Private-equity money sought to be big landlords, but now it senses a business opportunity among the little guys.

Several PE-backed nonbank lenders, originally formed to assemble large portfolios of single-family rentals, have begun offering loan products to small landlords — including some that own just one property.

FirstKey Mortgage, backed by Cerberus Capital Management; B2R Finance, backed by Blackstone Group; and Colony American Finance, backed by Colony Capital, all now offer loans under $100,000.

It makes sense.

With rents headed higher and the economy on solid footing, there may never be a better time to be a landlord. Job growth is picking up, but with mortgage credit still tight, fewer households are making the transition from renting to owning.

And the lenders are making their move at a time when Fannie Mae and Freddie Mac, the primary backers of loans to small landlords, are under pressure to scale back their roles in the nation's housing market.

"Single-family rental is a real asset class — it has been around forever — but in the U.S. it has never really been treated as an asset class," said Beth O'Brien, the chief executive of Colony American.

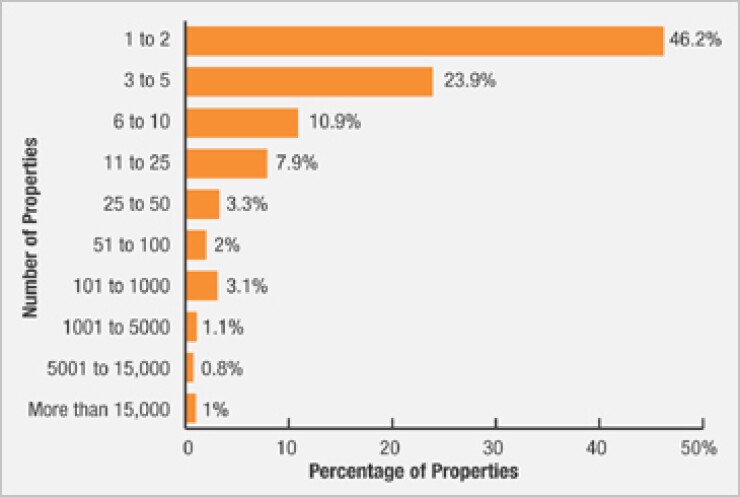

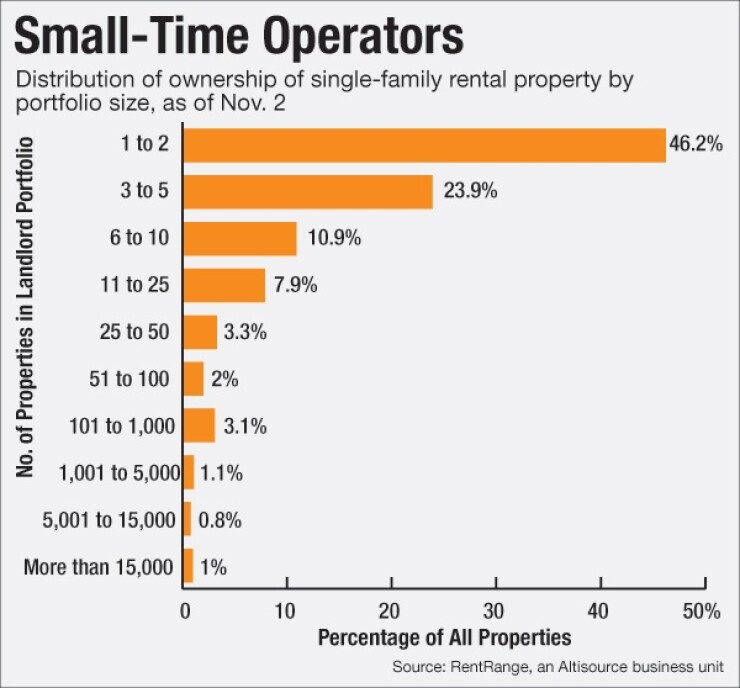

"The largest number of operators are small players who own 10 or fewer homes," she said. "And an important asset class should have a finance vehicle that fits that piece of the market."

Such financing exists in the U.K., where it is known as buy-to-let financing and has a strong performance record, O'Brien said. Cumulative net losses there were 0.88% this year as of August, according to Moody's Investors Service.

Colony American launched its first single-asset product in August. The loans, which are predominantly available through correspondent lenders, have a maximum loan-to-value ratio of 75% and there must be a tenant in place. Like all of Colony's products, these loans are made to a limited-liability corporation and are underwritten based on the property's income — not the borrower's.

"We hope to scale relatively quickly," O'Brien said.

Competing with GSEs

Landlords can also get financing for up to 10 properties from Fannie and Freddie, often at lower cost. But O'Brien argues that Colony American's single-asset loans are a better fit for many smaller landlords than loans backed by the government-sponsored enterprises, which are underwritten to a borrower's own debt-to-income ratio and put the borrower personally on the hook for the loan.

O'Brien recently spoke with a man in Tennessee who owns several rental homes with GSE loans on them and was turned down for a car loan, despite having what he considered strong credit, because his debt-to-income ratio was too high.

Colony American is not targeting first-time landlords, but other lenders are, including B2R Finance. In May the firm acquired Dwell Finance, which offers loans ranging in size from $60,000 to $750,000 that can be used to purchase or refinance individual properties. These loans are full recourse to the borrowers and available to those with a debt-to-income ratios of as much as 70%. The loans have minimum LTV of 75% for refinancing and 80% for acquisition loans, are fixed-rate and amortize over 30 years. They are available only in certain states.

FirstKey was the first to market, in early 2013. It currently offers 30-year fixed-rate loans that can be used to purchase between one and four single-family rental properties, according to its website. The minimum property value is $100,000, and the minimum LTV is 75%. The loans can be made either to an individual or to a limited-liability corporation, but in either case are full recourse to the borrower.

There are other companies offering products with tenants and maintenance already in place. In May 2014, HomeUnion launched a website with a database of vetted rental properties that allows individuals to invest remotely, based on their investment goals. The company manages the acquisition for the owner and then manages the property. It earns an acquisition fee at the time of a purchase and then an ongoing management fee. The company is now in 22 markets and says it is entering almost three a month.

"All the owner has to do is pay the mortgage," said Steve Hovland, HomeUnion's manager of research services. "We collect the rent and deliver it back to the homeowner. There's a ton of demand."

Investors have different needs. Some just want to do business in big markets like cities in Texas. Others are chasing the highest yields, so they might favor markets such as Cleveland or Indianapolis, where homes are less expensive and rents are high.

"Most people buy a couple of houses then come back to us to buy additional properties," he said.

Secondary-Market Impact

Colony American and FirstKey have yet to securitize a single-asset loan, though a deal launched by B2R Finance the first week of November has a smattering of them. Another lender, Velocity Commercial Capital, issued bonds in June that were backed by a mix of mortgages on single-family residences and two- to four-family rental properties as well as loans on larger multifamily properties, mixed-use properties and industrial properties.

But the big buzz is about the potential for deals backed exclusively by single-asset loans, which could provide an alternative to private-label, residential mortgage-backed securities. Lenders are already in discussions with credit ratings agencies about what these deals might look like.

"This is another way to get exposure to individual properties," said Brian Grow, a managing director for residential mortgage-backed securities at Morningstar Credit Ratings.

The only proxies that rating agencies have for how loans financing a single rental home might perform are mortgages used to finance investment properties. But these loans, whether acquired by the GSEs or securitized in private-label RMBS, are underwritten to the credit of the borrower, and not the income of the property. They might finance a vacation home that is only rented out seasonally or a spec house. In other words, the income from these properties does not necessarily cover their mortgage payments.

Nevertheless, Morningstar has analyzed investment property loans in private-label RMBS and is satisfied that the level of income from a property is strong predictor of performance.

"We had to make a lot of assumptions to get to net cash flow, but at the end of the day, it was very clear that properties with income that covered a mortgage payment performed significantly better," Grow said.

This makes sense, he said, since a borrower in financial trouble who has a rental property that pays for itself is more likely to default on his primary residence and keep making payments on the rental property. Still, "it's a new concept in the residential world."

Navneet Agarwal, a managing director in Moody's structured finance group, said it will be crucial for the rating agency to understand how lenders underwrite the loans, whether it is purely to the borrower's debt service coverage ratio, some formula based on that ratio that takes rent into account, or some extreme version of hard money lending based only on the value of property.

Agarwal noted that smaller retail loans to landlords will have attributes that are more like loans in an RMBS than loans in a commercial mortgage-backed security. For example, there is no cash trap, no lockbox and no reserving for capital expenditures.

Also with multiple borrowers, it will not be possible to do a deep dive on every loan in the pool, and operators have diverse property-management standards. "So we model recoveries on these smaller loans to be lower," Agarwal said.

Lenders and rating agencies agree on the need to ensure that borrowers accurately represent the purpose of their loans.

That is because some borrowers who do not quality for mortgages under the new ability-to-repay rules may have an incentive to misrepresent that they are buying a rental property, rather than a primary residence. This appears to have happened with one of the loans in Velocity's June deal: the borrower reportedly

"Before the financial crisis, the misrepresentation we worried about was that someone not living in a house would claim to be living in it, in order to quality for cheaper financing," Agarwal said. Now, "the regulatory arbitrage goes the other way. When we look at the first deals, this will be a big question."