NMI Holdings' common stock sale puts the company in a stronger position for future fundraising efforts, such as a now-delayed debt offering.

National MI had a high rate of growth in new insurance written during the fourth quarter, making one of the prime beneficiaries of

But that capital was expected to come from either

Doing the secondary offering does not mean NMI will not look at other opportunities to raise capital.

"NMI had a very successful offering and raised valuable growth capital in the equity market yesterday,” said Executive Vice President and Chief Financial Officer Adam Pollitzer.

"We continue to see opportunities to further enhance our funding profile and prudently manage risk in the ILN market. Yesterday's offering likely changes the timing of any future ILN issuance, but we continue to view ILN as a cost-efficient means to fund future growth capital needs, manage risk in our insured portfolio and satisfy our PMIERs needs."

The net impact to NMI's full-year earnings per share and return on equity from an equity sale is similar in Binner's model to a debt or reinsurance transaction. "This proactive capital raise should better set up future capital raises," he said.

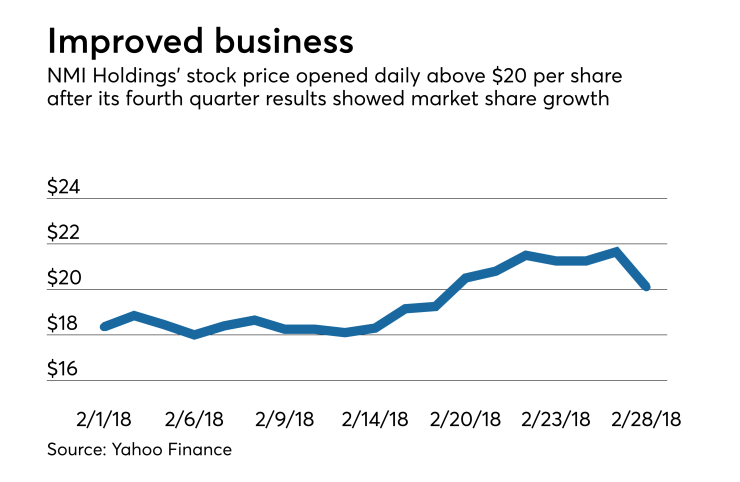

NMI priced the offering of 3.7 million shares at $19.25 per share, which was $0.70 below its closing price on Feb. 27. The next morning, NMI started trading at $20.10 per share.

The underwriters have a 30-day option to purchase up to an additional 555,000 shares.

NMI expects net proceeds of this offering, after deducting underwriting discounts and commissions and before expenses, of approximately $69.4 million, or $79.8 million if the underwriters exercise their option to purchase additional shares in full.

"NMI has decidedly transitioned to profitable operations, as the top line has ramped," Binner said. "Our view is that the premium ramp is coming at a good time, given our broadly constructive view on the macro environment for mortgage insurance writers. We continue to believe that NMI and MIs broadly offer a favorable risk/reward dynamic in the financials space, given growth potential, manageable Washington policy issues, and reasonable valuations, compared to other financials."