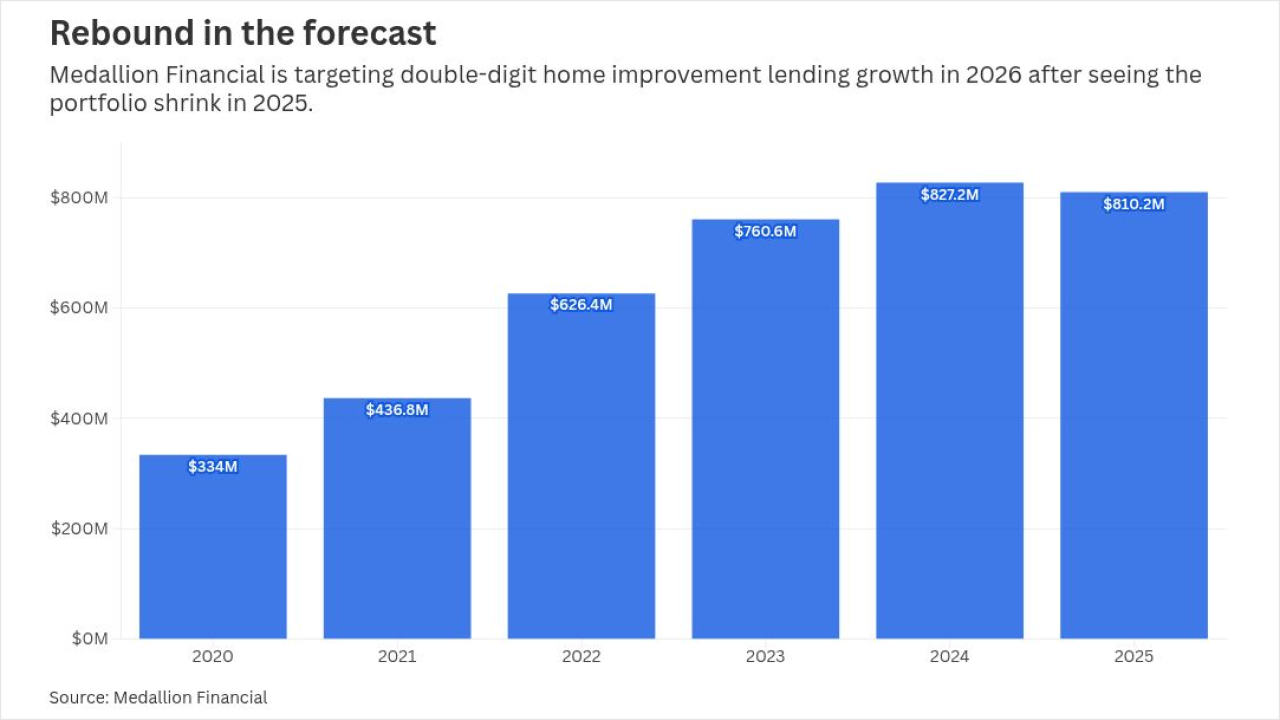

The New York City-based lender, whose roots lie in taxi lending, believes an expanded home-improvement loan operation will generate mid-teen loan growth this year.

February 19 -

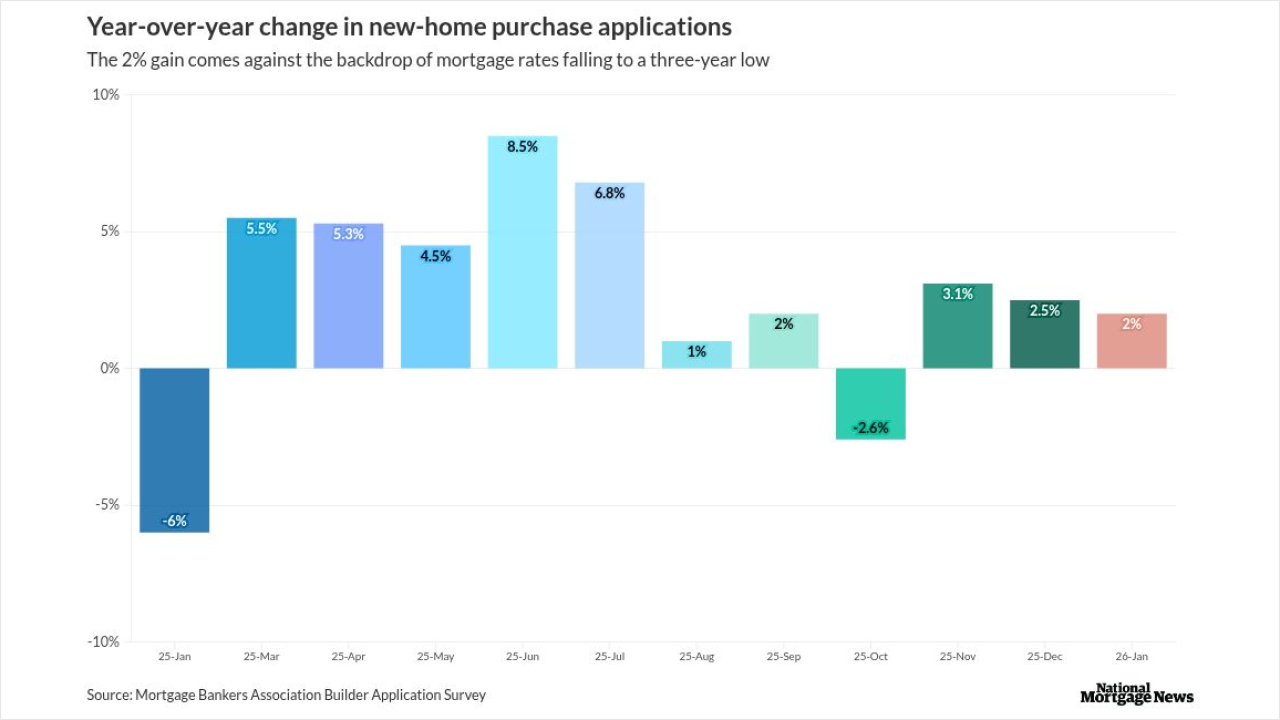

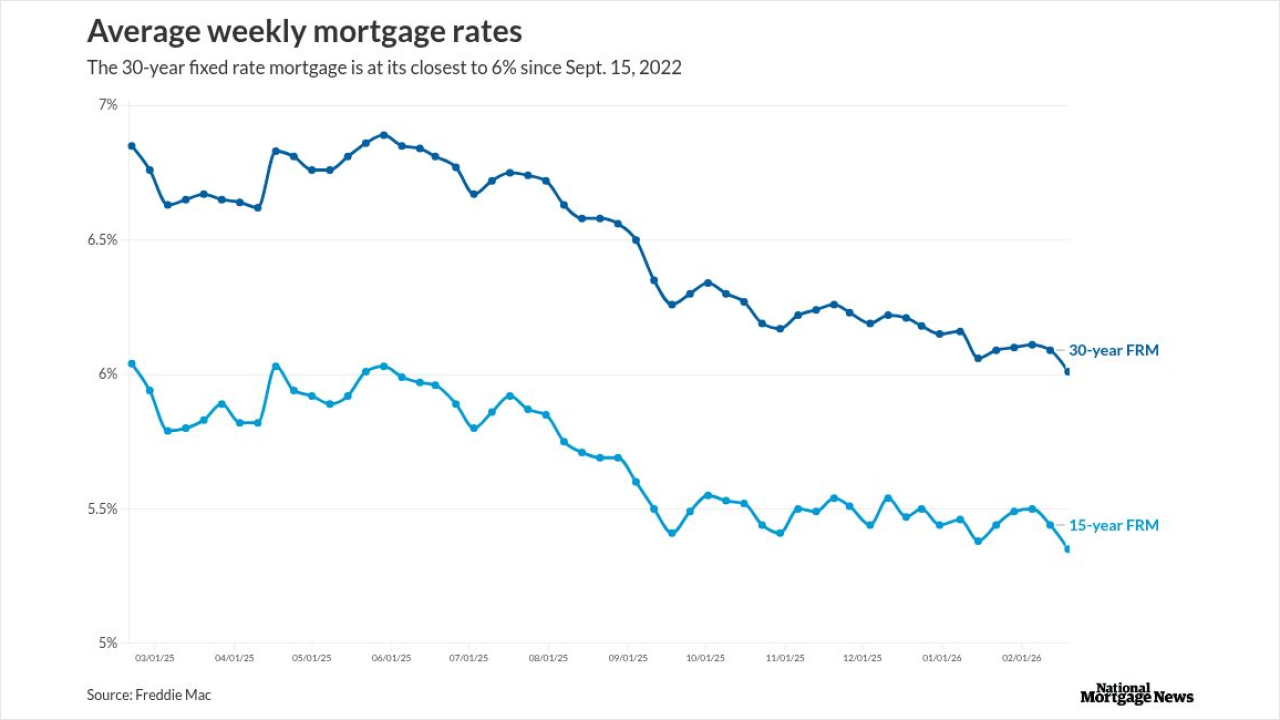

The increase in borrower activity came as housing starts ended 2025 on a high note, while mortgage rates were a percentage point lower year-over-year.

February 19 -

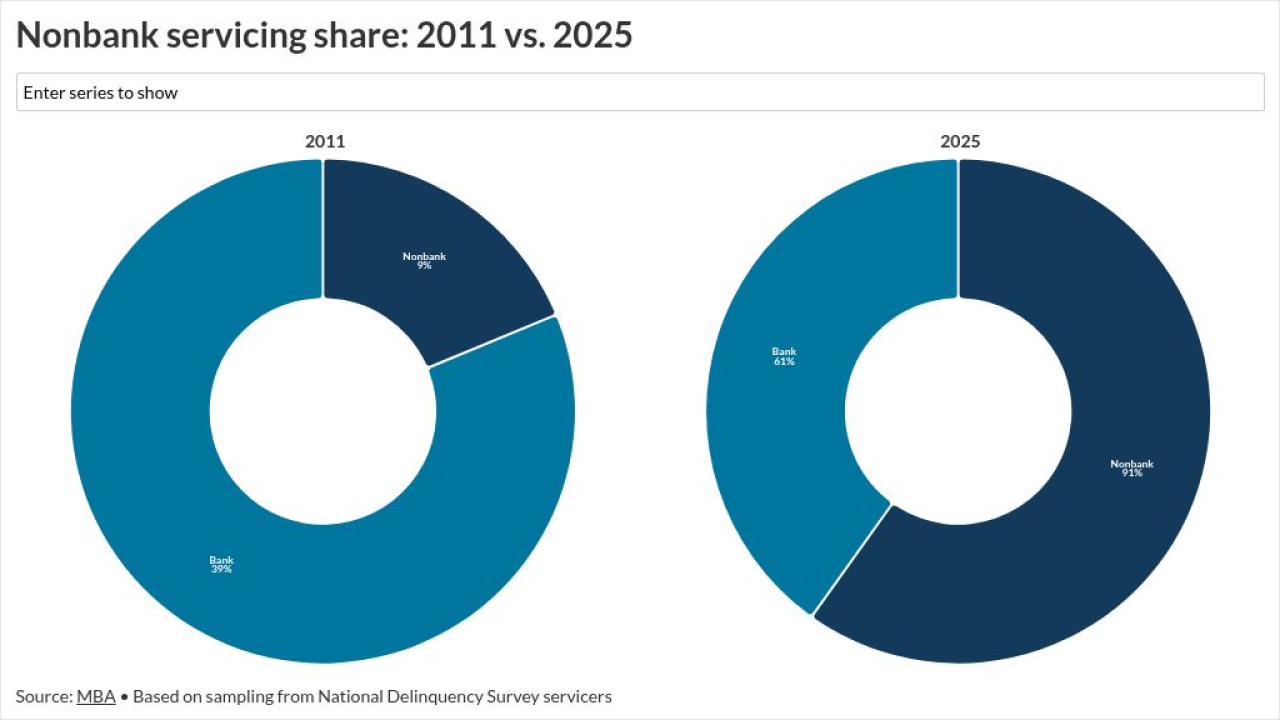

The impact of insurance costs, availability and related state rules also were top of mind at the Mortgage Bankers Association servicing conference.

February 19 -

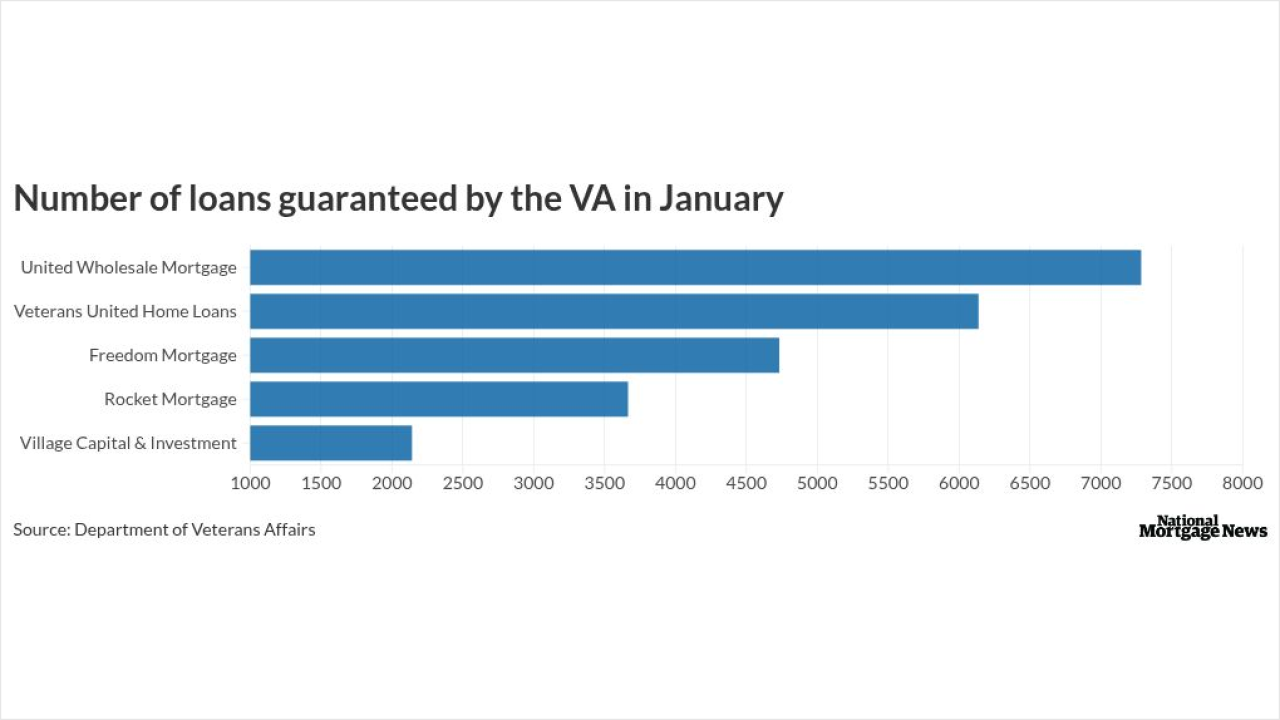

The lawsuit accuses Veterans United of deceptively suggesting it's part of the Department of Veterans Affairs and steering clients to more costly loans.

February 19 -

While the Freddie Mac survey recorded a weekly decline, the benchmark 10-year Treasury yield had moved back up by 6 basis points around midday on Thursday.

February 19