More mortgage lenders see profits increasing in the third quarter compared to

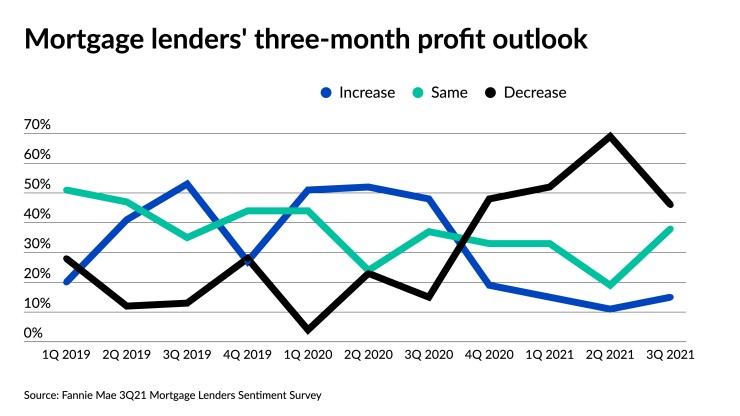

For the fourth consecutive quarter, a larger number of respondents — 46% — expected profits to shrink over the next three months rather than increase, with only 15% of those surveyed anticipating improved bottom lines. The remaining 38% thought margins would stay approximately the same.

But the results showed optimism returning from lower levels three months earlier, when 69% foresaw a quarterly profit decline, and only 11% expected gains. The current sentiment marks a near-complete reversal of the mood from the third quarter of 2020, when 48% of lenders predicted near-term profits to increase, while 15% planned for decreased margins.

“Lenders continue to overwhelmingly cite increased competition as their primary concern regarding future profitability,” said Mark Palim, Fannie Mae’s vice president and deputy chief economist, in a press release. In the survey, 80% of respondents expecting their income to decline cited competitive pressure as a key reason.

Other influencing factors included shifting market trends, which was selected by 31%, and

“The share citing personnel costs for their diminished profit margin outlook increased significantly, suggesting that mortgage lenders’ ability to efficiently manage their workforces will be critical to their bottom lines as competitive pressures remain intense,” said Palim.

Lenders have also adjusted their

The share of lenders anticipating purchase demand to increase over the next three months fell compared to the previous quarter’s sentiment, Palim said, dropping to its lowest mark across all loan types for any third quarter in two years. For conforming loans, 34% saw expected increased profits for both GSE and non-GSE eligible loans, while 31% anticipated positive growth in the third quarter for government-backed mortgages.

In the refinance market, a higher percentage of lenders now expect to generate gains over the next few months, compared to one quarter ago. But overall, more respondents expect refinance margins to decrease in the third quarter, with 42% expecting profits to fall among GSE-eligible loans, 40% for non-GSE-eligible mortgages and 41% for government loans.

A higher share of lenders also expect

Profit sentiment improved among lenders even as 36% of those surveyed thought the economy was on the wrong track, a substantial increase compared to 22% who expressed the same concern when asked three months earlier. The impact of the

But, according to Palim, signals exist in the current environment that might increase margins — and optimism — for lenders. “The primary-secondary spread, an indicator of potential profitability, remains wider than the previous decade’s average — a positive sign for lenders — though in August it was at its narrowest since February and 53 basis points below the peak seen in August 2020,” he said.