-

Submit your production volume from last year to be considered among the top in your field. The deadline for submissions is Feb. 27, and the clock is already running.

January 28 -

Mortgages that homebuyers locked in March rose 17% even with FICOs at record high for Optimal Blue's dataset, suggesting there are many qualified borrowers.

April 8 -

One Draper and Kramer LO's game plan includes making inroads with CPAs, divorce attorneys and attending Eastern-European festivals.

March 31 -

Mortgage lenders and real estate professionals share their perspectives on the cities predicted to draw the most interest from home buyers in the next year, according to the Urban Land Institute.

November 24 -

As interest rates fluctuated and purchase volumes increased in the second quarter, mortgage loans were more prone to defaults, according to actuarial and consulting firm Milliman.

November 22 -

The majority of prospective home sellers want to list their properties in the next six months, according to a recent survey by Realtor.com.

November 11 -

The lack of inventory pushed the median housing price to double-digit annual growth for the 14th straight month, according to Redfin.

October 15 -

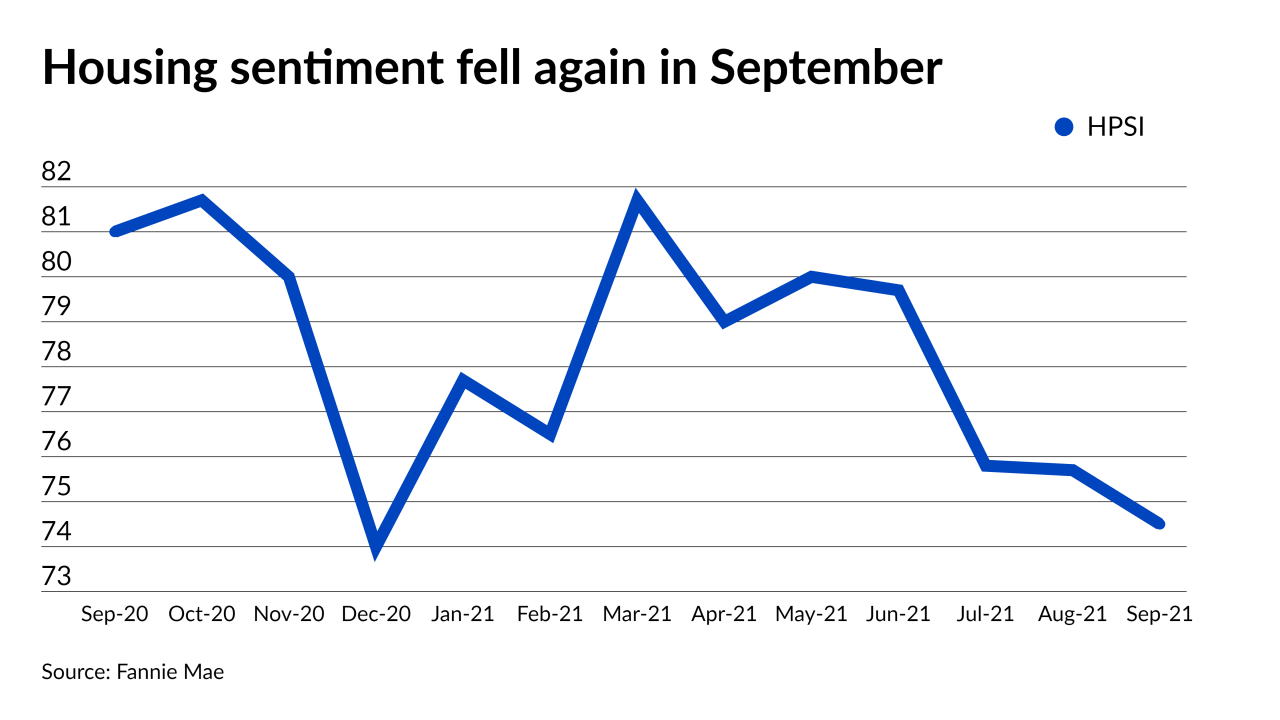

The share of borrowers who thought it was a good time to buy hit an all-time low, according to Fannie Mae.

October 7 -

More for-sale homes hit the market than at any point this year but a turning point may lie ahead, according to Realtor.com.

September 30 -

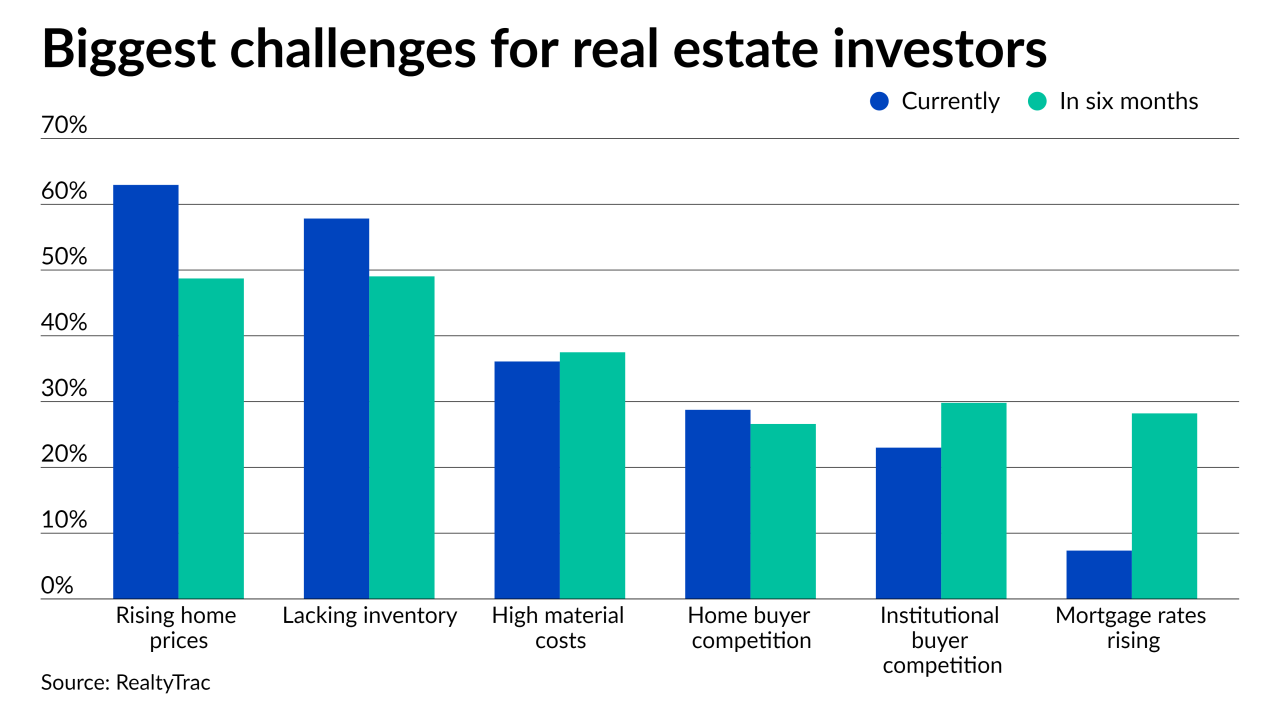

The home price increases and the ongoing inventory shortage made buying conditions difficult and many think it’s only getting more challenging, according to RealtyTrac.

September 29 -

Meanwhile, nearly half of consumers are more worried about severe weather now compared to five years ago, according to Realtor.com.

September 27 -

The government-sponsored enterprise also expects purchase and refinancing volumes to drop in 2022.

September 20 -

Last month’s housing market reversed a trend in purchases, but it wasn’t enough to stop the double-digit price growth, according to Redfin.

September 16 -

The fintech projects the Series C capital will enable $10 billion in annual housing transactions through its system and expansion to half the U.S.

September 14 -

August’s increase in that loan type drove refinancings to take up a slim majority share of origination volume for the first time since February, according to Black Knight.

September 13 -

A rising — but still small — share of borrowers believe interest rates and housing price appreciation will fall in the next year, according to Fannie Mae.

September 7 -

Meanwhile, property values across the U.S. have increased for 40 quarters in a row, according to the Federal Housing Finance Agency.

August 31 -

Local mortgage lenders give their boots-on-the-ground perspectives about the ZIP codes with 2021’s shortest list-to-sale times, according to Realtor.com.

August 27 -

Record high price growth and the dearth of housing inventory left the majority of consumers anxious about the market, a survey finds.

August 23 -

Measuring factors from affordability to quality of life, local lenders give insights to the top metro areas for new buyers, according to WalletHub.

August 20