PrimeLending reported a 46% year-over-year drop in annual loan production, leading it to a third quarter pre-tax loss, in another sign of the

The mortgage origination subsidiary of PlainsCapital Bank and its parent, Dallas-based Hilltop Holdings, reported total losses of $23.1 million in the third quarter,

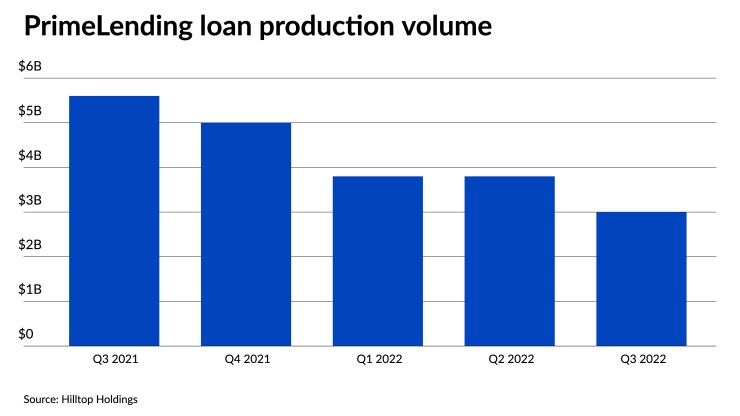

Dwindling volumes contributed to the steep decline, as loan production dipped 26.6% to $3.0 billion from $3.8 billion in the previous quarter. Year-over-year production plummeted by 46.4% from $5.6 million. As they have throughout the industry, the share of refinance customers at PrimeLending contracted sharply from 29% in the third quarter last year to just 7%.

Despite the precipitous annual drop, it was short of the industry-wide falloff in originations of 55% the Mortgage Bankers Association expects to see for the period, company officials said. But PrimeLending is also not expecting a quick turnaround in industry fortunes.

"The market has moved quickly. It is very dynamic, and so from our current perspective, it would lead us to believe that in Q4, we'll be in a net-loss position," said Hilltop Holdings Chief Financial Officer William Furr in the company's earnings call.

"While our business model is more purchase-oriented, the shrinking pool of purchase home buyers and the immediate need of competitors to generate mortgage volume will continue to put pressure on the organization," Hilltop's President and CEO Jeremy Ford also said.

The company has already introduced cost-cutting measures, joining

"What we're trying to say on the cost initiatives is, we're trying to do everything we can this year to position ourselves next year to weather through it," Ford said.

Shrinking gain-on-sale margins have also made a sizable impact on bottom lines, and they decreased again for the third-straight quarter at PrimeLending. From the second to third quarters, net margin dropped 35 basis points to 218 from 253. One year ago, reported gain on sale was 128 points higher at 346.

Mortgage-lending operations were the weak link in an otherwise positive earnings report at Hilltop Holdings, parent of PlainsCapital Bank and Hilltop Securities. Net income for the entire company came in at $33.3 million, down 5.8% on a quarterly basis from $35.3 million and 65.1% year over year from $95.4 million.