Purchase mortgage application volume was at its most in over a decade as consumer confidence continued to improve in the aftermath of the coronavirus shutdown, according to the Mortgage Bankers Association.

It didn't hurt that rates for the 30-year fixed loan fell to another all-time low since the organization began tracking this information.

The MBA's Weekly Mortgage Applications Survey for the week ending June 12 reported an 8% increase on a seasonally adjusted basis

The seasonally adjusted purchase index increased 4% from one week earlier, while the unadjusted purchase index increased 2% compared with the previous week and was 21% higher than the same week one year ago.

"Purchase applications increased to the highest level in over 11 years and for the ninth consecutive week. The housing market continues to experience the release of unrealized pent-up demand from earlier this spring, as well as a gradual improvement in consumer confidence," Joel Kan, the MBA's associate vice president of economic and industry forecasting, said in a press release.

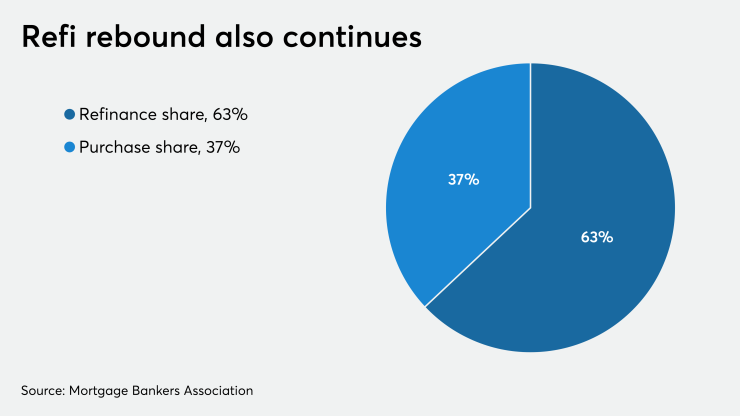

Refinance volume increased for the second consecutive week as well, following a period where this loan type was priced higher as lenders looked to manage volume.

"Mortgage rates dropped to another record low in MBA's survey, leading to a 10% surge in refinance applications. Refinancing continues to support households' finances, as homeowners who refinance are able to gain savings on their monthly mortgage payments in a still-uncertain period of the economic recovery," Kan said.

Compared with the same week in 2019, refi application volume was 106% higher. The refinance share of mortgage activity increased to 63.2% of total applications from 61.3% the previous week.

Adjustable-rate mortgage activity decreased to 2.8% from 3.1%, while the share of Federal Housing Administration-insured loan applications decreased to 11% from 11.5% the week prior.

The share of applications for Veterans Affairs-guaranteed loans decreased to 11.5% from 12.3% and the U.S. Department of Agriculture/Rural Development share increased to 0.7% from 0.6% the week prior.

The average contract interest rate for 30-year fixed-rate mortgages with conforming loan balances ($510,400 or less) decreased 8 basis points to 3.3%. For 30-year fixed-rate mortgages with jumbo loan balances (greater than $510,400), the average contract rate decreased 3 basis points to 3.67%.

The average contract interest rate for 30-year fixed-rate mortgages backed by the FHA decreased 5 basis points to 3.33%. For 15-year fixed-rate mortgages, the average decreased 3 basis points to 2.8%. The average contract interest rate for 5/1 ARMs increased 5 basis points to 3.07%.