Incenter Mortgage Advisors is accepting bids on behalf of an independent mortgage banker for a $326 million portfolio of Fannie Mae, Freddie Mac and Ginnie Mae mortgage servicing rights.

The unnamed mortgage banker prefers bids for the combined portfolio but also will consider separate bids on the government-sponsored enterprise and Ginnie portfolios, respectively.

"The seller would prefer that the successful purchaser be capable of completing its due diligence and executing a purchase and sale agreement to effectuate a bulk sale data on May 31, 2017 with a mutually agreed upon transfer date," IMA added.

All bids must be submitted to IMA by 2 p.m. Eastern Time on Thursday, April 27, to be considered.

The portfolio's weighted average note rate is 4.033% and the loans have four months of seasoning. The total delinquency rate is 0.21%. A little over 37% of the loans in the bulk MSR deal are concentrated in Michigan, but none of the 35 other states represented constitute more than 8% of the portfolio.

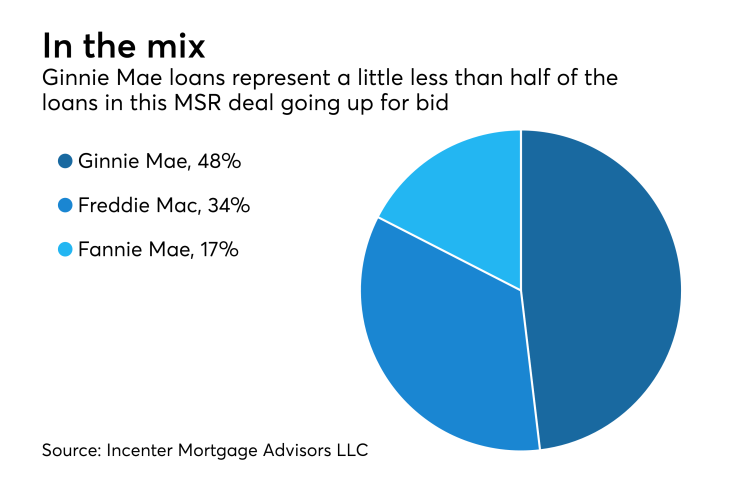

GSE loans represent a little over half of the MSRs in terms of both the number of loans involved and their principal value. There are 904 Ginnie loans, 647 Freddie Mac loans and 328 Fannie Mae loans in the portfolio.

Ginnie Mae MSRs had gone through a period where they attracted a