Ocrolus completed a Series C financing round that gives the fintech company a valuation over $500 million.

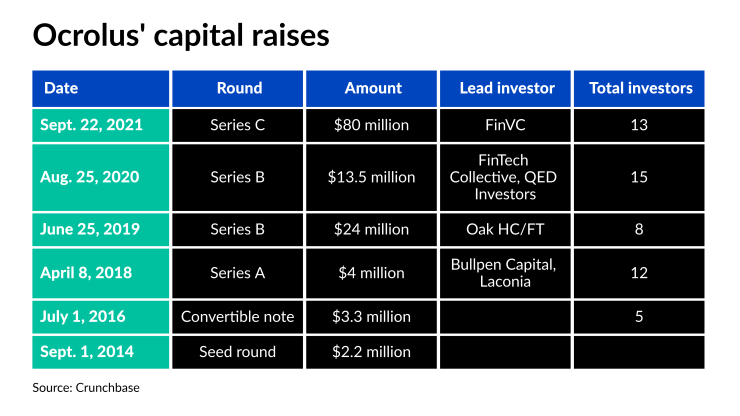

The round added $80 million in new capital and was led by FinVC. Other participants included Thomvest Ventures, Mubadala Capital, Oak HC/FT, FinTech Collective, QED Investors, Bullpen Capital, ValueStream Ventures, Laconia, RiverPark Ventures, Invicta Growth, Stage 2 Capital and

FinTech Collective and QED were the lead investors on the August 2020 Series B, Oak HC/FT on the June 2019 Series B and Bullpen Capital and Laconia on the April 2018 Series A. In total, Ocrolus has raised $127 million over six rounds, according to Crunchbase.

"Mortgage lenders and banks recognize they need to adopt the same workflow digitization and underwriting automation used by fintech lenders," said Logan Allin, managing general partner and founder of Fin VC in a press release. "We're excited to support Ocrolus, the category leader in back-office automation."

Allin joined Ocrolus' board as part of making the investment.

Ocrolus uses

"Our platform helps lenders automate underwriting and intelligently leverage cash flow and income data for credit scoring," said Sam Bobley, Ocrolus' CEO. "By enabling lenders to more quickly

So far this year, Ocrolus has added 75 employees. With the new funding, it plans to further ramp-up hiring with a focus on its machine learning and data science teams. The company is also opening a new data quality control facility in Florida to accommodate financial institutions and government entities with onshore data requirements.